Question: Question 4 On 3 March 2020, five-year credit default swaps (CDS) on the senior US dollar- denominated debt of ANZ Banking Group were trading at

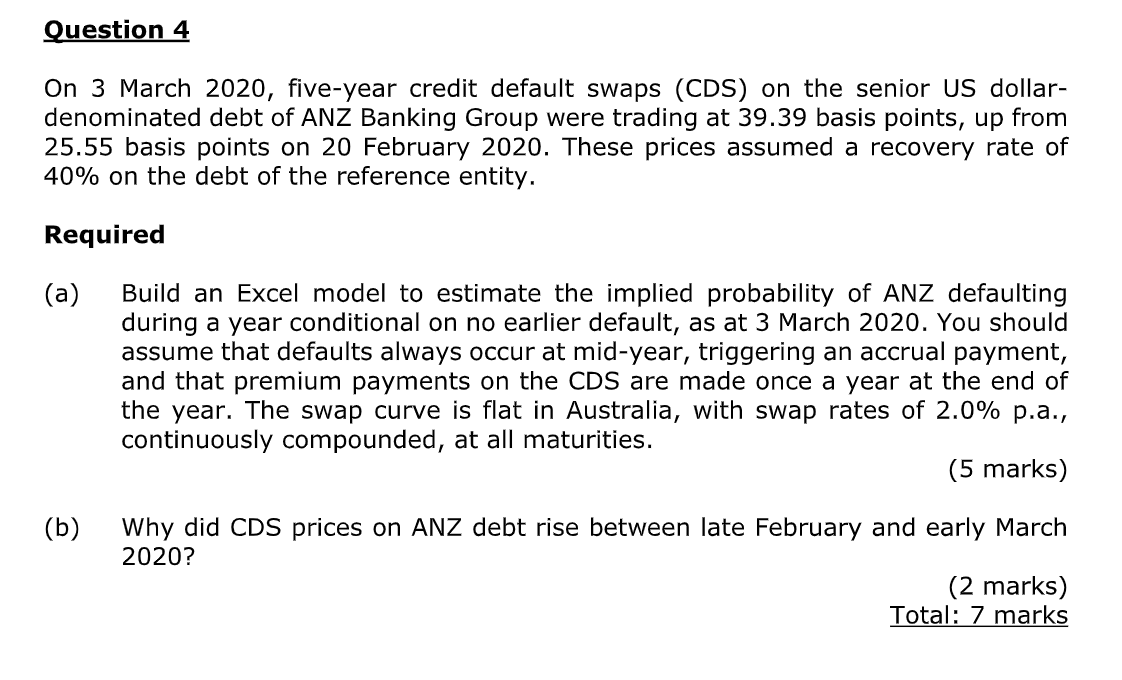

Question 4 On 3 March 2020, five-year credit default swaps (CDS) on the senior US dollar- denominated debt of ANZ Banking Group were trading at 39.39 basis points, up from 25.55 basis points on 20 February 2020. These prices assumed a recovery rate of 40% on the debt of the reference entity. Required (a) Build an Excel model to estimate the implied probability of ANZ defaulting during a year conditional on no earlier default, as at 3 March 2020. You should assume that defaults always occur at mid-year, triggering an accrual payment, and that premium payments on the CDS are made once a year at the end of the year. The swap curve is flat in Australia, with swap rates of 2.0% p.a., continuously compounded, at all maturities. (5 marks) (b) Why did CDS prices on ANZ debt rise between late February and early March 2020? (2 marks) Total: 7 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts