Question: Chapter 6 Assignment Solve Debit and Credit Spaces with information given. in Dashboard X My Home X CengageNOWv2 | Online teachin x X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=

Chapter 6 Assignment

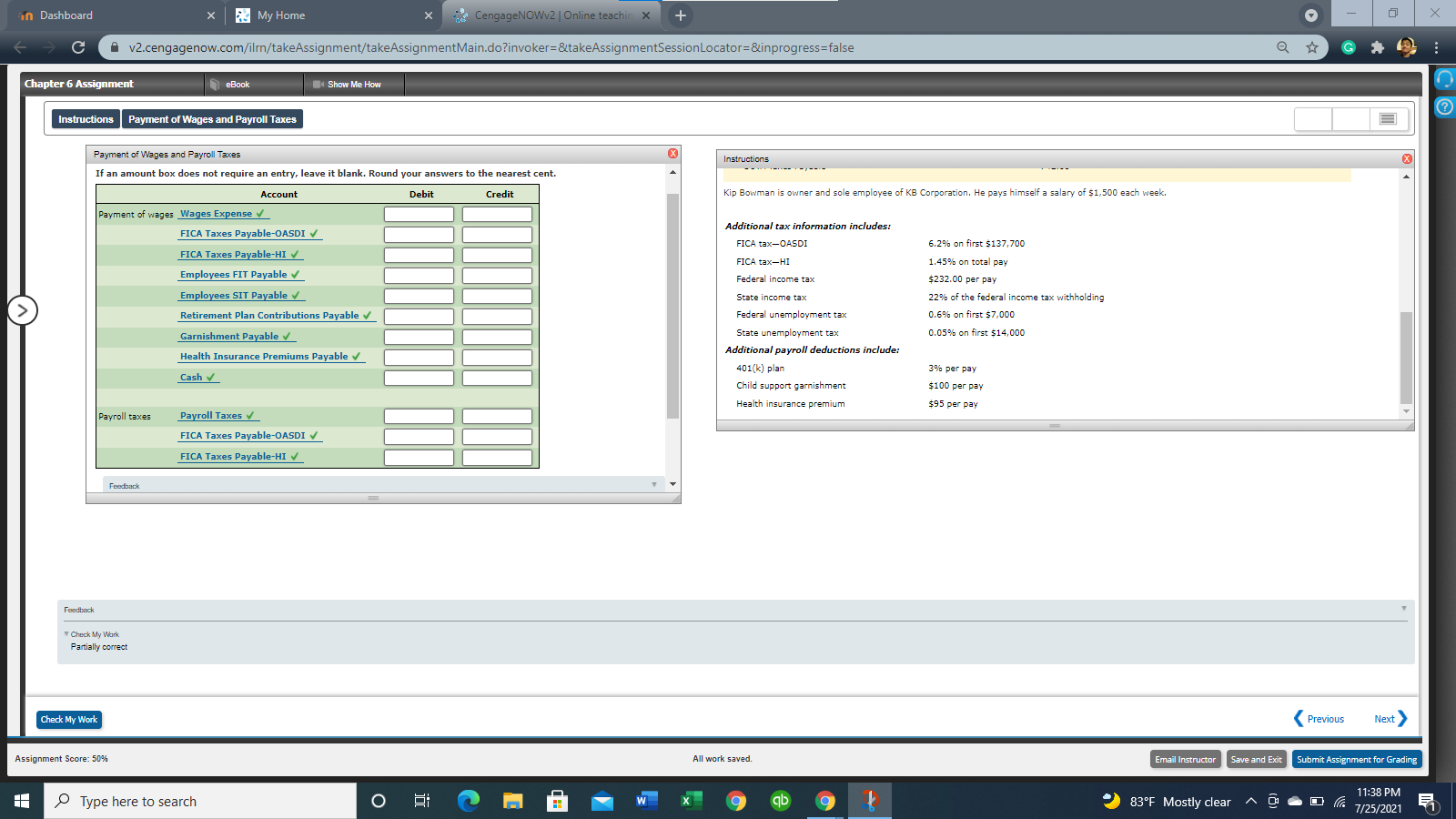

Solve Debit and Credit Spaces with information given.

in Dashboard X My Home X CengageNOWv2 | Online teachin x X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker= &takeAssignmentSessionLocator=&inprogress=false Q G Chapter 6 Assignment eBook Show Me How Instructions Payment of Wages and Payroll Taxes Payment of Wages and Payroll Taxes Instructions X If an amount box does not require an entry, leave it blank. Round your answers to the nearest cent. Account Debit redit Kip Bowman is owner and sole employee of KB Corporation. He pays himself a salary of $1,500 each week. Payment of wages Wages Expense v FICA Taxes Payable-OASDI Additional tax information includes: FICA tax-OASDI 6.2% on first $137,700 FICA Taxes Payable-HI V FICA tax-HI 1.45% on total pay Employees FIT Payable v Federal income tax $232.00 per pay Employees SIT Payable v State income tax 22% of the federal income tax withholding Retirement Plan Contributions Payable Federal unemployment tax 0.6% on first $7,000 Garnishment Payable v State unemployment tax 0.05% on first $14,000 Health Insurance Premiums Payable Additional payroll deductions include: 401(k) plan 39% per pay Cash Child support garnishment $100 per pay Health insurance premium $95 per pay Payroll taxes Payroll Taxes FICA Taxes Payable-OASDI FICA Taxes Payable-HI V Feedback Feedback Check My Work Partially correct Check My Work Previous Next Assignment Score: 50% All work saved. Email Instructor Save and Exit Submit Assignment for Grading Type here to search W gb 283F Mostly clear 11:38 PM E 7/25/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts