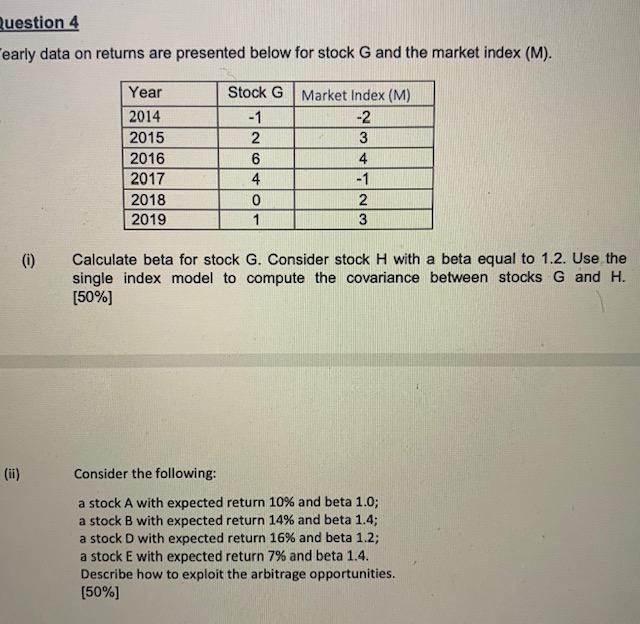

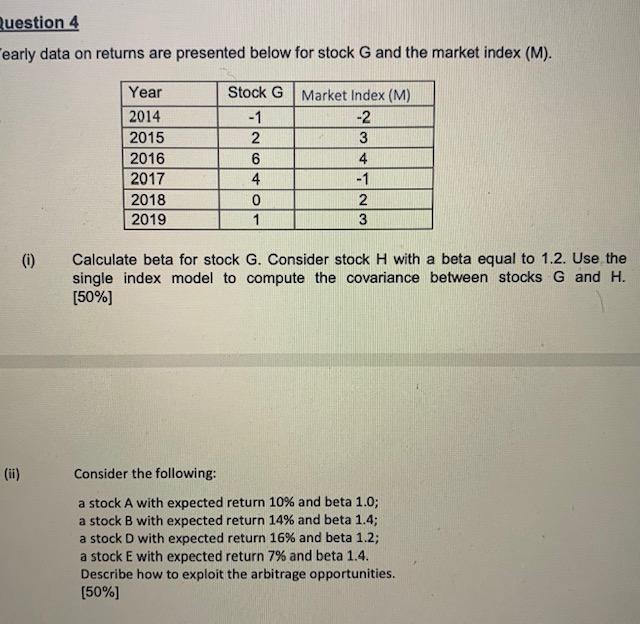

Question: Question 4 early data on returns are presented below for stock G and the market index (M). Year 2014 2015 2016 2017 2018 2019 Stock

Question 4 early data on returns are presented below for stock G and the market index (M). Year 2014 2015 2016 2017 2018 2019 Stock Market Index (M) -1 -2 2 3 6 4 4 -1 0 2 1 3 (0) Calculate beta for stock G. Consider stock H with a beta equal to 1.2. Use the single index model to compute the covariance between stocks G and H. (50%) (ii) Consider the following: a stock A with expected return 10% and beta 1.0; a stock B with expected return 14% and beta 1.4; a stock D with expected return 16% and beta 1.2; a stock E with expected return 7% and beta 1.4. Describe how to exploit the arbitrage opportunities. (50%) Question 4 early data on returns are presented below for stock G and the market index (M). Year 2014 2015 2016 2017 2018 2019 Stock Market Index (M) -1 -2 2 3 6 4 4 -1 0 2 1 3 (0) Calculate beta for stock G. Consider stock H with a beta equal to 1.2. Use the single index model to compute the covariance between stocks G and H. (50%) (ii) Consider the following: a stock A with expected return 10% and beta 1.0; a stock B with expected return 14% and beta 1.4; a stock D with expected return 16% and beta 1.2; a stock E with expected return 7% and beta 1.4. Describe how to exploit the arbitrage opportunities. (50%) Question 4 early data on returns are presented below for stock G and the market index (M). Year 2014 2015 2016 2017 2018 2019 Stock Market Index (M) -1 -2 2 3 6 4 4 -1 0 2 1 3 (0) Calculate beta for stock G. Consider stock H with a beta equal to 1.2. Use the single index model to compute the covariance between stocks G and H. (50%) (ii) Consider the following: a stock A with expected return 10% and beta 1.0; a stock B with expected return 14% and beta 1.4; a stock D with expected return 16% and beta 1.2; a stock E with expected return 7% and beta 1.4. Describe how to exploit the arbitrage opportunities. (50%) Question 4 early data on returns are presented below for stock G and the market index (M). Year 2014 2015 2016 2017 2018 2019 Stock Market Index (M) -1 -2 2 3 6 4 4 -1 0 2 1 3 (0) Calculate beta for stock G. Consider stock H with a beta equal to 1.2. Use the single index model to compute the covariance between stocks G and H. (50%) (ii) Consider the following: a stock A with expected return 10% and beta 1.0; a stock B with expected return 14% and beta 1.4; a stock D with expected return 16% and beta 1.2; a stock E with expected return 7% and beta 1.4. Describe how to exploit the arbitrage opportunities. (50%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts