Question: Question 4 of15 - /1 E View Policies Current Attempt in Progress Vaughn Ltd. sold $6,010,000 of 8% bonds, which were dated March 1, 2020,

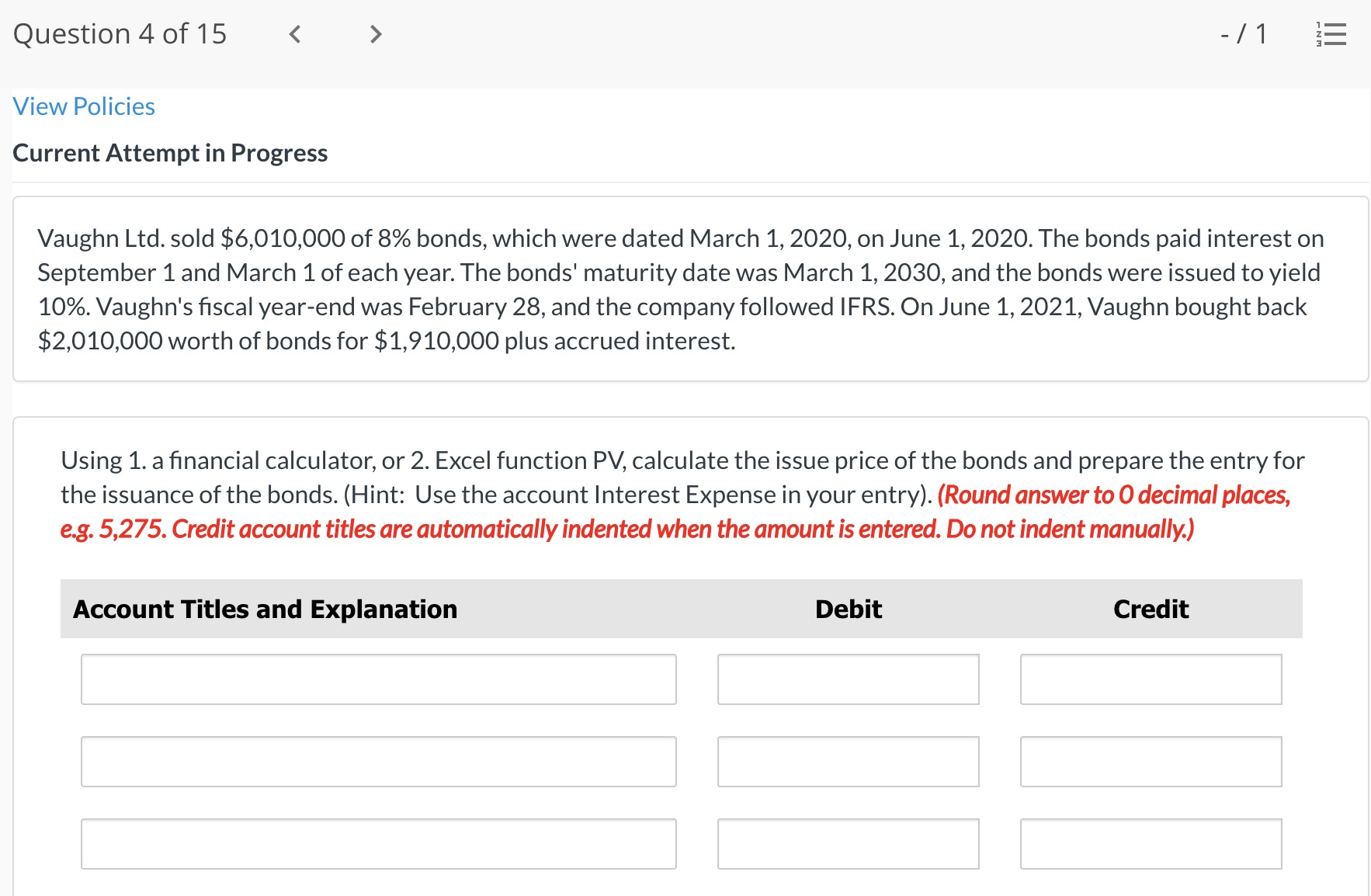

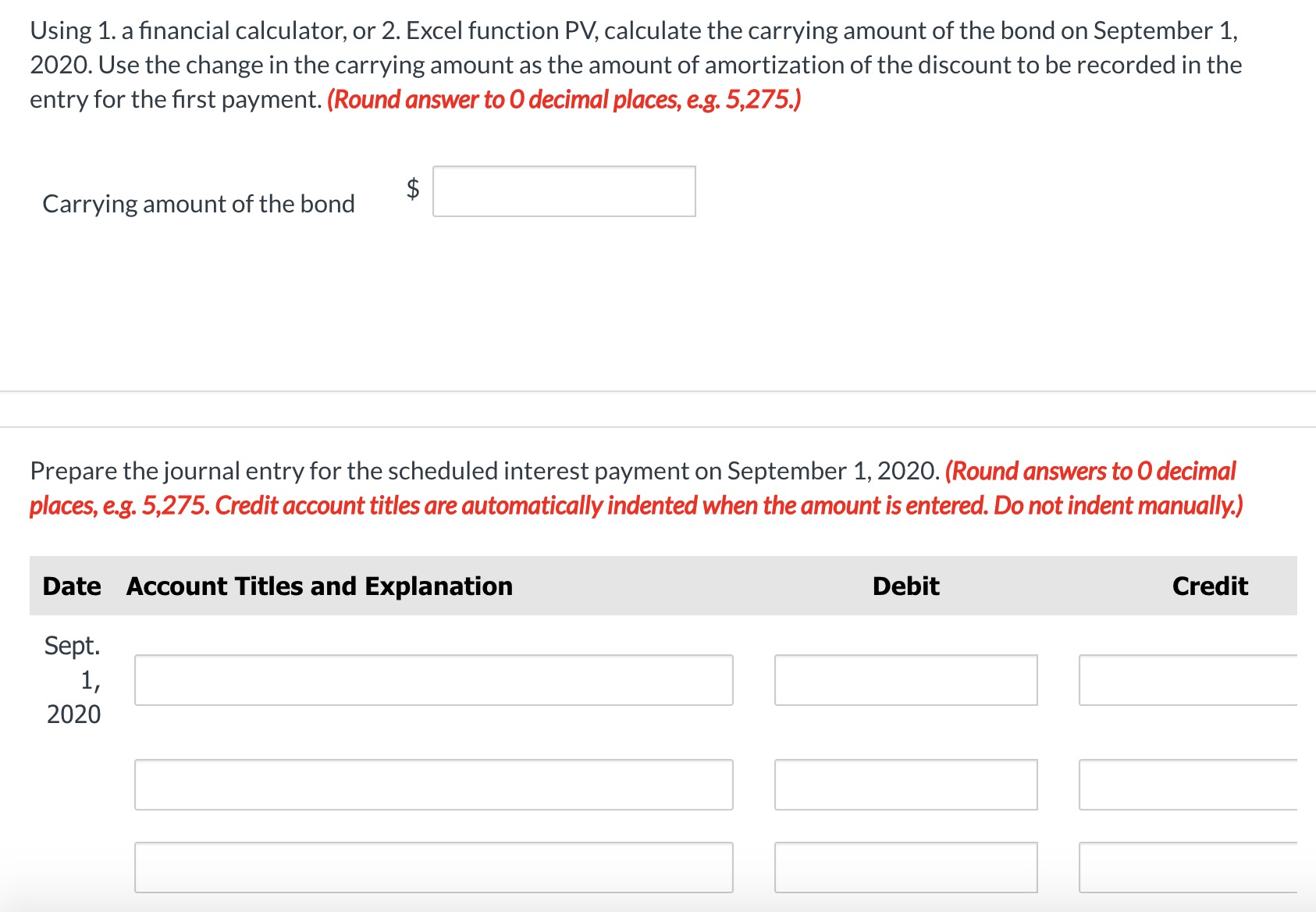

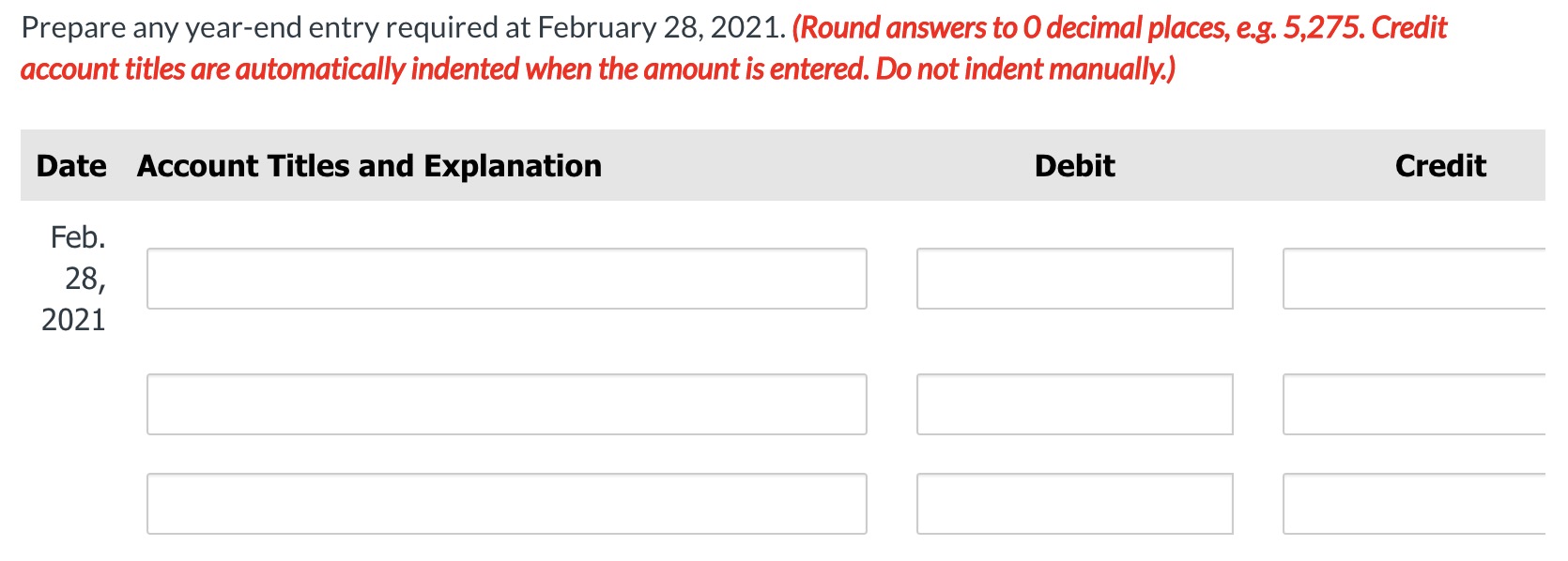

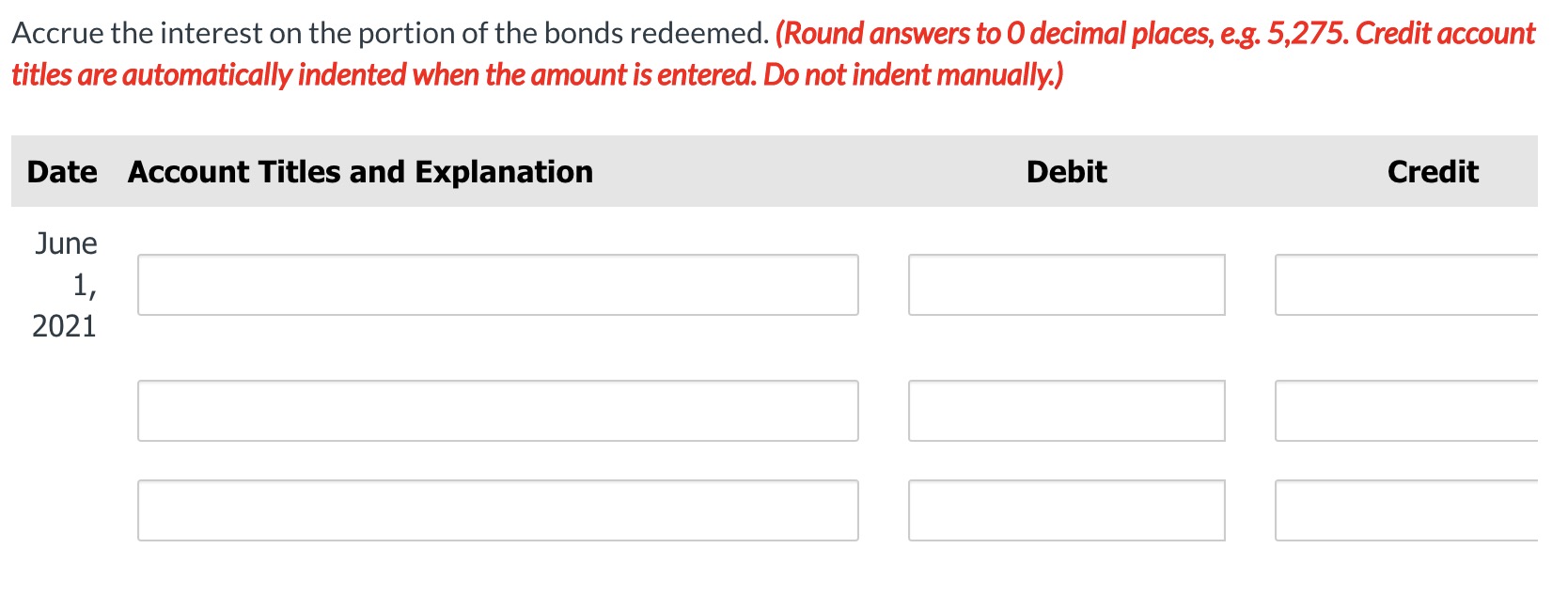

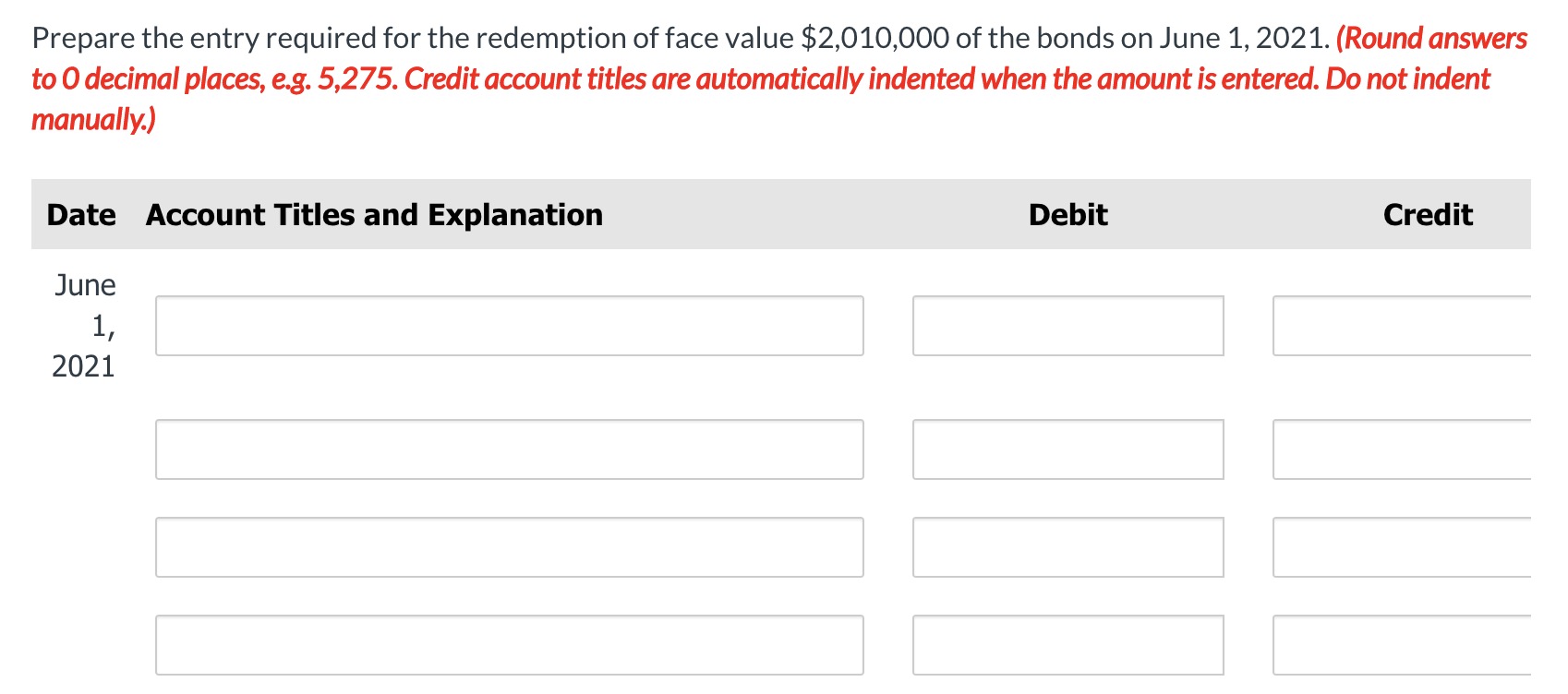

Question 4 of15 - /1 E View Policies Current Attempt in Progress Vaughn Ltd. sold $6,010,000 of 8% bonds, which were dated March 1, 2020, on June 1, 2020. The bonds paid interest on September 1 and March 1 of each year. The bonds' maturity date was March 1, 2030, and the bonds were issued to yield 10%. Vaughn's scal yearend was February 28, and the company followed IFRS. On June 1, 2021, Vaughn bought back $2,010,000 worth of bonds for $1,910,000 plus accrued interest. Using 1. a nancial calculator, or 2. Excel function PV, calculate the issue price of the bonds and prepare the entry for the issuance of the bonds. (Hint: Use the account Interest Expense in your entry). (Round answer to 0 decimal places. e3. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Using 1. a nancial calculator, or 2. Excel function PV, calculate the carrying amount of the bond on September 1, 2020. Use the change in the carrying amount as the amount of amortization of the discount to be recorded in the entry for the rst payment. (Round answer to 0 decimal places, as. 5,275.) Carrying amount of the bond $ :| Prepare the journal entry for the scheduled interest payment on September 1, 2020. (Round answers to 0 decimal places, 3.3. 5,2 75. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Sept. 1, S : 2020 Prepare any yea r-end entry required at February 28, 202 1. (Round answers to 0 decimal places, e3. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Accrue the interest on the portion of the bonds redeemed. (Round answers to 0 decimal places, as. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit June 1mg; mg; mg; Prepare the entry required for the redemption of face value $2,010,000 of the bonds on June 1, 2021. (Round answers to 0 decimal places, e3. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit June 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts