Question: Question 4: FFF Company is using the allowance method to account for bad debts. The company policy is to estimate the uncollectible accounts as

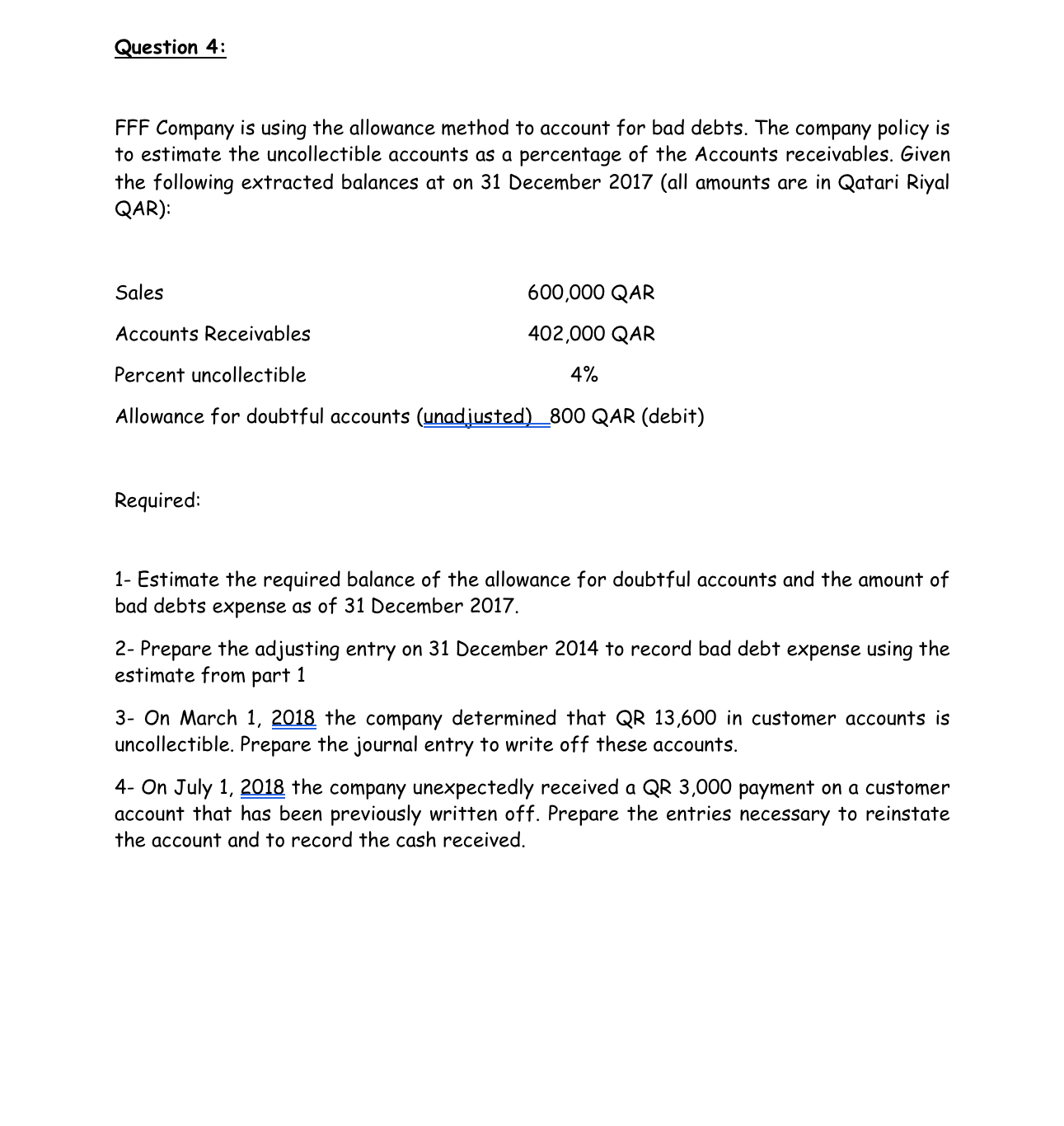

Question 4: FFF Company is using the allowance method to account for bad debts. The company policy is to estimate the uncollectible accounts as a percentage of the Accounts receivables. Given the following extracted balances at on 31 December 2017 (all amounts are in Qatari Riyal QAR): Sales Accounts Receivables Percent uncollectible 600,000 QAR 402,000 QAR 4% Allowance for doubtful accounts (unadjusted) _800 QAR (debit) Required: 1- Estimate the required balance of the allowance for doubtful accounts and the amount of bad debts expense as of 31 December 2017. 2- Prepare the adjusting entry on 31 December 2014 to record bad debt expense using the estimate from part 1 3- On March 1, 2018 the company determined that QR 13,600 in customer accounts is uncollectible. Prepare the journal entry to write off these accounts. 4- On July 1, 2018 the company unexpectedly received a QR 3,000 payment on a customer account that has been previously written off. Prepare the entries necessary to reinstate the account and to record the cash received.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts