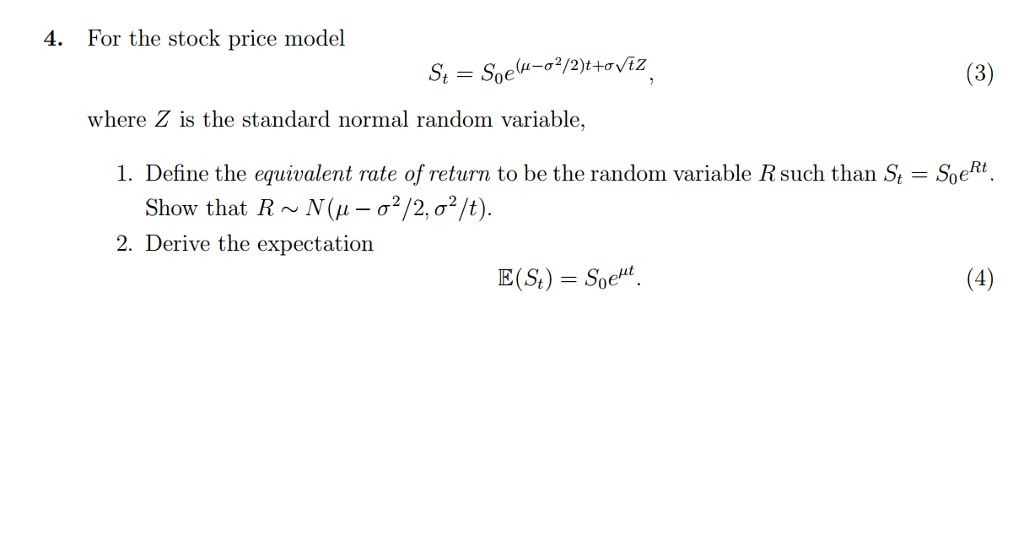

Question: Question # 4 please! For the stock price model S_t = S_0 e^(mu-sigma^2/2)t + sigma squareroot tz, where Z is the standard normal random variable,

Question # 4 please!

For the stock price model S_t = S_0 e^(mu-sigma^2/2)t + sigma squareroot tz, where Z is the standard normal random variable, Define the equivalent rate of return to be the random variable R such than S_t =S_0 e^Rt, Show that R approximately N (mu - sigma^2/2, sigma^2/t). Derive the expectation E(S_t) = S_0e^mu t. For the stock price model S_t = S_0 e^(mu-sigma^2/2)t + sigma squareroot tz, where Z is the standard normal random variable, Define the equivalent rate of return to be the random variable R such than S_t =S_0 e^Rt, Show that R approximately N (mu - sigma^2/2, sigma^2/t). Derive the expectation E(S_t) = S_0e^mu t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts