Question: Question 3 - Accounting for Receivables (13 marks) Surrey Co. has the following unadjusted account balances at March 31, 2022: Accounts Receivable of $252,000,

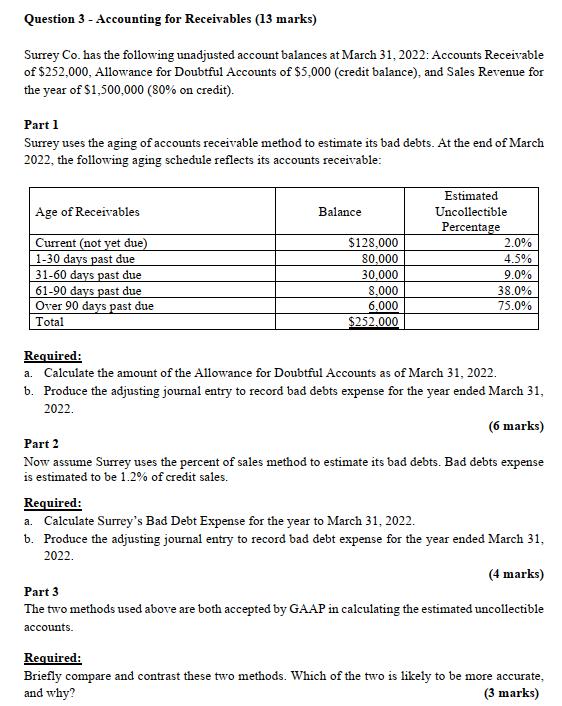

Question 3 - Accounting for Receivables (13 marks) Surrey Co. has the following unadjusted account balances at March 31, 2022: Accounts Receivable of $252,000, Allowance for Doubtful Accounts of $5,000 (credit balance), and Sales Revenue for the year of $1,500,000 (80% on credit). Part 1 Surrey uses the aging of accounts receivable method to estimate its bad debts. At the end of March 2022, the following aging schedule reflects its accounts receivable: Age of Receivables Current (not yet due) 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due Total Balance $128,000 80,000 30,000 8,000 6,000 $252.000 Estimated Uncollectible Percentage 2.0% 4.5% 9.0% 38.0% 75.0% Required: a. Calculate the amount of the Allowance for Doubtful Accounts as of March 31, 2022. b. Produce the adjusting journal entry to record bad debts expense for the year ended March 31, 2022. (6 marks) Part 2 Now assume Surrey uses the percent of sales method to estimate its bad debts. Bad debts expense is estimated to be 1.2% of credit sales. Required: a. Calculate Surrey's Bad Debt Expense for the year to March 31, 2022. b. Produce the adjusting journal entry to record bad debt expense for the year ended March 31, 2022. (4 marks) Part 3 The two methods used above are both accepted by GAAP in calculating the estimated uncollectible accounts. Required: Briefly compare and contrast these two methods. Which of the two is likely to be more accurate, and why? (3 marks)

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts