Question: Question 4 (6 marks). The current spot rate is $0.80/A$ and the six-month forward rate is $0.7775/A$. One-year interest is 8% in the United

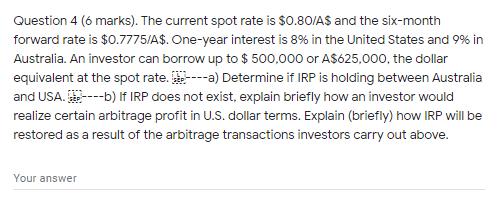

Question 4 (6 marks). The current spot rate is $0.80/A$ and the six-month forward rate is $0.7775/A$. One-year interest is 8% in the United States and 9% in Australia. An investor can borrow up to $ 500,000 or A$625,000, the dollar equivalent at the spot rate. ----a) Determine if IRP is holding between Australia and USA.----b) If IRP does not exist, explain briefly how an investor would realize certain arbitrage profit in U.S. dollar terms. Explain (briefly) how IRP will be restored as a result of the arbitrage transactions investors carry out above. Your answer

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

a As per interest rate parity Forward rate ab Spot rate ab x 1 i a 1 i b Where a currency of country ... View full answer

Get step-by-step solutions from verified subject matter experts