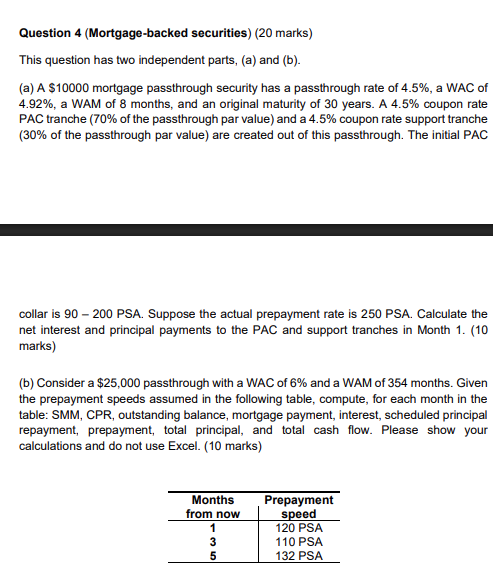

Question: Question 4 ( Mortgage - backed securities ) ( 2 0 marks ) This question has two independent parts, ( a ) and ( b

Question Mortgagebacked securities marks This question has two independent parts, a and ba A $ mortgage passthrough security has a passthrough rate of a WAC of a WAM of months, and an original maturity of years. A coupon rate PAC tranche of the passthrough par value and a coupon rate support tranche of the passthrough par value are created out of this passthrough. The initial PAC collar is PSA. Suppose the actual prepayment rate is PSA. Calculate the net interest and principal payments to the PAC and support tranches in Month marksb Consider a $ passthrough with a WAC of and a WAM of months. Given the prepayment speeds assumed in the following table, compute, for each month in the table: SMM CPR outstanding balance, mortgage payment, interest, scheduled principal repayment, prepayment, total principal, and total cash flow. Please show your calculations and do not use Excel. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock