Question: Question 4. (a) Reload Options. Reload options are often issued to executives as part of their compensation packages. They are American-style options, giving the holder

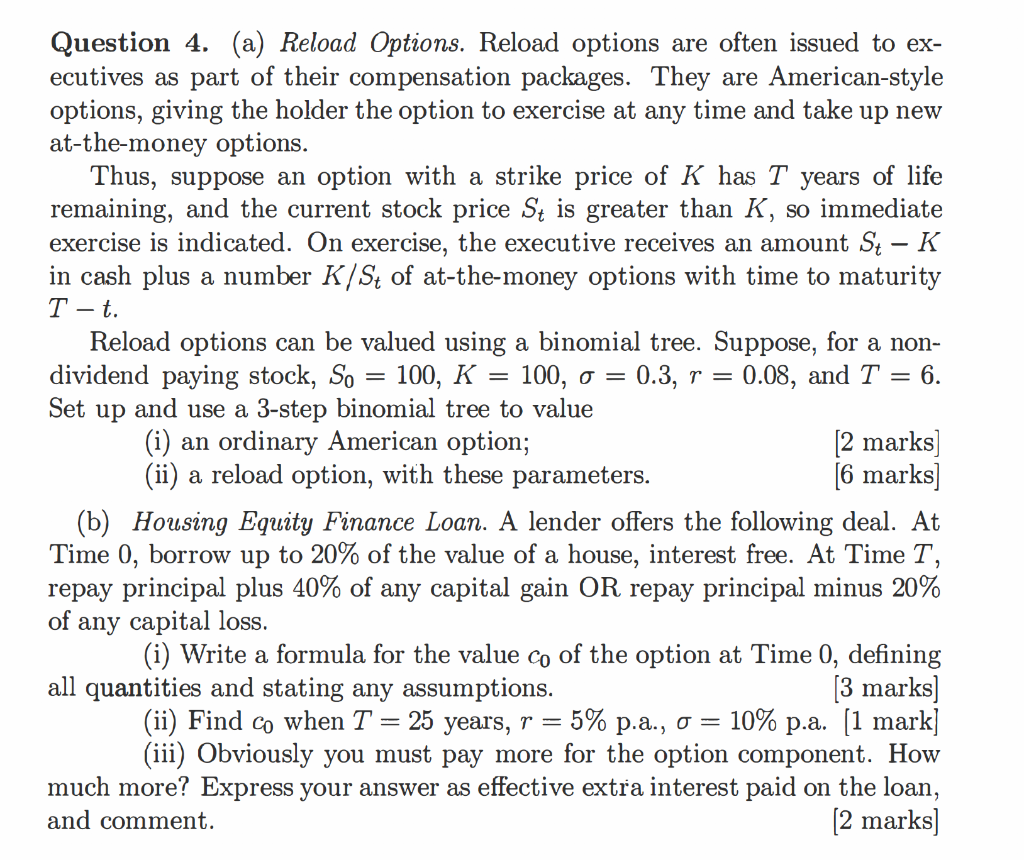

Question 4. (a) Reload Options. Reload options are often issued to executives as part of their compensation packages. They are American-style options, giving the holder the option to exercise at any time and take up new at-the-money options. Thus, suppose an option with a strike price of K has T years of life remaining, and the current stock price St is greater than K, so immediate exercise is indicated. On exercise, the executive receives an amount St - K in cash plus a number K/St of at-the-money options with time to maturity T-t.

Reload options can be valued using a binomial tree. Suppose, for a nondividend paying stock, S0 = 100, K = 100, a- = 0.3, r = 0.08, and T = 6. Set up and use a 3-step binomial tree to value

(i) an ordinary American option;

(ii) a reload option, with these parameters.

(b) Housing Equity Finance Loan. A lender offers the following deal. At Time 0, borrow up to 20% of the value of a house, interest free. At Time T, repay principal plus 40% of any capital gain OR repay principal minus 20% of any capital loss.

(i) Write a formula for the value C0 of the option at Time 0, defining all quantities and stating any assumptions.

(ii) Find C0 when T = 25 years, r = 5% p.a., = 10% p.a.

(iii) Obviously you must pay more for the option component. How much more? Express your answer as effective extra interest paid on the loan, and comment.

Question 4. (a) Reload Options. Reload options are often issued to ex- ecutives as part of their compensation packages. They are American-style options, giving the holder the option to exercise at any time and take up new at-the-money options. Thus, suppose an option with a strike price of K has T years of life remaining, and the current stock price St greater than K, so immediate exercise is indicated. On exercise, the executive receives an amount St - K in cash plus a number K/St of at-the-money options with time to maturity T-t. Reload options can be valued using a binomial tree. Suppose, for non- dividend paying stock, So = 100, K = 100, 0 = 0.3, r = 0.08, and T = 6. Set up and use a 3-step binomial tree to value (i) an ordinary American option; [2 marks] (ii) a reload option, with these parameters. [6 marks] (b) Housing Equity Finance Loan. A lender offers the following deal. At Time 0, borrow up to 20% of the value of a house, interest free. At Time T, repay principal plus 40% of any capital gain OR repay principal minus 20% of any capital loss. (i) Write a formula for the value co of the option at Time 0, defining all quantities and stating any assumptions. [3 marks) (ii) Find co when T = 25 years, r = - 5% p.a., o = 10% p.a. (1 mark] (iii) Obviously you must pay more for the option component. How much more? Express your answer as effective extra interest paid on the loan, and comment. (2 marks] Question 4. (a) Reload Options. Reload options are often issued to ex- ecutives as part of their compensation packages. They are American-style options, giving the holder the option to exercise at any time and take up new at-the-money options. Thus, suppose an option with a strike price of K has T years of life remaining, and the current stock price St greater than K, so immediate exercise is indicated. On exercise, the executive receives an amount St - K in cash plus a number K/St of at-the-money options with time to maturity T-t. Reload options can be valued using a binomial tree. Suppose, for non- dividend paying stock, So = 100, K = 100, 0 = 0.3, r = 0.08, and T = 6. Set up and use a 3-step binomial tree to value (i) an ordinary American option; [2 marks] (ii) a reload option, with these parameters. [6 marks] (b) Housing Equity Finance Loan. A lender offers the following deal. At Time 0, borrow up to 20% of the value of a house, interest free. At Time T, repay principal plus 40% of any capital gain OR repay principal minus 20% of any capital loss. (i) Write a formula for the value co of the option at Time 0, defining all quantities and stating any assumptions. [3 marks) (ii) Find co when T = 25 years, r = - 5% p.a., o = 10% p.a. (1 mark] (iii) Obviously you must pay more for the option component. How much more? Express your answer as effective extra interest paid on the loan, and comment. (2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts