Question: QUESTION 4 An implication of the efficient market hypothesis is that O high book to market ratio stocks are consistently better performers O low beta

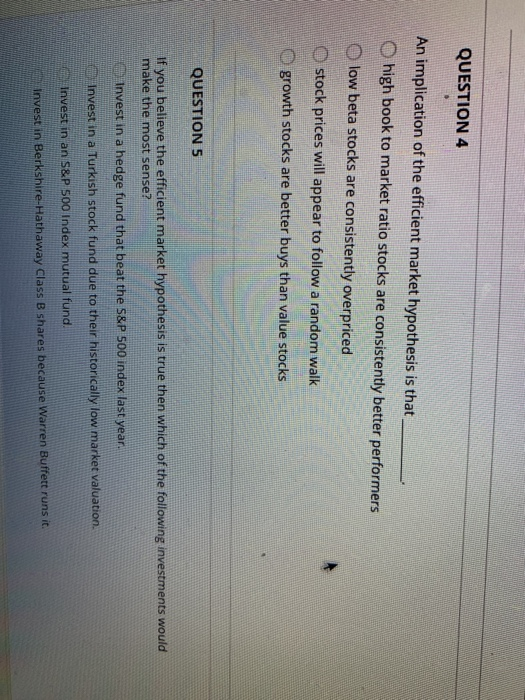

QUESTION 4 An implication of the efficient market hypothesis is that O high book to market ratio stocks are consistently better performers O low beta stocks are consistently overpriced O stock prices will appear to follow a random walk O growth stocks are better buys than value stocks QUESTION 5 If you believe the efficient market hypothesis is true then which of the following investments would make the most sense? Invest in a hedge fund that beat the S&P 500 index last year Invest in a Turkish stock fund due to their historically low market valuation. Q Invest in an S&P s00 Index mutual fund. invest in Berkshire-Hathaway Class B shares because Warren Buffett runs it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts