Question: QUESTION 4 a) Below is Yok Engineering Company's capital structure. The company has to raise RM4 million and has the following financing alternatives to meet

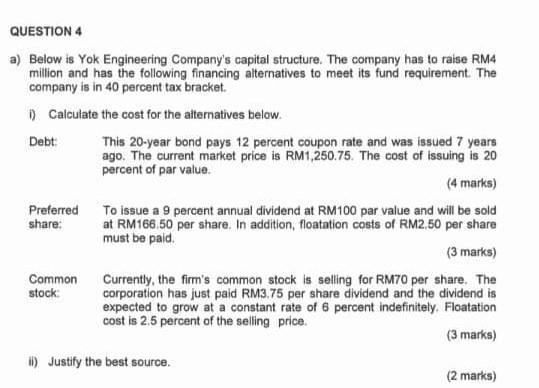

QUESTION 4 a) Below is Yok Engineering Company's capital structure. The company has to raise RM4 million and has the following financing alternatives to meet its fund requirement. The company is in 40 percent tax bracket. i) Calculate the cost for the alternatives below. Debt: Preferred share: Common stock: This 20-year bond pays 12 percent coupon rate and was issued 7 years ago. The current market price is RM1,250.75. The cost of issuing is 20 percent of par value. (4 marks) To issue a 9 percent annual dividend at RM100 par value and will be sold at RM166.50 per share. In addition, floatation costs of RM2.50 per share must be paid. (3 marks) Currently, the firm's common stock is selling for RM70 per share. The corporation has just paid RM3.75 per share dividend and the dividend is expected to grow at a constant rate of 6 percent indefinitely. Floatation cost is 2.5 percent of the selling price. (3 marks) ii) Justify the best source. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts