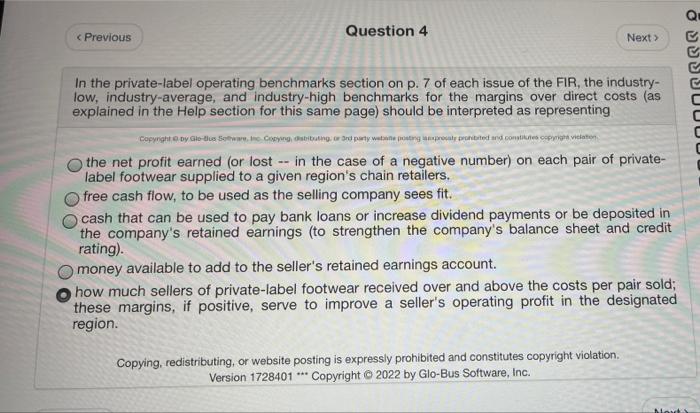

Question: Question 4 OUSSUUUUU In the private-label operating benchmarks section on p. 7 of each issue of the FIR, the industry- low, industry-average, and industry-high benchmarks

Question 4 OUSSUUUUU In the private-label operating benchmarks section on p. 7 of each issue of the FIR, the industry- low, industry-average, and industry-high benchmarks for the margins over direct costs (as explained in the Help section for this same page) should be interpreted as representing Copyright by Glow Copying, stingrand party was posting proval rated and constitucivitation the net profit earned (or lost -- in the case of a negative number) on each pair of private- label footwear supplied to a given region's chain retailers. free cash flow, to be used as the selling company sees fit. cash that can be used to pay bank loans or increase dividend payments or be deposited in the company's retained earnings (to strengthen the company's balance sheet and credit rating) money available to add to the seller's retained earnings account. how much sellers of private-label footwear received over and above the costs per pair sold; these margins, if positive, serve to improve a seller's operating profit in the designated region. Copying, redistributing, or website posting is expressly prohibited and constitutes copyright violation. Version 1728401 *** Copyright 2022 by Glo-Bus Software, Inc. No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts