Question: Question 4 (Hedging a Stock Portfolio) (20 points) Consider the following information on three investors, A, B and C. Portfolio Size P Investor A ||

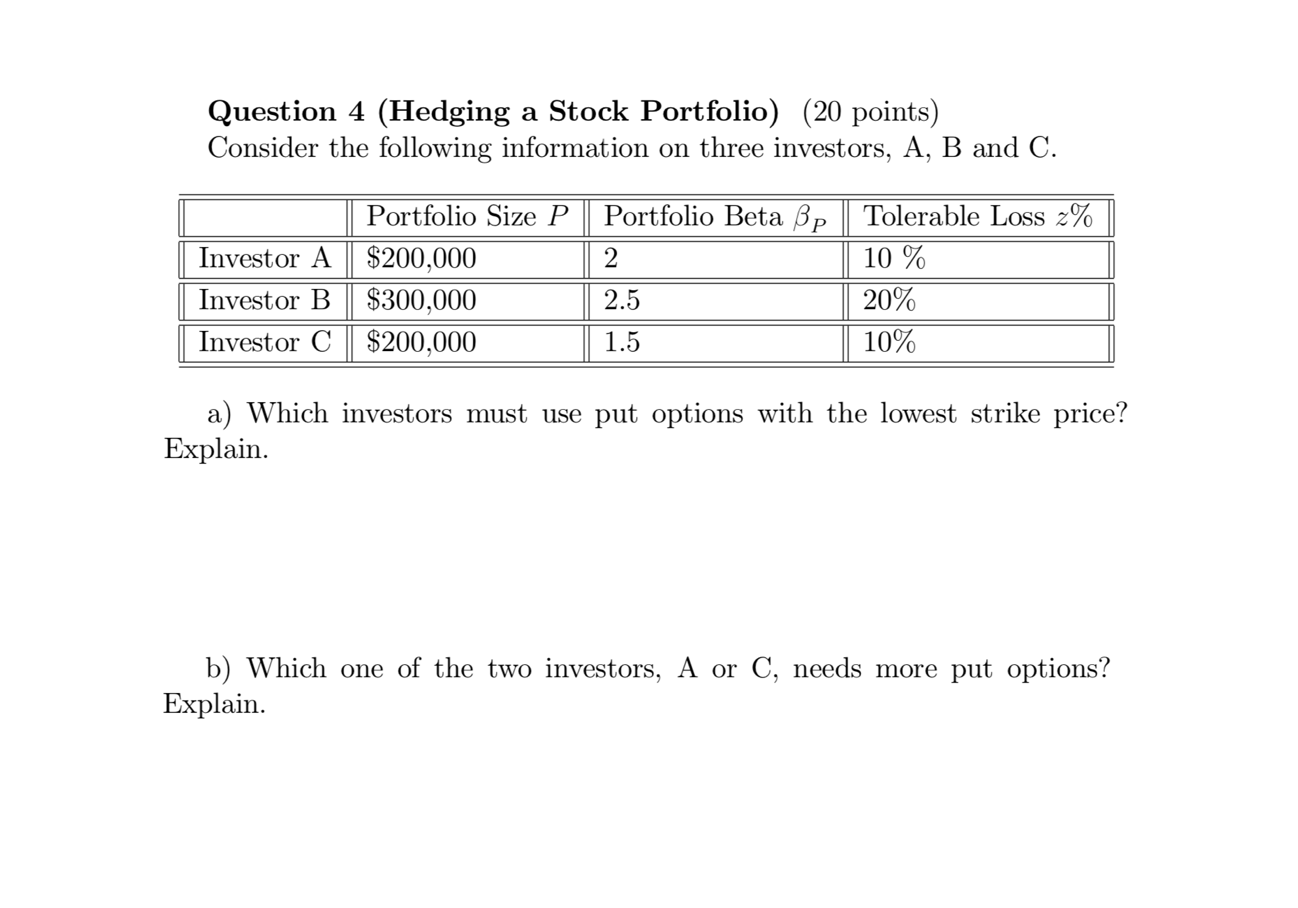

Question 4 (Hedging a Stock Portfolio) (20 points) Consider the following information on three investors, A, B and C. Portfolio Size P Investor A || $200,000 Investor B || $300,000 Investor C || $200,000 Portfolio Beta Bp Tolerable Loss z% 2 10 % 2.5 20% 1.5 10% a) Which investors must use put options with the lowest strike price? Explain. b) Which one of the two investors, A or C, needs more put options? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts