Question: QUESTION 4 FINANCIAL STATEMENT ANALYSIS: FOR THIS AND THE NEXT 2 QUESTIONS. A breakdown af a company's return on equity (ROE), using the DuPont model

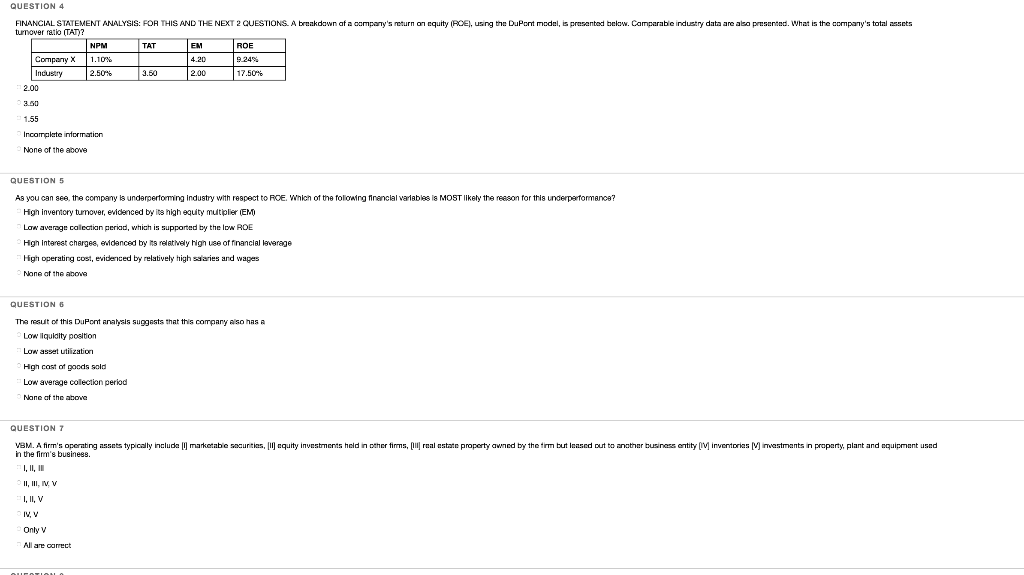

QUESTION 4 FINANCIAL STATEMENT ANALYSIS: FOR THIS AND THE NEXT 2 QUESTIONS. A breakdown af a company's return on equity (ROE), using the DuPont model is presented below. Comparable industry data are also presented. What is the company's total sets turnover ratio (TAT)? NPTATEMROE Company X 1.10% 4.20 9 .24% Industry 2.50% 3.50 2.00 17.50% 2.00 3.50 155 Incomplete information None of the above QUESTION 5 As you can see the company is underperforming Industry with respect to ROE. Which of the following financial variables is MOST likely the reason for this underperformance? High inventory tumover, evidenced by its high equity multiplier EM Low average calection period, which is supported by the low ROE High interest charges, evidenced by its relatively high use of financial leverage High operating cost, evidenced by relatively high salaries and wages None of the above QUESTION 6 The result of this DuPont Analysis suggests that this company Also has a Low liquidity position Low asset utilization High cost of goods sold Low average collection period None at the above QUESTION 7 VBM. A firm's operating assets typically include U marketable securities, equity investments held in other tims, il real estate property awned by the firm but Ioased out to another business entity (IM inventories M investments in property, plant and equipment used in the film's business. I, II, IN II, III, IV V IVV Only V Allare correct QUESTION 4 FINANCIAL STATEMENT ANALYSIS: FOR THIS AND THE NEXT 2 QUESTIONS. A breakdown af a company's return on equity (ROE), using the DuPont model is presented below. Comparable industry data are also presented. What is the company's total sets turnover ratio (TAT)? NPTATEMROE Company X 1.10% 4.20 9 .24% Industry 2.50% 3.50 2.00 17.50% 2.00 3.50 155 Incomplete information None of the above QUESTION 5 As you can see the company is underperforming Industry with respect to ROE. Which of the following financial variables is MOST likely the reason for this underperformance? High inventory tumover, evidenced by its high equity multiplier EM Low average calection period, which is supported by the low ROE High interest charges, evidenced by its relatively high use of financial leverage High operating cost, evidenced by relatively high salaries and wages None of the above QUESTION 6 The result of this DuPont Analysis suggests that this company Also has a Low liquidity position Low asset utilization High cost of goods sold Low average collection period None at the above QUESTION 7 VBM. A firm's operating assets typically include U marketable securities, equity investments held in other tims, il real estate property awned by the firm but Ioased out to another business entity (IM inventories M investments in property, plant and equipment used in the film's business. I, II, IN II, III, IV V IVV Only V Allare correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts