Question: QUESTION 4 Consider a 9%-coupon bond with a remaining maturity of 3.5 years. Which of the following bonds will have a longer duration than this

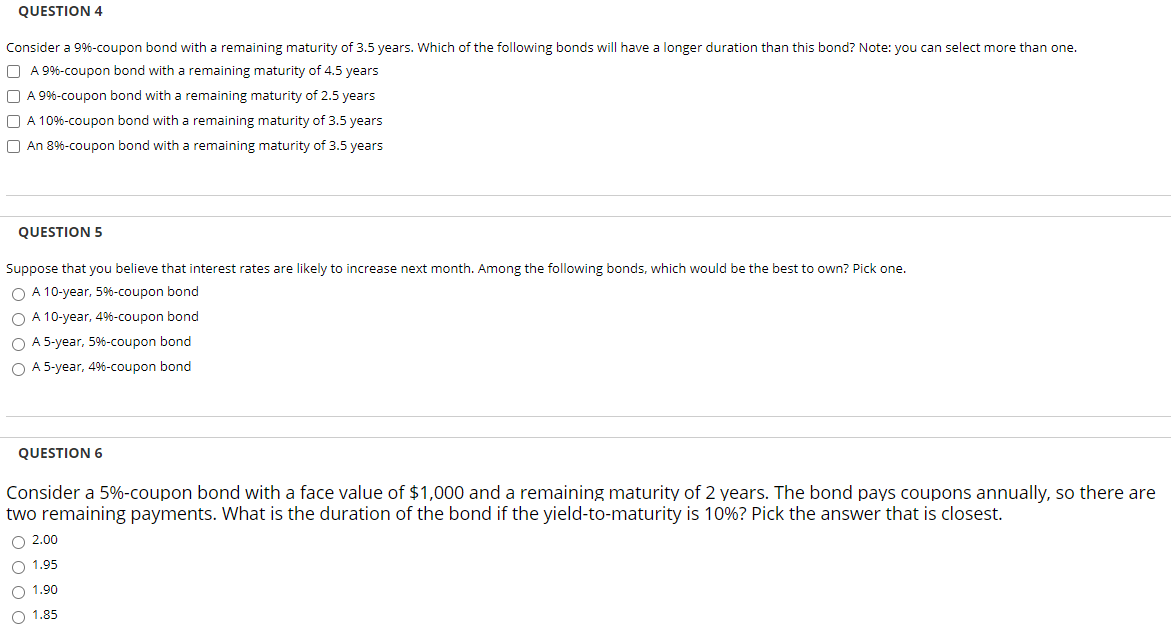

QUESTION 4 Consider a 9%-coupon bond with a remaining maturity of 3.5 years. Which of the following bonds will have a longer duration than this bond? Note: you can select more than one. O A 996-coupon bond with a remaining maturity of 4.5 years A9%-coupon bond with a remaining maturity of 2.5 years A 1096-coupon bond with a remaining maturity of 3.5 years An 896-coupon bond with a remaining maturity of 3.5 years QUESTION 5 Suppose that you believe that interest rates are likely to increase next month. Among the following bonds, which would be the best to own? Pick one. O A 10-year, 596-coupon bond O A 10-year, 496-coupon bond O A 5-year, 5%-coupon bond O A 5-year, 49-coupon bond QUESTION 6 Consider a 5%-coupon bond with a face value of $1,000 and a remaining maturity of 2 years. The bond pays coupons annually, so there are two remaining payments. What is the duration of the bond if the yield-to-maturity is 10%? Pick the answer that is closest. O 2.00 O 1.95 O 1.90 O 1.85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts