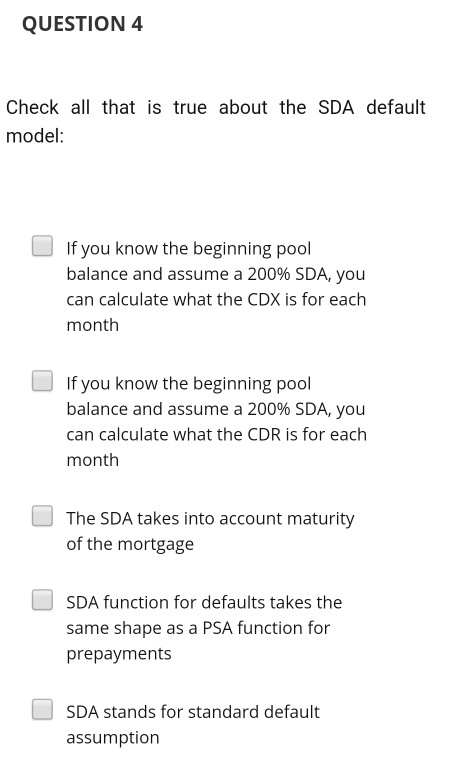

Question: QUESTION 4 Check all that is true about the SDA default model: If you know the beginning pool balance and assume a 200% SDA, you

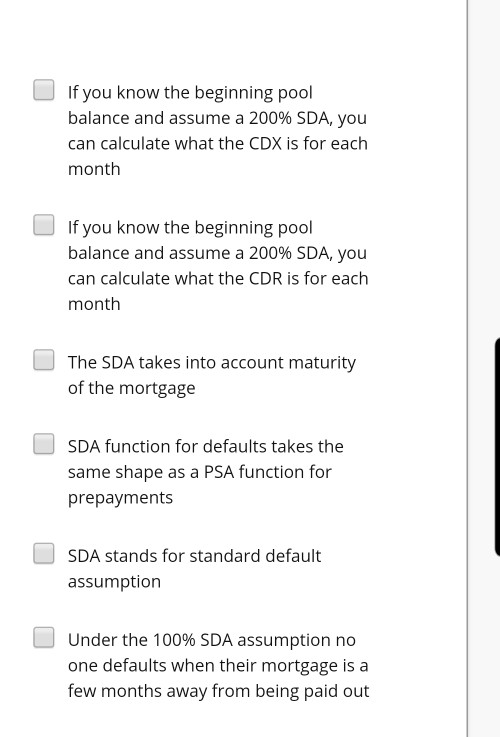

QUESTION 4 Check all that is true about the SDA default model: If you know the beginning pool balance and assume a 200% SDA, you can calculate what the CDX is for each month If you know the beginning pool balance and assume a 200% SDA, you can calculate what the CDR is for each month The SDA takes into account maturity of the mortgage SDA function for defaults takes the same shape as a PSA function for prepayments SDA stands for standard default assumption U If you know the beginning pool balance and assume a 200% SDA, you can calculate what the CDX is for each month If you know the beginning pool balance and assume a 200% SDA, you can calculate what the CDR is for each month The SDA takes into account maturity of the mortgage SDA function for defaults takes the same shape as a PSA function for prepayments SDA stands for standard default assumption Under the 100% SDA assumption no one defaults when their mortgage is a few months away from being paid out QUESTION 6 Consider a sequential pay CMO that is backed by 60 mortgages with average balance of $100,000 each. The mortgages have monthly payments with WAM = 15 years and WAC = 4%. There is a servicing fee of 0.6% and prepayment is according to 100% PSA. There are two tranches in this CMO: tranch A issued for $3,000,000 and tranche B issued for $3,000,000. How much cash flow do investors in tranche A receive in the first month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts