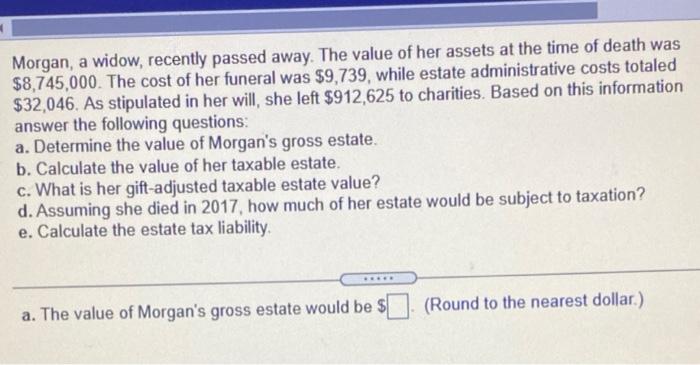

Question: Question 4. Need a-e Morgan, a widow, recently passed away. The value of her assets at the time of death was $8,745,000. The cost of

Question 4. Need a-e

Morgan, a widow, recently passed away. The value of her assets at the time of death was $8,745,000. The cost of her funeral was $9,739, while estate administrative costs totaled $32,046. As stipulated in her will, she left $912,625 to charities. Based on this information answer the following questions: a. Determine the value of Morgan's gross estate. b. Calculate the value of her taxable estate. c. What is her gift-adjusted taxable estate value? d. Assuming she died in 2017. how much of her estate would be subject to taxation? e. Calculate the estate tax liability . (Round to the nearest dollar) a. The value of Morgan's gross estate would be

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock