Question: QUESTION #4 Consider the same data as in question 3 and now assume that the required annual yield-to-maturity of the bond denoted by k, will

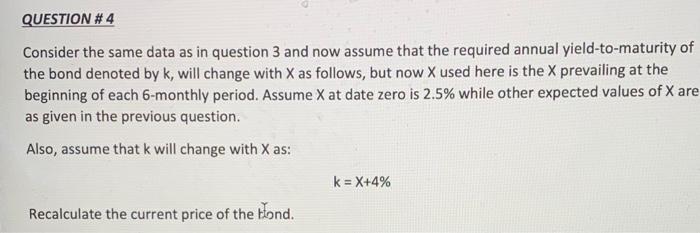

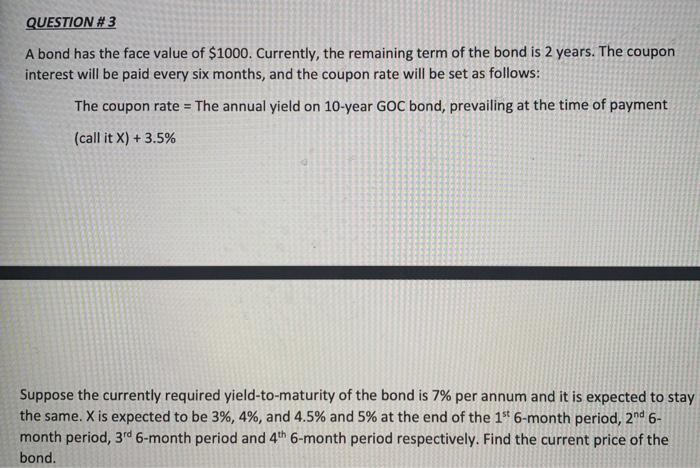

QUESTION #4 Consider the same data as in question 3 and now assume that the required annual yield-to-maturity of the bond denoted by k, will change with X as follows, but now X used here is the X prevailing at the beginning of each 6-monthly period. Assume X at date zero is 2.5% while other expected values of X are as given in the previous question. Also, assume that k will change with X as: k = X+4% Recalculate the current price of the tond. QUESTION #3 A bond has the face value of $1000. Currently, the remaining term of the bond is 2 years. The coupon interest will be paid every six months, and the coupon rate will be set as follows: The coupon rate = The annual yield on 10-year GOC bond, prevailing at the time of payment (call it X) + 3.5% Suppose the currently required yield-to-maturity of the bond is 7% per annum and it is expected to stay the same. X is expected to be 3%, 4%, and 4.5% and 5% at the end of the 1st 6-month period, 2nd 6- month period, 6-month period and 4th 6-month period respectively. Find the current price of the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts