Question: question 4 please On Friday, April 3, 2020 J bought shares of the following stocks and held this portfolio for a year: Q. When JD

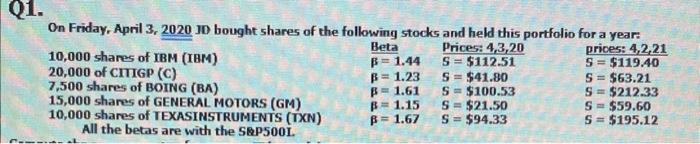

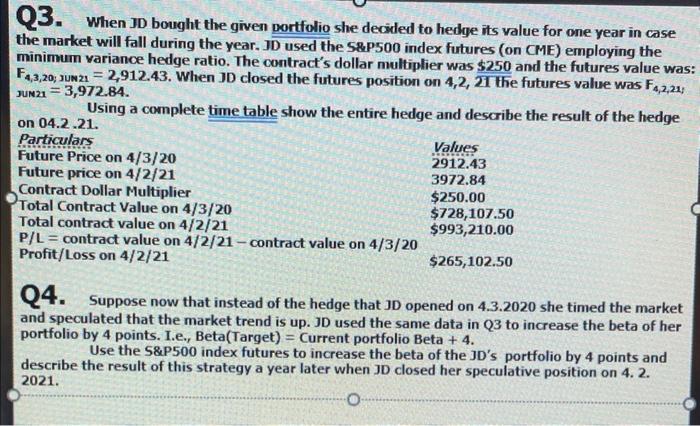

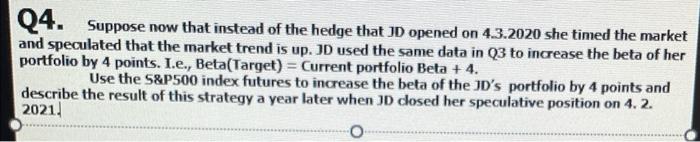

On Friday, April 3, 2020 J bought shares of the following stocks and held this portfolio for a year: Q. When JD bought the given portfolio she decided to hedge its value for one year in case the market will fall during the year. JD used the S\&P500 index futures (on CME) employing the minimum variance hedge ratio. The contract's dollar multiplier was $250 and the futures value was: F4,3,20; jum21 =2,912,43. When J D closed the futures position on 4,2 , 21 the futures value was F4,2,21 UM21 =3,972.84 Using a complete time table show the entire hedqe and describe the result of the hedge Q4. Suppose now that instead of the hedge that JD opened on 4.3.2020 she timed the market and speculated that the market trend is up. JD used the same data in Q3 to increase the beta of her portfolio by 4 points. I.e., Beta(Target) = Current portfolio Beta +4. Use the S\&P500 index futures to increase the beta of the JD's portfolio by 4 points and describe the result of this strategy a year later when JD closed her speculative position on 4.2. 2021. Q4: Suppose now that instead of the hedge that JD opened on 4.3.2020 she timed the market and speculated that the market trend is up. JD used the same data in Q3 to increase the beta of her portfolio by 4 points. I.e., Beta(Target) = Current portfolio Beta +4. Use the S\&P500 index futures to increase the beta of the JD's portfolio by 4 points and describe the result of this strategy a year later when JD dosed her speculative position on 4.2. 2021. On Friday, April 3, 2020 J bought shares of the following stocks and held this portfolio for a year: Q. When JD bought the given portfolio she decided to hedge its value for one year in case the market will fall during the year. JD used the S\&P500 index futures (on CME) employing the minimum variance hedge ratio. The contract's dollar multiplier was $250 and the futures value was: F4,3,20; jum21 =2,912,43. When J D closed the futures position on 4,2 , 21 the futures value was F4,2,21 UM21 =3,972.84 Using a complete time table show the entire hedqe and describe the result of the hedge Q4. Suppose now that instead of the hedge that JD opened on 4.3.2020 she timed the market and speculated that the market trend is up. JD used the same data in Q3 to increase the beta of her portfolio by 4 points. I.e., Beta(Target) = Current portfolio Beta +4. Use the S\&P500 index futures to increase the beta of the JD's portfolio by 4 points and describe the result of this strategy a year later when JD closed her speculative position on 4.2. 2021. Q4: Suppose now that instead of the hedge that JD opened on 4.3.2020 she timed the market and speculated that the market trend is up. JD used the same data in Q3 to increase the beta of her portfolio by 4 points. I.e., Beta(Target) = Current portfolio Beta +4. Use the S\&P500 index futures to increase the beta of the JD's portfolio by 4 points and describe the result of this strategy a year later when JD dosed her speculative position on 4.2. 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts