Question: Question 4 (a) Using a no-arbitrage argument, derive an expression for the k-period forward price of an asset where F is the k-period forward price,

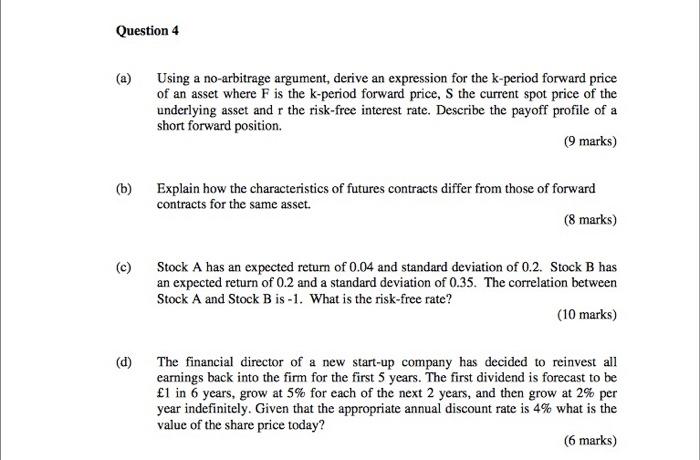

Question 4 (a) Using a no-arbitrage argument, derive an expression for the k-period forward price of an asset where F is the k-period forward price, the current spot price of the underlying asset and r the risk-free interest rate. Describe the payoff profile of a short forward position. (9 marks) (b) Explain how the characteristics of futures contracts differ from those of forward contracts for the same asset. (8 marks) (c) Stock A has an expected return of 0.04 and standard deviation of 0.2. Stock B has an expected return of 0.2 and a standard deviation of 0.35. The correlation between Stock A and Stock B is -1. What is the risk-free rate? (10 marks) (d) The financial director of a new start-up company has decided to reinvest all earnings back into the firm for the first 5 years. The first dividend is forecast to be 1 in 6 years, grow at 5% for each of the next 2 years, and then grow at 2% per year indefinitely. Given that the appropriate annual discount rate is 4% what is the value of the share price today? 6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts