Question: Question 4 ABCD Ltd. has two divisions CD and AB. CD is an iron foundry division which produces mouldings that have a limited external market

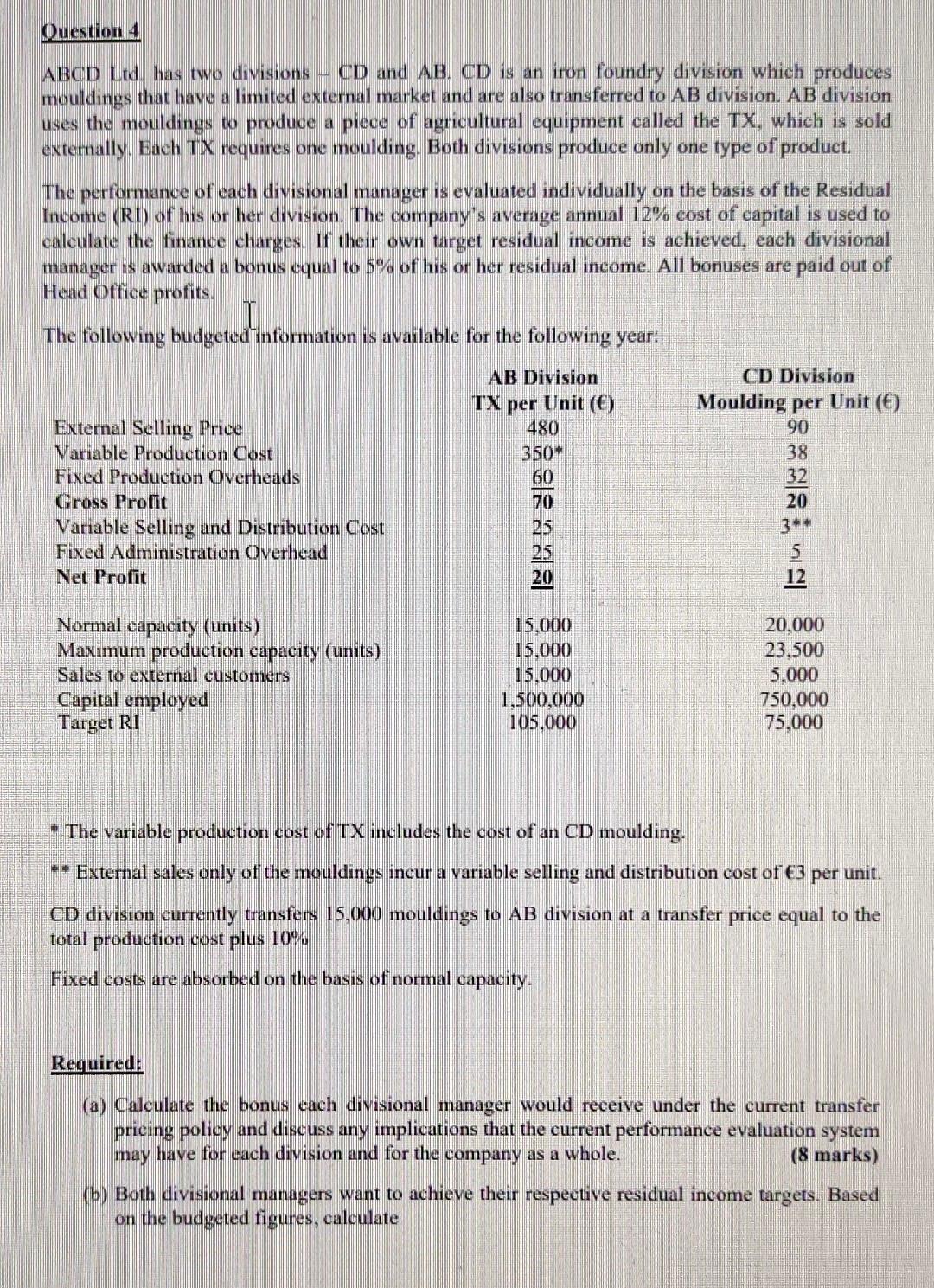

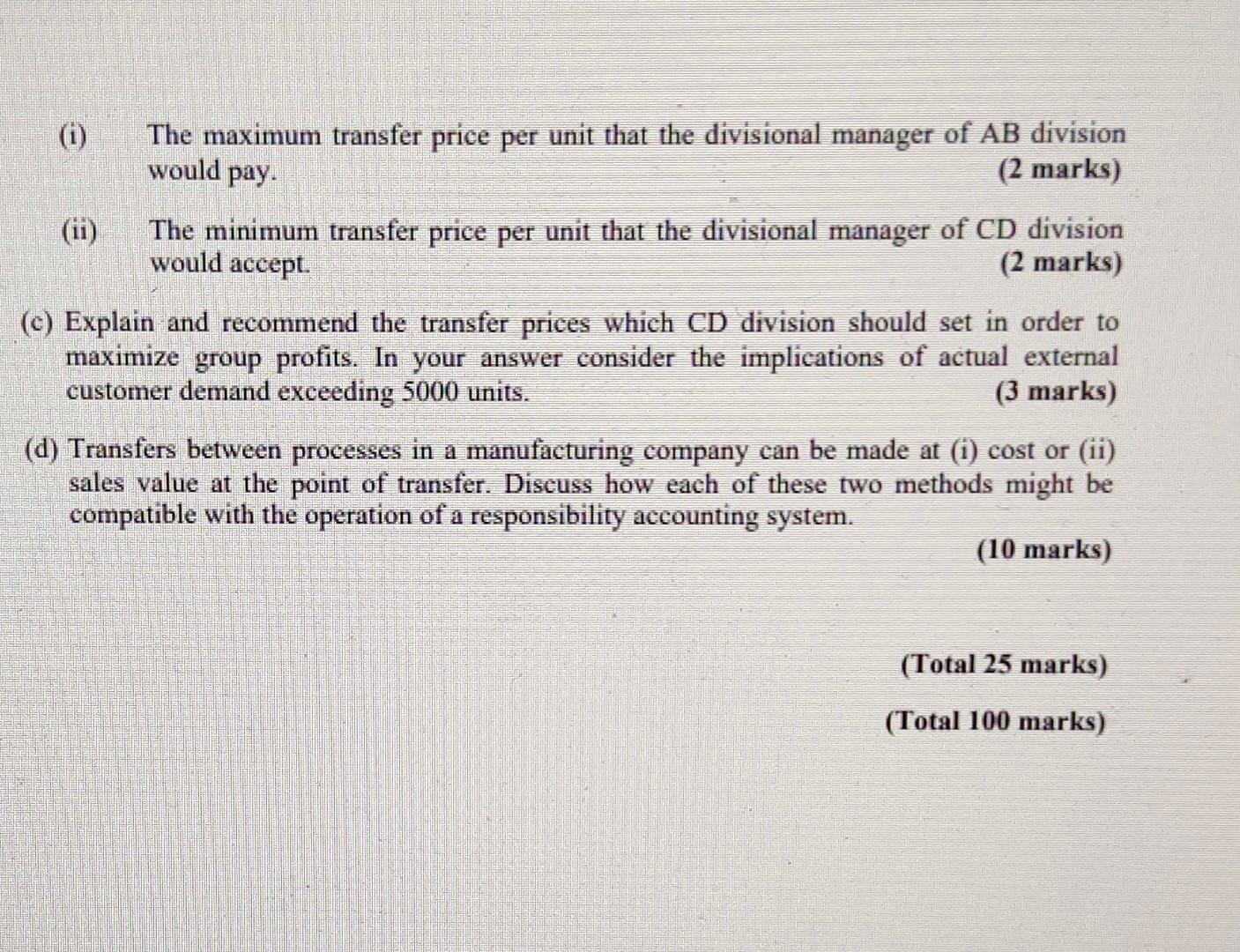

Question 4 ABCD Ltd. has two divisions CD and AB. CD is an iron foundry division which produces mouldings that have a limited external market and are also transferred to AB division. AB division uses the mouldings to produce a piece of agricultural equipment called the TX, which is sold externally. Each TX requires one moulding. Both divisions produce only one type of product. The performance of each divisional manager is evaluated individually on the basis of the Residual Income (RI) of his or her division. The company's average annual 12% cost of capital is used to calculate the finance charges. If their own target residual income is achieved, each divisional manager is awarded a bonus cqual to 5% of his or her residual income. All bonuses are paid out of Head Office profits. The following budgeted information is available for the following year: The variable production cost of TX includes the cost of an CD moulding. External sales only of the mouldings incur a variable selling and distribution cost of 3 per unit. CD division currently transfers 15,000 mouldings to AB division at a transfer price equal to the total production cost plus 10% Fixed costs are absorbed on the basis of normal capacity. Required: (a) Calculate the bonus each divisional manager would receive under the current transfer pricing policy and discuss any implications that the current performance evaluation system may have for each division and for the company as a whole. ( 8 marks) (b) Both divisional managers want to achieve their respective residual income targets. Based on the budgeted figures, calculate (i) The maximum transfer price per unit that the divisional manager of AB division would pay. (2 marks) (ii) The minimum transfer price per unit that the divisional manager of CD division would accept. ( 2 marks) (c) Explain and recommend the transfer prices which CD division should set in order to maximize group profits. In your answer consider the implications of actual external customer demand exceeding 5000 units. (3 marks) (d) Transfers between processes in a manufacturing company can be made at (i) cost or (ii) sales value at the point of transfer. Discuss how each of these two methods might be compatible with the operation of a responsibility accounting system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts