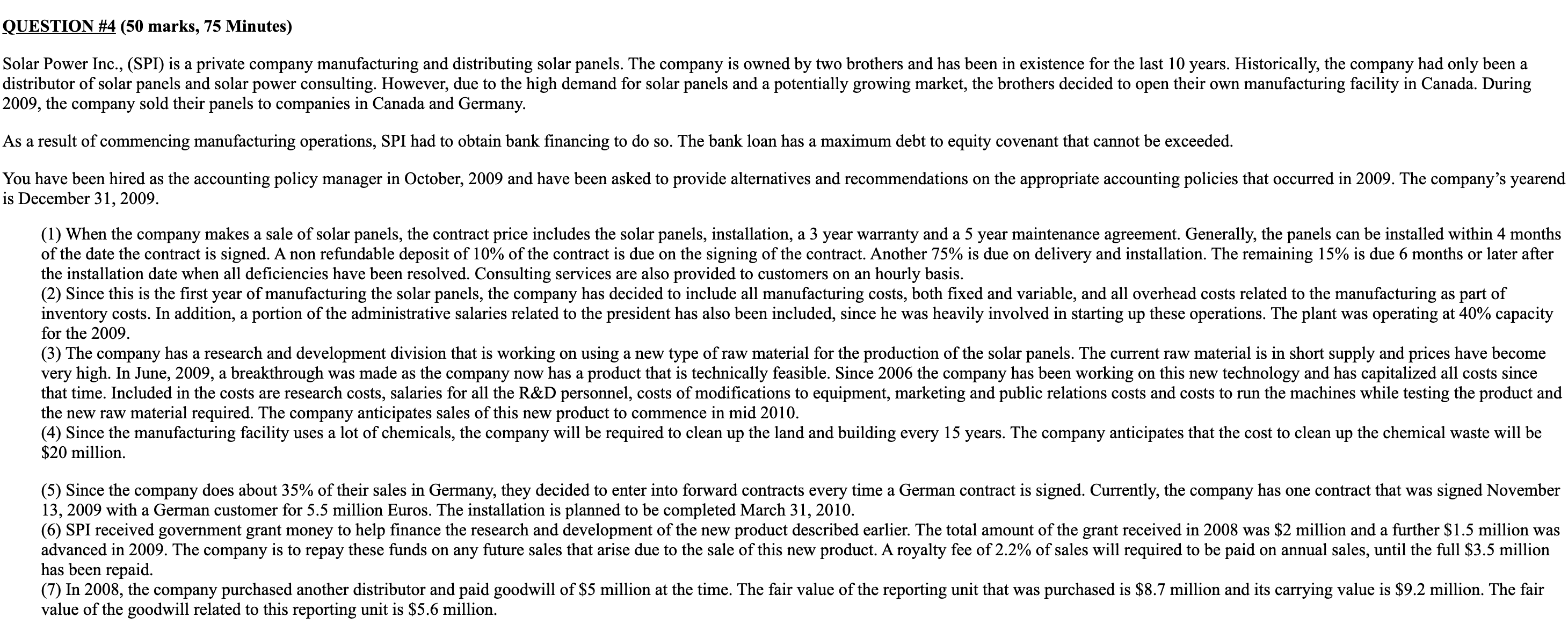

Question: QUESTION # 4 ( 5 0 marks, 7 5 Minutes ) Solar Power Inc., ( SPI ) is a private company manufacturing and distributing solar

QUESTION # marks, Minutes

Solar Power Inc., SPI is a private company manufacturing and distributing solar panels. The company is owned by two brothers and has been in existence for the last years. Historically, the company had only been a

distributor of solar panels and solar power consulting. However, due to the high demand for solar panels and a potentially growing market, the brothers decided to open their own manufacturing facility in Canada. During

the company sold their panels to companies in Canada and Germany.

As a result of commencing manufacturing operations, SPI had to obtain bank financing to do so The bank loan has a maximum debt to equity covenant that cannot be exceeded.

You have been hired as the accounting policy manager in October, and have been asked to provide alternatives and recommendations on the appropriate accounting policies that occurred in The company's yearend

is December

When the company makes a sale of solar panels, the contract price includes the solar panels, installation, a year warranty and a year maintenance agreement. Generally, the panels can be installed within months

of the date the contract is signed. A non refundable deposit of of the contract is due on the signing of the contract. Another is due on delivery and installation. The remaining is due months or later after

the installation date when all deficiencies have been resolved. Consulting services are also provided to customers on an hourly basis.

Since this is the first year of manufacturing the solar panels, the company has decided to include all manufacturing costs, both fixed and variable, and all overhead costs related to the manufacturing as part of

inventory costs. In addition, a portion of the administrative salaries related to the president has also been included, since he was heavily involved in starting up these operations. The plant was operating at capacity

for the

The company has a research and development division that is working on using a new type of raw material for the production of the solar panels. The current raw material is in short supply and prices have become

very high. In June, a breakthrough was made as the company now has a product that is technically feasible. Since the company has been working on this new technology and has capitalized all costs since

that time. Included in the costs are research costs, salaries for all the R&D personnel, costs of modifications to equipment, marketing and public relations costs and costs to run the machines while testing the product and

the new raw material required. The company anticipates sales of this new product to commence in mid

Since the manufacturing facility uses a lot of chemicals, the company will be required to clean up the land and building every years. The company anticipates that the cost to clean up the chemical waste will be

$ million.

Since the company does about of their sales in Germany, they decided to enter into forward contracts every time a German contract is signed. Currently, the company has one contract that was signed Nover

with a German customer for million Euros. The installation is planned to be completed March

SPI received government grant money to help finance the research and development of the new product described earlier. The total amount of the grant received in was $ million and a further $ million was

advanced in The company is to repay these funds on any future sales that arise due to the sale of this new product. A royalty fee of of sales will required to be paid on annual sales, until the full $ million

has been repaid.

In the company purchased another distributor and paid goodwill of $ million at the time. The fair value of the reporting unit that was purchased is $ million and its carrying value is $ million. The fair

value of the goodwill related to this reporting unit is $ million.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock