Question: using the Simultaneous equation instead of the repeated distribution method. Overhead is absorbed on a machine hour basis. It has been estimated that service department

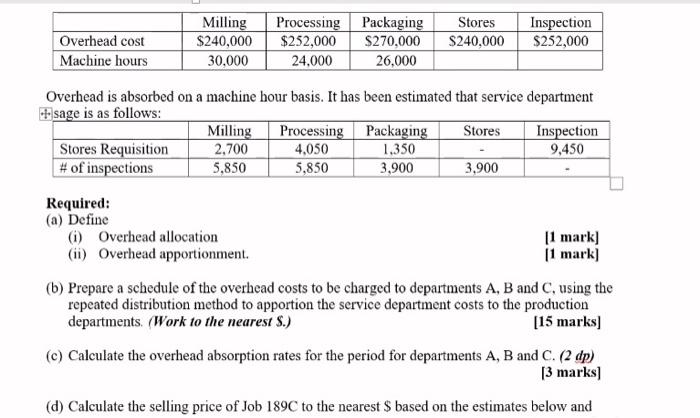

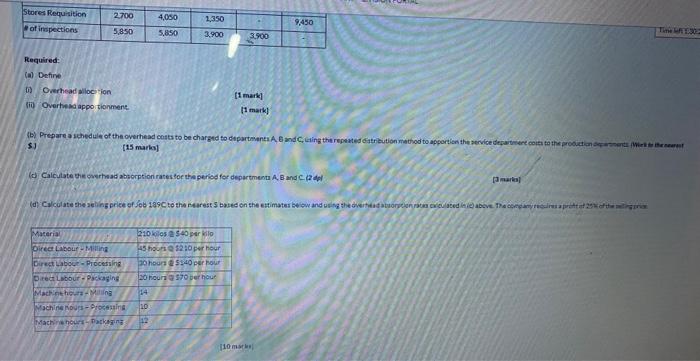

Overhead is absorbed on a machine hour basis. It has been estimated that service department +?sage is as follows: Required: (a) Define (i) Overhead allocation [1 mark] (ii) Overhead apportionment. [1 mark] (b) Prepare a schedule of the overhead costs to be charged to departments A, B and C, using the repeated distribution method to apportion the service department costs to the production departments. (Work to the nearest S.) [15 marks] (c) Calculate the overhead absorption rates for the period for departments A, B and C. (2 dp) [3 marks] (d) Calculate the selling price of Job 189C to the nearest $ based on the estimates below and \$) [15 marko] [3 maka]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts