Question: QUESTION 4 a) A non-current asset (which has never been revalued) has a carrying amount of a straight-line basis, with a remaining 100,000. The asset

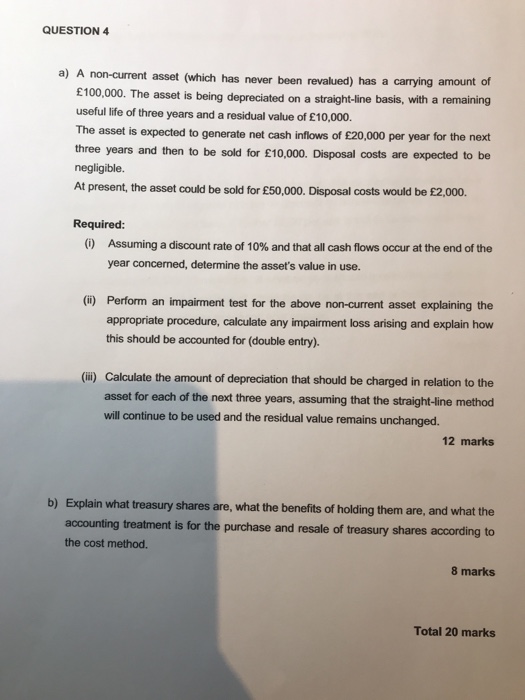

QUESTION 4 a) A non-current asset (which has never been revalued) has a carrying amount of a straight-line basis, with a remaining 100,000. The asset is being depreciated on useful life of three years and a residual value of 10,000. The asset is expected to three years and then to be sold for 10,000. Disposal costs are expected to be negligible. At present, the asset could be sold for 50,000. Disposal costs would be 2,000. generate net cash inflows of 20,000 per year for the next Required: Assuming a discount rate of 10% and that all cash flows occur at the end of the year concerned, determine the asset's value in use. (i) (i) Perform an impairment test for the above non-current asset explaining the appropriate procedure, calculate any impairment loss arising and explain how this should be accounted for (double entry). (ii) Calculate the amount of depreciation that should be charged in relation to the asset for each of the next three years, assuming that the straight-ine method will continue to be used and the residual value remains unchanged. 12 marks Explain what treasury shares are, what the benefits of holding them are, and what the accounting treatment is for the purchase and resale of treasury shares according to the cost method. b) 8 marks Total 20 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts