Question: QUESTION 4 Given a pool of FRMs, we would like to create floater and inverse floater securities from a set amount of pool of mortgages.

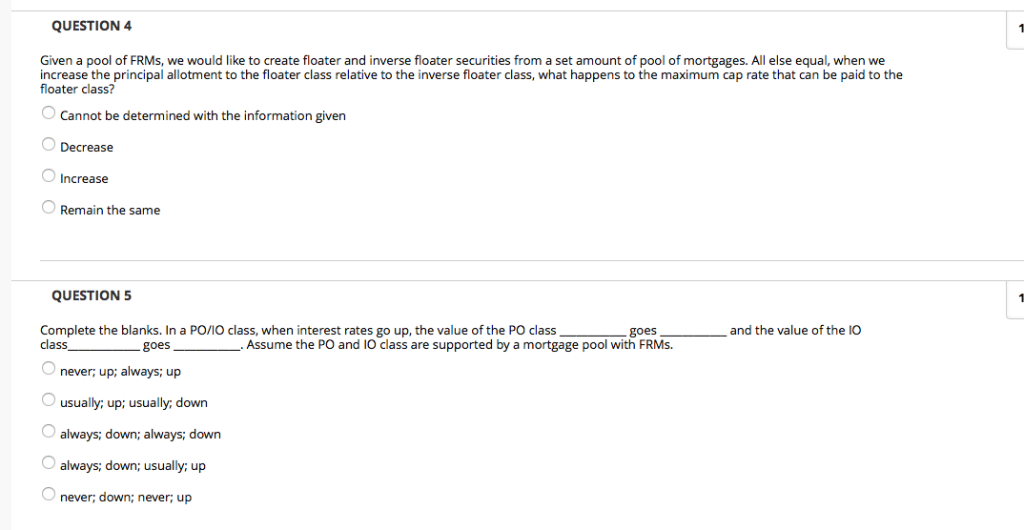

QUESTION 4 Given a pool of FRMs, we would like to create floater and inverse floater securities from a set amount of pool of mortgages. All else equal, when we increase the principal allotment to the floater class relative to the inverse floater class, what happens to the maximum cap rate that can be paid to the floater class? Cannot be determined with the information given Decrease Increase ORemain the same QUESTIONS Complete the blanks. In a PO/IO class, when interest rates go up, the value of the PO class goes and the value of the IO class O never; up; always; up O usually; up; usually, down goes Assume the PO and 1O class are supported by a mortgage pool with FRMs always; down; always; down always; down; usually; up Onever, down; never; up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts