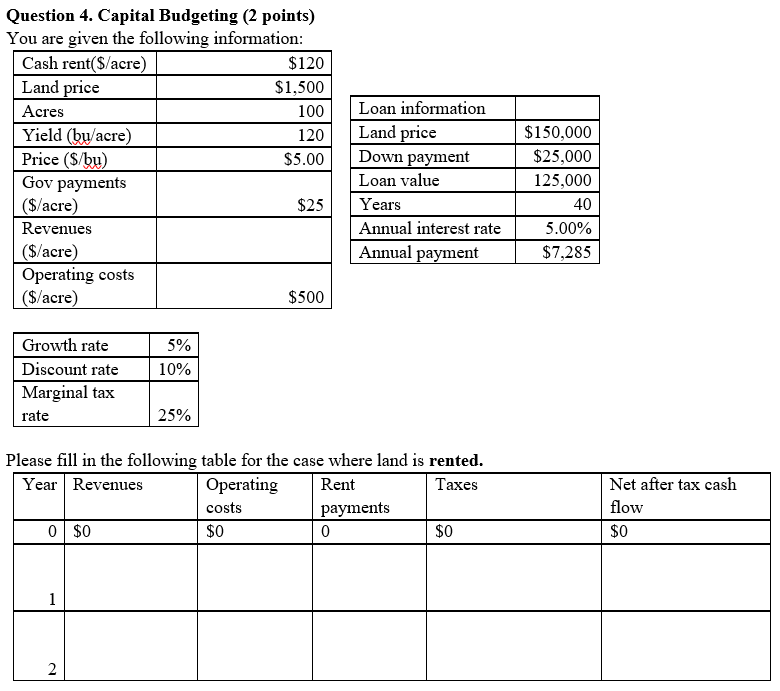

Question: Question 4. Capital Budgeting (2 points) You are given the following information: Cash rent($/acre) $120 Land price $1,500 Acres 100 Yield (bu/acre) 120 Price ($/bu)

Question 4. Capital Budgeting (2 points) You are given the following information: Cash rent($/acre) $120 Land price $1,500 Acres 100 Yield (bu/acre) 120 Price ($/bu) $5.00 Gov payments ($/acre) Revenues ($/acre) Operating costs ($/acre) $500 Loan information Land price Down payment Loan value Years Annual interest rate Annual payment $150,000 $25,000 125,000 40 5.00% $7.285 5% 10% Growth rate Discount rate Marginal tax rate 25% Please fill in the following table for the case where land is rented. Year Revenues Operating Rent Taxes costs payments 0 $0 $0 0 Net after tax cash flow $0 $0 Question 4. Capital Budgeting (2 points) You are given the following information: Cash rent($/acre) $120 Land price $1,500 Acres 100 Yield (bu/acre) 120 Price ($/bu) $5.00 Gov payments ($/acre) Revenues ($/acre) Operating costs ($/acre) $500 Loan information Land price Down payment Loan value Years Annual interest rate Annual payment $150,000 $25,000 125,000 40 5.00% $7.285 5% 10% Growth rate Discount rate Marginal tax rate 25% Please fill in the following table for the case where land is rented. Year Revenues Operating Rent Taxes costs payments 0 $0 $0 0 Net after tax cash flow $0 $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts