Question: Question #4. MBA or Ph.D. You just completed BT321 and you discovered a love of finance. After graduation and having worked in the finance industry

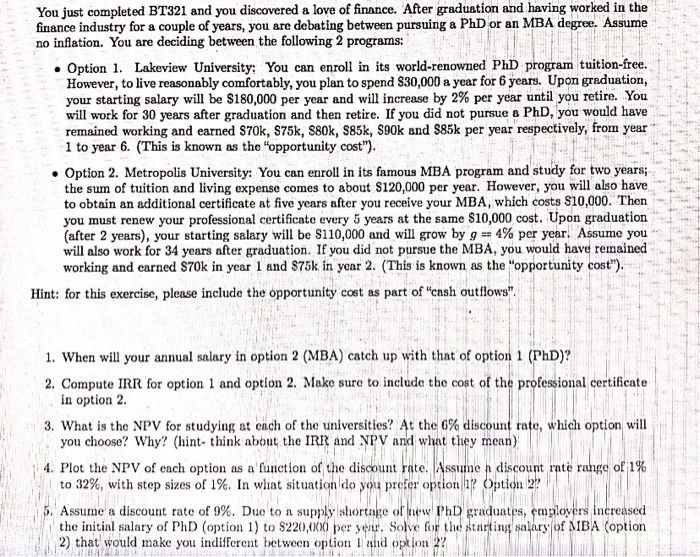

Question #4. MBA or Ph.D. You just completed BT321 and you discovered a love of finance. After graduation and having worked in the finance industry for a couple of years, you are debating between pursuing a PhD or an MBA degree. Assume no inflation. You are deciding between the following 2 programs: Option 1. Likeview University: You can enroll in its world-renowned PhD program tuition.free. However, to live resonably comfortably, you plan to spend 830,000 a year for 6 years. Upon graduation, your starting salary will be $180,000 per year and will increase by 2% per year until you retire. You will work for 30 years after graduation and then retire. If you did not pursue a PhD, you would have remained working and enrned $70k, $75k, 880k, 885k, 890k and $85k per year respectively, from year 1 to year 6. (This is known as the opportunity cost"). Option 2. Metropolis University: You can enroll in its famous MBA program and study for two years the sum of tuition and living expense comes to about $120,000 per year. However, you will also have to obtain an additional certificate at five years after you receive your MBA, which costs $10,000. Then you must renew your professional certificate every 5 years at the same $10,000 cost. Upon graduation (after 2 years), your starting salary will be $110.000 and will grow by g 4% per year. Assume you will also work for 34 years after graduation. If you did not pursue the MBA, you would have remained working and earned 870k in year 1 and S kin yenu 2. This is known as the opportunity cost") Hint: for this exercise, please include the opportunity cost as part of cash outflows 1. When will your t a ry in option 2 (MBA) catch up with that of option 1 (PhD) 2. Compute IRR for option 1 and option 2. Make sure to include the cost of the professional certificate in option 2 3. What is the NPV for studying at each of the universiteit At the discount rute, which option will you choose? Why? Chint think about the IRR and NPV and what they mean) 4. Plot the NPV of each option function of the d a te. As dit rate range of 1% to 32%, with step as of 1%. In whitt t dlo y per option 1 Option 2? 5. Asume a discount rate of O. Due to supply of bew u ste, employers increased the initial salary of PhD (option) to 220.000 per s for the starting salary of MBA (option 2) that would make you indifferen t land tot 21 You just completed BT321 and you discovered a love of finance. After graduation and having worked in the finance industry for a couple of years, you are debating between pursuing a PhD or an MBA degree. Assume no inflation. You are deciding between the following 2 programs: Option 1. Lakeview University: You can enroll in its world-renowned PhD program tuition-free. However, to live reasonably comfortably, you plan to spend $30,000 a year for 6 years. Upon graduation, your starting salary will be $180,000 per year and will increase by 2% per year until you retire. You will work for 30 years after graduation and then retire. If you did not pursue a PhD, you would have remained working and earned $70k, 875k, S80k, S85k, 890k and $85k per year respectively, from year 1 to year 6. (This is known as the "opportunity cost"). Option 2. Metropolis University. You can enroll in its famous MBA program and study for two years; the sum of tuition and living expense comes to about $120,000 per year. However, you will also have to obtain an additional certificate at five years after you receive your MBA, which costs $10,000. Then you must renew your professional certificate every 5 years at the same $10,000 cost. Upon graduation (after 2 years), your starting salary will be $110,000 and will grow by g 4% per year. Assume you will also work for 34 years after graduation. If you did not pursue the MBA, you would have remained working and earned $70k in year 1 and 875k in year 2. (This is known as the opportunity cost"). Hint: for this exercise, please include the opportunity cost as part of "cash out flows" 1. When will your annual salary in option 2 (MBA) catch up with that of option 1 (PhD)? 2. Compute IRR for option 1 and option 2. Make sure to include the cost of the professional certificate in option 2. 3. What is the NPV for studying at each of the universities? At the 6% discount rate, which option will you choose? Why? (hint think about the IRR and NPV and what they mean) 4. Plot the NPV of each option as a function of the discount rate. Assumen discount rate range of 1% to 32%, with step sizes of 1%. In what situation do you preier option 1? Option 2? 5. Assume a discount rate of 9%. Due to supply shortage of new PhD graduates, employers increased the initial salary of PhD (option 1) to $220,000 per yeur. Solve for the starting salary of MBA (option 2) that would make you indifferent between option 1 and option 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts