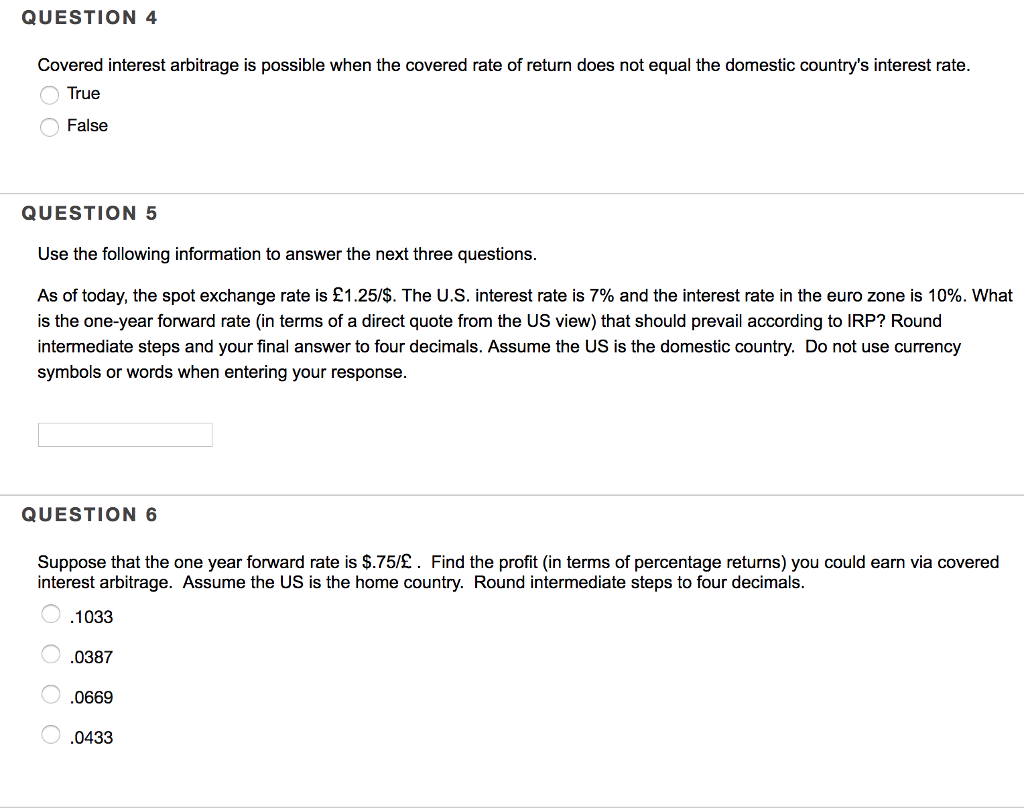

Question: QUESTION 4 Covered interest arbitrage is possible when the covered rate of return does not equal the domestic country's interest rate. True False QUESTION 5

QUESTION 4 Covered interest arbitrage is possible when the covered rate of return does not equal the domestic country's interest rate. True False QUESTION 5 Use the following information to answer the next three questions. As of today, the spot exchange rate is 1.25/$. The U.S. interest rate is 7% and the interest rate in the euro zone is 10%. What is the one-year forward rate (in terms of a direct quote from the US view) that should prevail according to IRP? Round intermediate steps and your final answer to four decimals. Assume the US is the domestic country. Do not use currency symbols or words when entering your response. QUESTION 6 Suppose that the one year forward rate is $.75/. Find the profit (in terms of percentage returns) you could earn via covered interest arbitrage. Assume the US is the home country. Round intermediate steps to four decimals. 1033 0387 0669 0433

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts