Question: QUESTION 4 PARTNERSHIPS (20) The information given below was extracted from the accounting records of Salmon Traders, a partnership business with Sally and Monty as

QUESTION 4

PARTNERSHIPS

(20)

The information given below was extracted from the accounting records of Salmon Traders, a partnership business with Sally and Monty as partners. The financial year ends on the last day of February each year.

REQUIRED

Prepare the following accounts in the General ledger of Salmon Traders:

4.1 Current a/c: Monty (Balance the account.)

(7)

4.2 Appropriation account (Close off the account.)

(13)

INFORMATION

Balances in the ledger on 28 February 2017

R

Capital: Sally

400 000

Capital: Monty

200 000

Current a/c: Sally (01 March 2016)

20 000

(DR)

Current a/c: Monty (01 March 2016)

33 000

(CR)

Drawings: Sally

200 000

Drawings: Monty

180 000

The following must be taken into account:

(a)

The net profit according to the Profit and Loss account amounted to R500 000 on 28 February 2017.

(b)

The partnership agreement makes provision for the following:

?

Interest on capital must be provided at 15% per annum on the balances in the capital accounts. Note: Sally increased his capital by R100 000 on 01 September 2016. Monty decreased his capital by R100 000 on the same date. The capital changes have been recorded.

The partners are entitled to the following monthly salaries:

Sally

R12 000

Monty

R13 000

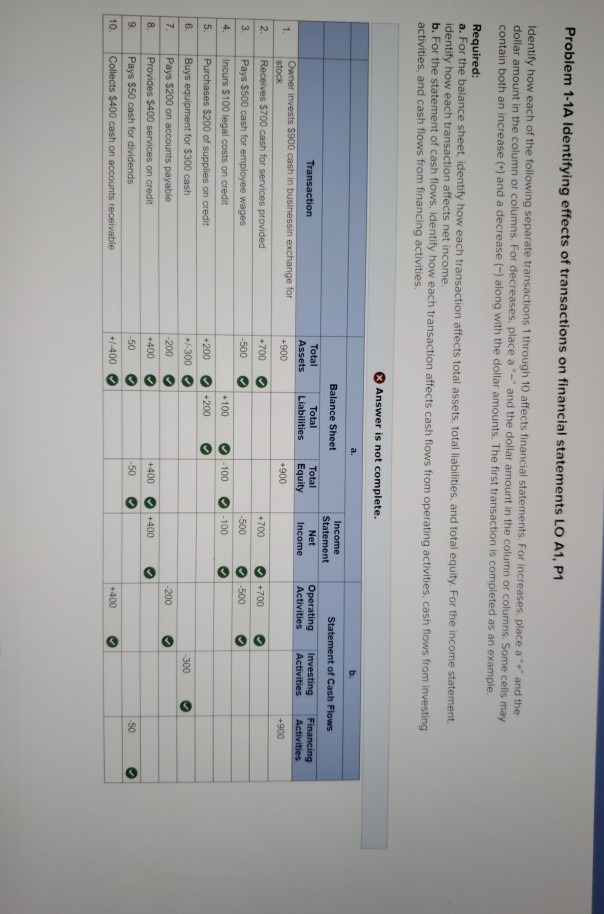

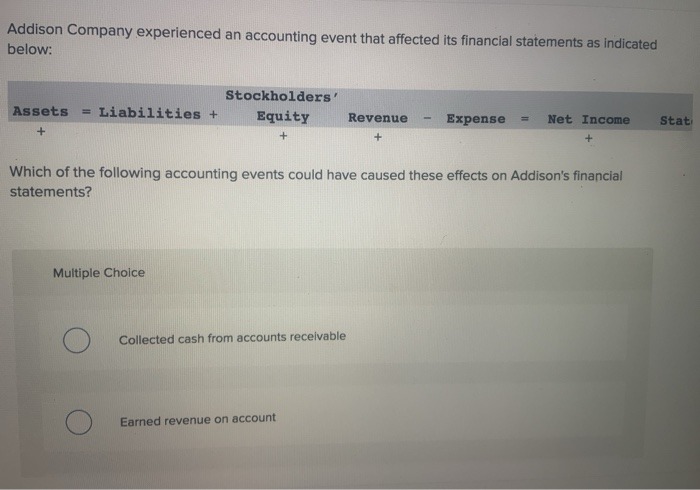

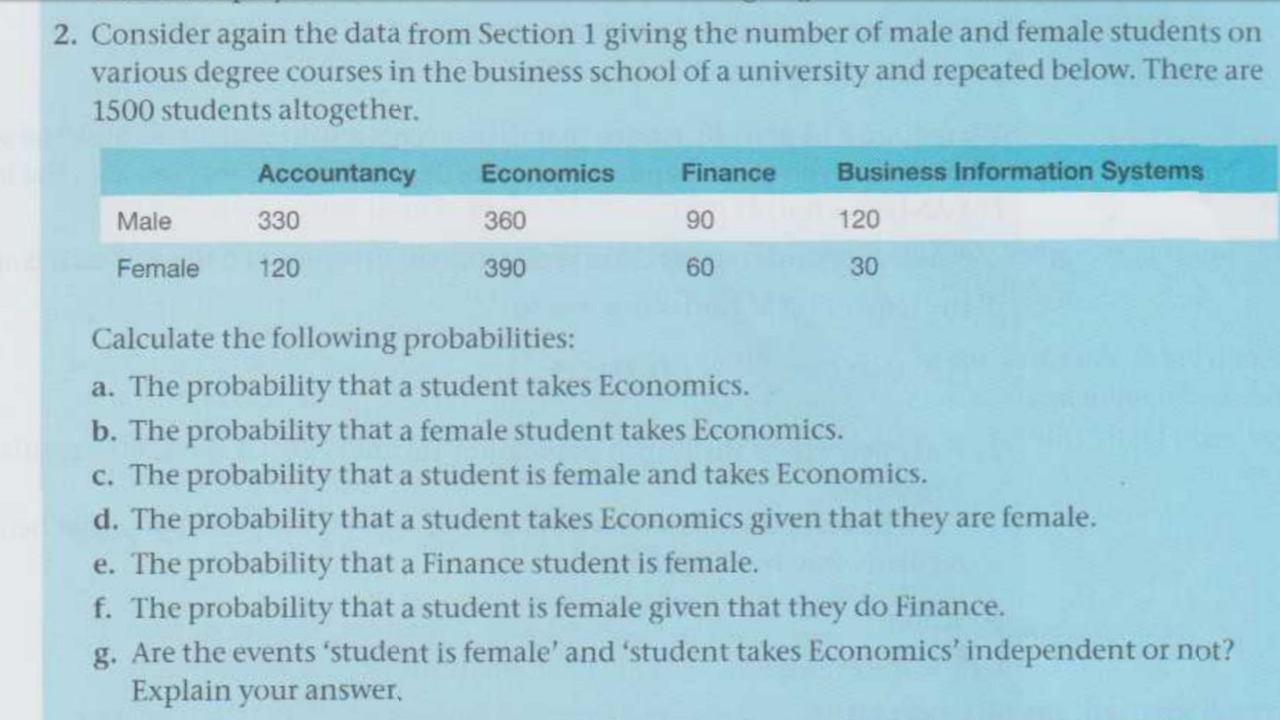

Problem 1-1A Identifying effects of transactions on financial statements LO A1, P1 Identify how each of the following separate transactions 1 through 10 affects financial statements. For increases, place a "+" and the dollar amount in the column or columns. For decreases, place a "-" and the dollar amount in the column or columns. Some cells may contain both an increase (+) and a decrease (-) along with the dollar amounts. The first transaction is completed as an example. Required: a. For the balance sheet, identify how each transaction affects total assets, total liabilities, and total equity. For the income statement, identify how each transaction affects net income. b. For the statement of cash flows, identify how each transaction affects cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities, x Answer is not complete. Balance Sheet Income Statement Statement of Cash Flows Total Total Total Net Operating Investing Financing Transaction Assets Liabilities Equity Income Activities Activities Activities Owner invests $900 cash in businessin exchange for +900 +900 +900 stock Receives $700 cash for services provided #700 700 +700 Pays $500 cash for employee wages 500 -500 500 Incurs $100 legal costs on credit -100 -100 O 100 Purchases $200 of supplies on credit -200 +200 Buys equipment for $300 cash /-300 300 Pays $200 on accounts payable 200 200 Provides $400 services on credit 400 +400 +400 Pays $50 cash for dividends 50 Collects $400 cash on accounts receivable +/-400 +400Addison Company experienced an accounting event that affected its financial statements as indicated below: Stockholders' Assets = Liabilities + Equity Revenue - Expense = Net Income Stat + + + + Which of the following accounting events could have caused these effects on Addison's financial statements? Multiple Choice O Collected cash from accounts receivable O Earned revenue on account2. Consider again the data from Section 1 giving the number of male and female students on various degree courses in the business school of a university and repeated below. There are 1500 students altogether. Accountancy Economics Finance Business Information Systems Male 330 360 90 120 Female 120 390 60 30 Calculate the following probabilities: a. The probability that a student takes Economics. b. The probability that a female student takes Economics. c. The probability that a student is female and takes Economics. d. The probability that a student takes Economics given that they are female. e. The probability that a Finance student is female. f. The probability that a student is female given that they do Finance. g. Are the events 'student is female' and 'student takes Economics' independent or not? Explain your