Question: QUESTION 4 a) Why will an American call option on a stock that pays no dividend not be exercised before maturity? (6 Marks) b) Consider

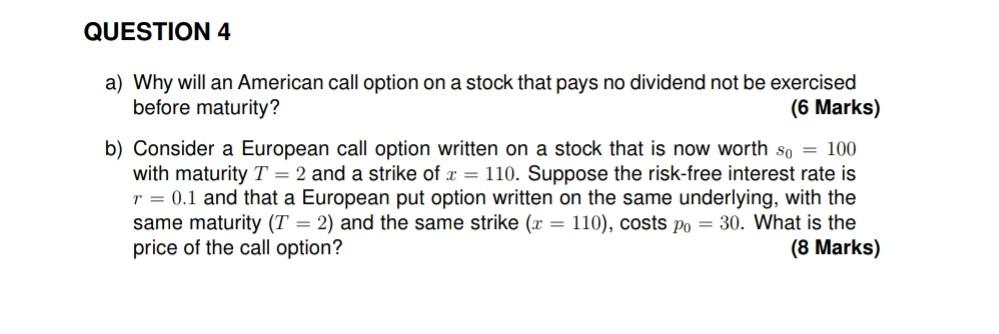

QUESTION 4 a) Why will an American call option on a stock that pays no dividend not be exercised before maturity? (6 Marks) b) Consider a European call option written on a stock that is now worth so = 100 with maturity T = 2 and a strike of r = 110. Suppose the risk-free interest rate is r = 0.1 and that a European put option written on the same underlying, with the same maturity (T = 2) and the same strike (x = 110), costs po = 30. What is the price of the call option? (8 Marks) c) Which one costs more: A European call option or an American call option (when they have the same maturity and the same strike price)? (Explain your answer.) (5 Marks) (Total 19 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts