Question: Question 4 a) Define non-diversifiable risk. Explain why, in theory, non-diversifiable risk is considered the only relevant risk for determination of an investor's required

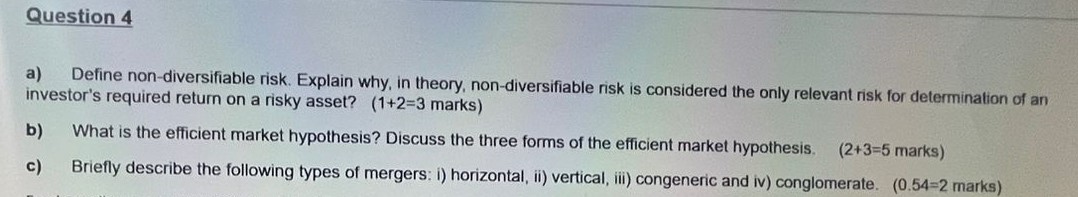

Question 4 a) Define non-diversifiable risk. Explain why, in theory, non-diversifiable risk is considered the only relevant risk for determination of an investor's required return on a risky asset? (1+2-3 marks) b) What is the efficient market hypothesis? Discuss the three forms of the efficient market hypothesis. (2+3=5 marks) c) Briefly describe the following types of mergers: i) horizontal, ii) vertical, iii) congeneric and iv) conglomerate. (0.54-2 marks)

Step by Step Solution

There are 3 Steps involved in it

a Nondiversifiable risk also known as systematic risk or market risk refers to the risk that is inherent in the overall market or economy and cannot be eliminated through diversification This type of ... View full answer

Get step-by-step solutions from verified subject matter experts