Question: Question 4 (FIS Active strategies and Term Structure changes) This question considers the impact of a twist (flattening and steepening) in the yield curve on

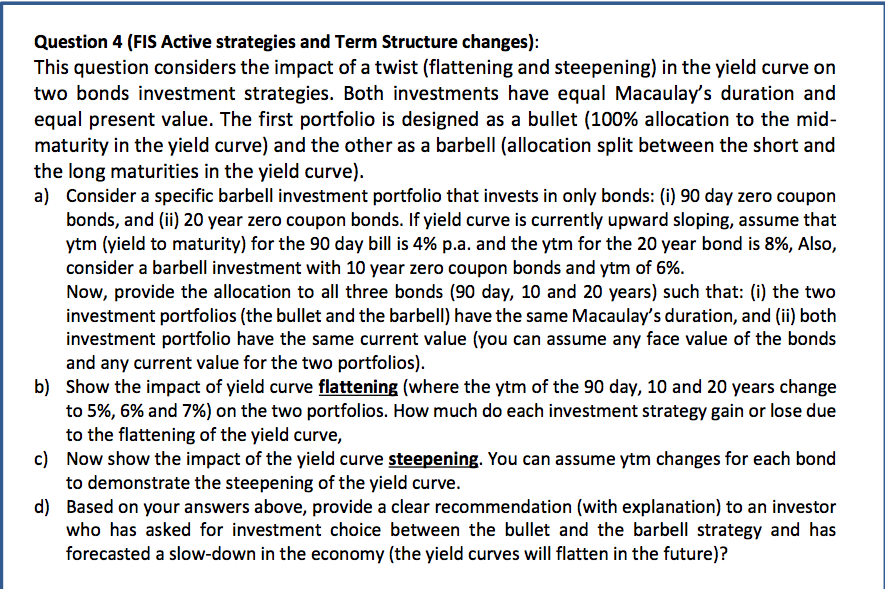

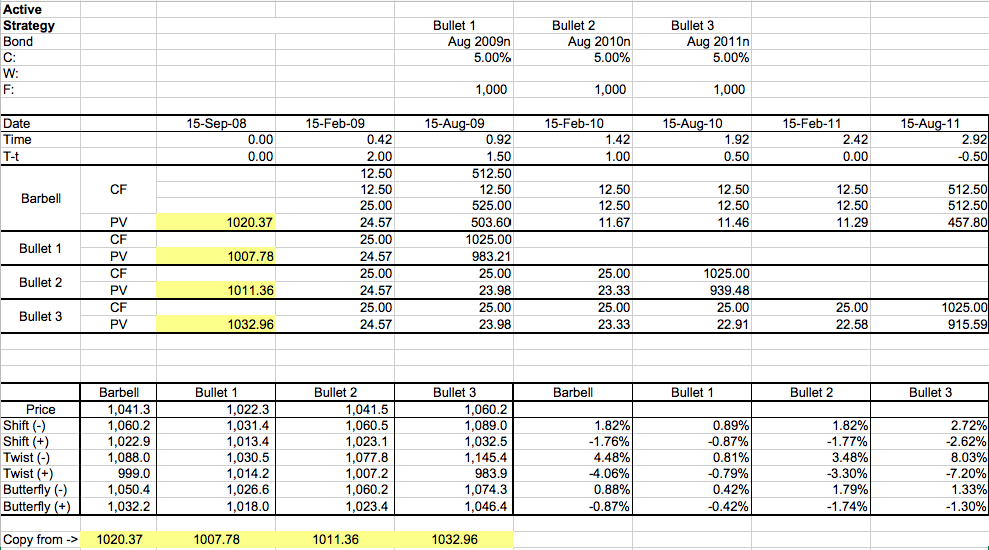

Question 4 (FIS Active strategies and Term Structure changes) This question considers the impact of a twist (flattening and steepening) in the yield curve on two bonds investment strategies. Both investments have equal Macaulay's duration and equal present value. The first portfolio is designed as a bullet (100% allocation to the mid- maturity in the yield curve) and the other as a barbell (allocation split between the short and the long maturities in the yield curve) a) Consider a specific barbell investment portfolio that invests in only bonds: (i) 90 day zero coupon bonds, and (ii) 20 year zero coupon bonds. If yield curve is currently upward sloping, assume that ytm (yield to maturity) for the 90 day bill is 4% pa. and the ytm for the 20 year bond is 8%, Also, consider a barbell investment with 10 year zero coupon bonds and ytm of 6% Now, provide the allocation to all three bonds (90 day, 10 and 20 years) such that: (i) the two investment portfolios (the bullet and the barbell) have the same Macaulay's duration, and (ii) both investment portfolio have the same current value (you can assume any face value of the bonds and any current value for the two portfolios) b) Show the impact of yield curve flattening (where the ytm of the 90 day, 10 and 20 years change to 5%, 6% and 7%) on the two portfolios. How much do each investment strategy gain or lose due to the flattening of the yield curve, c) Now show the impact of the yield curve steepening. You can assume ytm changes for each bond to demonstrate the steepening of the yield curve. d) Based on your answers above, provide a clear recommendation (with explanation) to an investor who has asked for investment choice between the bullet and the barbell strategy and has forecasted a slow-down in the economy (the yield curves will flatten in the future)? Active Bullet 1 Aug 2009n Strategy Bullet 2 Bullet 3 Aug 2010n 5.00% 5.00% 1,000 1,000 15-Feb-09 15-Aug-09 15-Aug-10 15-Sep-08 15-Feb-10 15-Feb-11 15-Aug-11 0 2 0 0 512.50 2 2 Barbell 512.50 1020.37 457.80 Bullet 1 1007.78 0 Bullet 2 1011.36 25.00 1025.00 Bullet 3 1032.96 22.58 915.59 Bullet 1 Bullet 2 Bullet 3 Barbell Bullet 1 Bullet 2 Bullet 3 0 3 6 78% 0 4 3 Butterfly () 1,050.4 Butterfly (+) 8 Copy from> 1020.37 1007.78 1011.36 1032.96 Question 4 (FIS Active strategies and Term Structure changes) This question considers the impact of a twist (flattening and steepening) in the yield curve on two bonds investment strategies. Both investments have equal Macaulay's duration and equal present value. The first portfolio is designed as a bullet (100% allocation to the mid- maturity in the yield curve) and the other as a barbell (allocation split between the short and the long maturities in the yield curve) a) Consider a specific barbell investment portfolio that invests in only bonds: (i) 90 day zero coupon bonds, and (ii) 20 year zero coupon bonds. If yield curve is currently upward sloping, assume that ytm (yield to maturity) for the 90 day bill is 4% pa. and the ytm for the 20 year bond is 8%, Also, consider a barbell investment with 10 year zero coupon bonds and ytm of 6% Now, provide the allocation to all three bonds (90 day, 10 and 20 years) such that: (i) the two investment portfolios (the bullet and the barbell) have the same Macaulay's duration, and (ii) both investment portfolio have the same current value (you can assume any face value of the bonds and any current value for the two portfolios) b) Show the impact of yield curve flattening (where the ytm of the 90 day, 10 and 20 years change to 5%, 6% and 7%) on the two portfolios. How much do each investment strategy gain or lose due to the flattening of the yield curve, c) Now show the impact of the yield curve steepening. You can assume ytm changes for each bond to demonstrate the steepening of the yield curve. d) Based on your answers above, provide a clear recommendation (with explanation) to an investor who has asked for investment choice between the bullet and the barbell strategy and has forecasted a slow-down in the economy (the yield curves will flatten in the future)? Active Bullet 1 Aug 2009n Strategy Bullet 2 Bullet 3 Aug 2010n 5.00% 5.00% 1,000 1,000 15-Feb-09 15-Aug-09 15-Aug-10 15-Sep-08 15-Feb-10 15-Feb-11 15-Aug-11 0 2 0 0 512.50 2 2 Barbell 512.50 1020.37 457.80 Bullet 1 1007.78 0 Bullet 2 1011.36 25.00 1025.00 Bullet 3 1032.96 22.58 915.59 Bullet 1 Bullet 2 Bullet 3 Barbell Bullet 1 Bullet 2 Bullet 3 0 3 6 78% 0 4 3 Butterfly () 1,050.4 Butterfly (+) 8 Copy from> 1020.37 1007.78 1011.36 1032.96

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts