Question: Question 4 (7 marks) Kenith Padovan operates an incorporated consulting business, Padovan Consulting Ltd. (PCL) PCL is a Canadian-controlled private corporation that has a

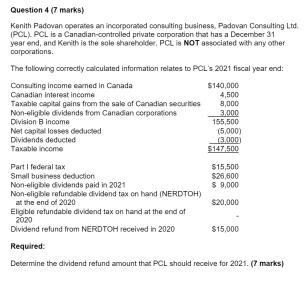

Question 4 (7 marks) Kenith Padovan operates an incorporated consulting business, Padovan Consulting Ltd. (PCL) PCL is a Canadian-controlled private corporation that has a December 31 year end, and Kenith is the sole shareholder, PCL is NOT associated with any other corporations. The following correctly calculated information relates to PCL's 2021 fiscal year end: $140,000 Consulting income earned in Canada Canadian interest income 4,500 8,000 3.000 155,500 (5,000) (3.000) $147.500 Taxable capital gains from the sale of Canadian securities Non-eligible dividends from Canadian corporations Division B income Net capital losses deducted Dividends deducted Taxable income Part I federal tax Small business deduction Non-eligible dividends paid in 2021 Non-eligible refundable dividend tax on hand (NERDTOH) at the end of 2020 Eligible refundable dividend tax on hand at the end of 2020 Dividend refund from NERDTOH received in 2020 $15,500 $26,600 $ 9,000 $20,000 $15,000 Required: Determine the dividend refund amount that PCL should receive for 2021. (7 marks)

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

The dividend refund amount that PCL should receive for 2021 is 14000 PCLs taxable incom... View full answer

Get step-by-step solutions from verified subject matter experts