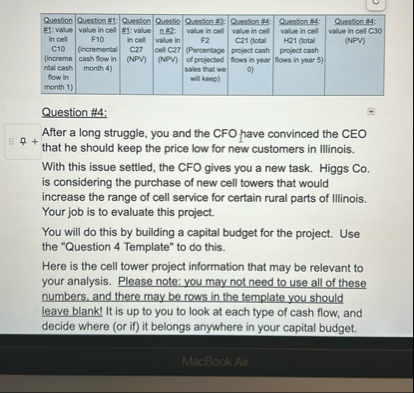

Question: Question # 4 : After a long struggle, you and the CFO have convinced the CEO that he should keep the price low for new

Question #:

After a long struggle, you and the CFO have convinced the CEO that he should keep the price low for new customers in Illinois.

With this issue settled, the CFO gives you a new task. Higgs Co is considering the purchase of new cell towers that would increase the range of cell service for certain rural parts of Illinois. Your job is to evaluate this project.

You will do this by building a capital budget for the project. Use the "Question Template" to do this.

Here is the cell tower project information that may be relevant to your analysis. Please note: you may not need to use all of these numbers, and there may be rows in the template you should leave blank! It is up to you to look at each type of cash flow, and decide where or if it belongs anywhere in your capital budget.

MacBook AirYou can use the same tax rate as you used in Question The information below will be a mix of pretax and aftertax cash flows, so I will try to be very specific about where you need to consider taxes in your calculations.

The capital expenditure related to these cell towers would be $ million dollars at the beginning of the project. There would also be an additional $ of installation fees related to these cell towers.

Higgs Co uses a MACRS depreciation schedule, which is provided for you at the top of the template. The company will realize a tax benefit related to the 'tax shield' created by the depreciation expenses from the cell tower project.

The project horizon is five years. At the end of the fifth year, you can sell the cell towers for $ million. Make sure you figure out the tax impact of this sale and include it in your template!

To evaluate the potential impact of these cell towers, the CEO and CFO commissioned a consulting study. The consulting firm presented their conclusions to Higgs Co and Higgs Co paid the consultants $ for their service.

If you don't build the cell towers, the company can sell off the land where the towers would have been constructed. This land wouldgenerate an aftertax cash flow of $ million. If you don't sell the land today and build the towers instead, you can still sell the land at the end of year for the same amount.

To complete the project, Higgs Co will have to set aside some net working capital. More specifically, Higgs will need $ in working capital. These funds can be 'released' in the last year of the project.

The main benefit of building the cell towers is that more potential customers from rural lllinois will be interested in buying a cell phone from your company!

You estimate that the cell towers will result in new incremental customer? in each of the five years of the project. Normally, modeling the cash flows associated with these new customers would be tricky youd have to consider the timing of the new customers, costs associated with them, probability they stay with Higgs for a year or longer, etc.

However, I have some good news you've already done this!II The NPV you calculated for question is in fact, the lifetime, aftertax cash flow associated with each new lllinois customer.

You can include these cash flows in the model simply by multiplying your NPV from question by in each year in the question template.

What is the NPV of the llinois cell tower project?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock