Question: Question 4 (5 marks) Suppose that in December 2012, a U.S. firm placed a purchase order with a German seller with a price of

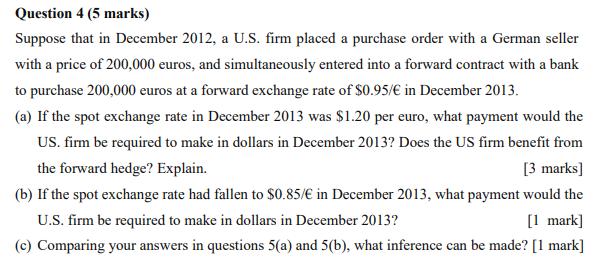

Question 4 (5 marks) Suppose that in December 2012, a U.S. firm placed a purchase order with a German seller with a price of 200,000 euros, and simultaneously entered into a forward contract with a bank to purchase 200,000 euros at a forward exchange rate of $0.95/ in December 2013. (a) If the spot exchange rate in December 2013 was $1.20 per euro, what payment would the US. firm be required to make in dollars in December 2013? Does the US firm benefit from the forward hedge? Explain. [3 marks] (b) If the spot exchange rate had fallen to $0.85/ in December 2013, what payment would the U.S. firm be required to make in dollars in December 2013? [1 mark] (c) Comparing your answers in questions 5(a) and 5(b), what inference can be made? [1 mark]

Step by Step Solution

There are 3 Steps involved in it

The image youve provided contains a finance question divided into three parts a b and c It appears t... View full answer

Get step-by-step solutions from verified subject matter experts