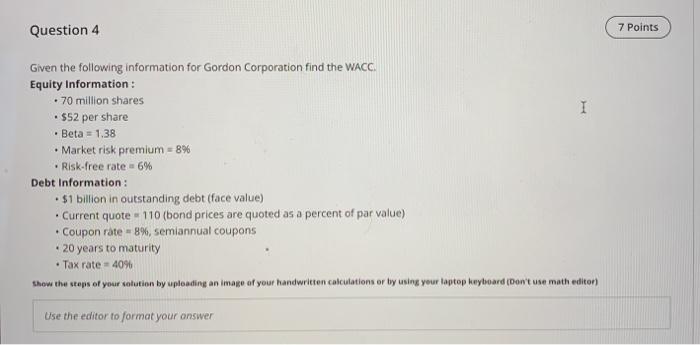

Question: Question 4 7 Points . Given the following information for Gordon Corporation find the WACC. Equity Information: . 70 million shares I $52 per share

Question 4 7 Points . Given the following information for Gordon Corporation find the WACC. Equity Information: . 70 million shares I $52 per share Beta = 1.38 Market risk premium = 8% Risk-free rate 6% Debt Information: $1 billion in outstanding debt (face value) . Current quote - 110 (bond prices are quoted as a percent of par value) . Coupon rate - 8%, semiannual coupons 20 years to maturity Tax rate=40% Show the steps of your solution by uploading an image of your handwritten calculations or by using your laptop keyboard (Don't use math editor) Use the editor to format your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts