Question: Question (4 points to do) 1-Prepar inventory costing sheet 2-calculate Breakeven in units and dollars 3- calculate units required for certain target 4-Calculate cost of

Question (4 points to do)

1-Prepar inventory costing sheet 2-calculate Breakeven in units and dollars 3- calculate units required for certain target 4-Calculate cost of goods manufactured, cost of goods sold, and Income Statement under variable and absorption costing

Information provided

Information provided

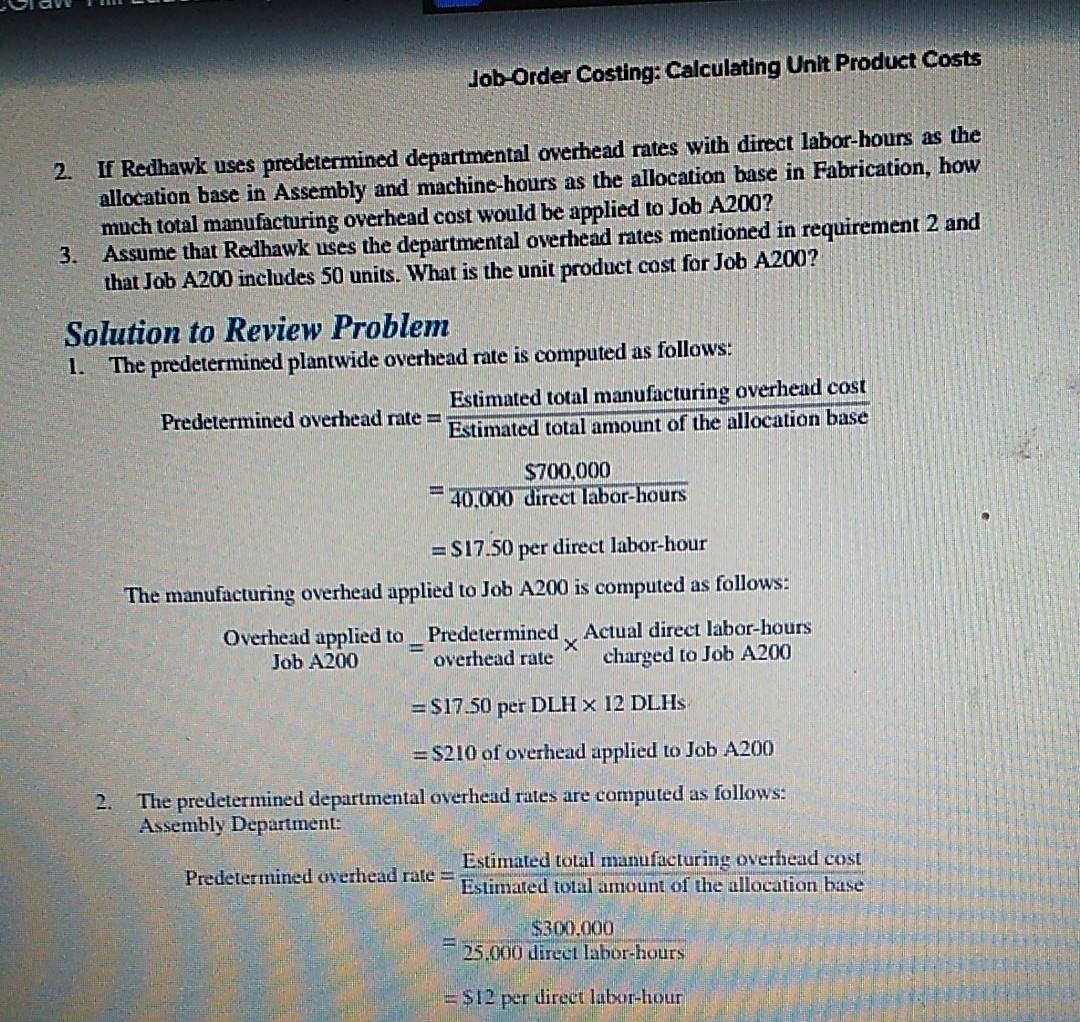

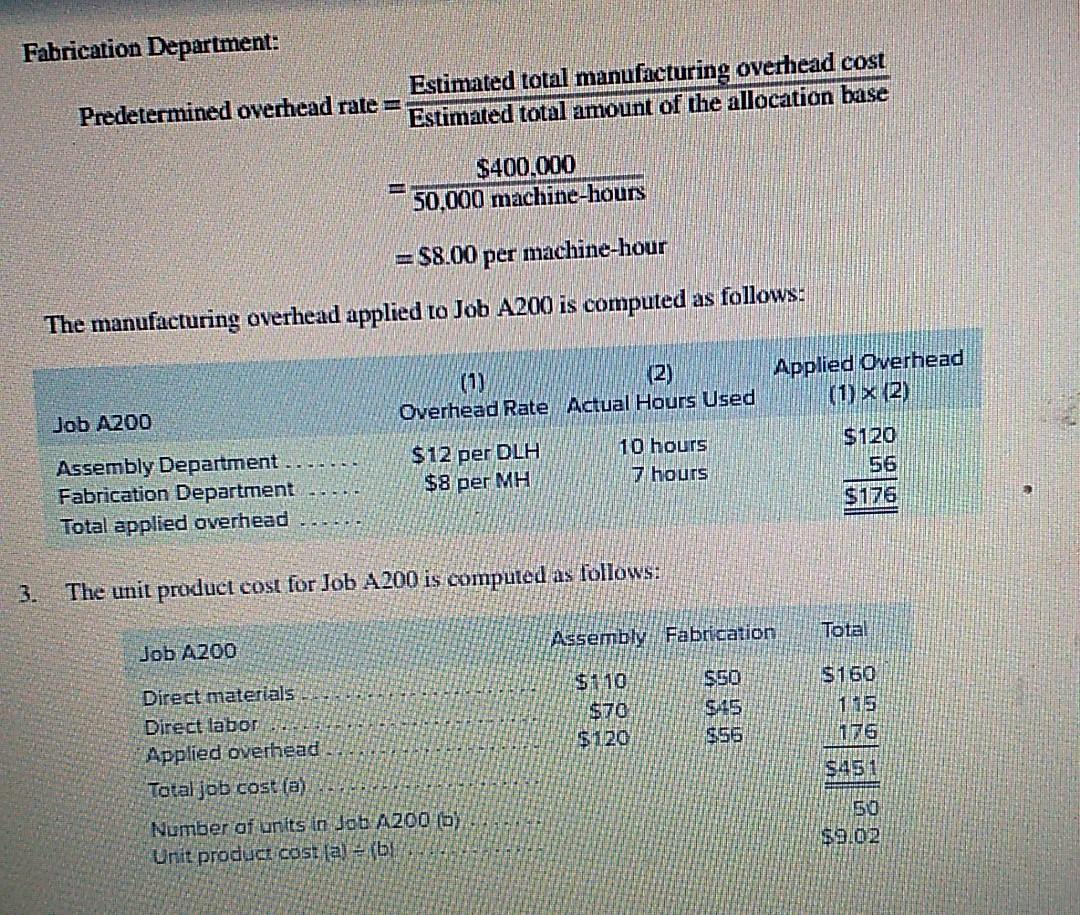

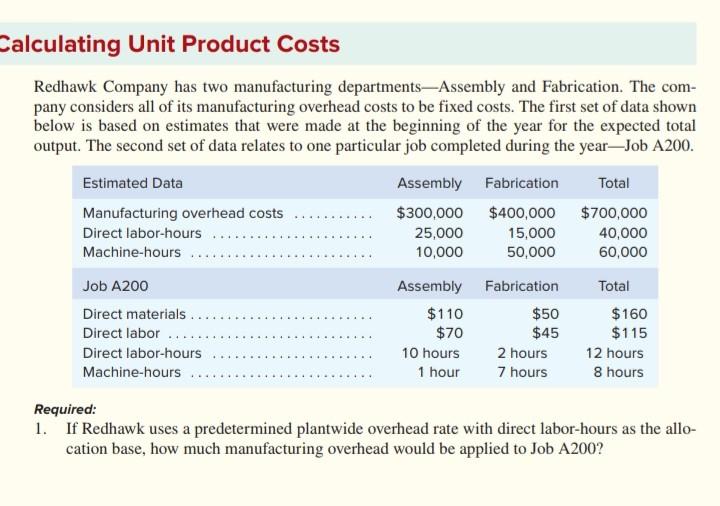

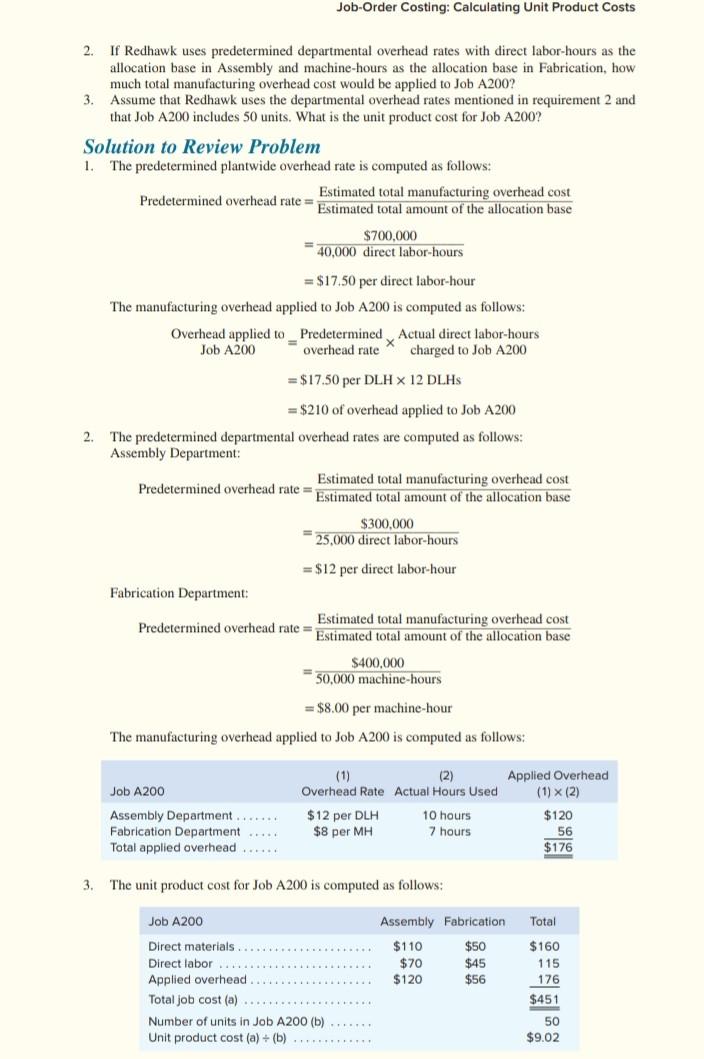

Job-Order Costing: Calculating Unit Product Costs 2. If Redhawk uses predetermined departmental overhead rates with direct labor-hours as the allocation base in Assembly and machine-hours as the allocation base in Fabrication, how much total manufacturing overhead cost would be applied to Job A200? 3. Assume that Redhawk uses the departmental overhead rates mentioned in requirement 2 and that Job A200 includes 50 units. What is the unit product cost for Job A200? Solution to Review Problem 1. The predetermined plantwide overhead rate is computed as follows: Predetermined overhead rate = Estimated total manufacturing overhead cost Estimated total amount of the allocation base $700,000 40.000 direct labor-hours = $17.50 per direct labor-hour The manufacturing overhead applied to Job A200 is computed as follows: Overhead applied to Predetermined Actual direct labor-hours Job A200 overhead rate charged to Job A200 = $17.50 per DLH X 12 DLHS 2. = $210 of overhead applied to Job A200 The predetermined departmental overhead rates are computed as follows: Assembly Department: Estimated total manufacturing overhead cost Predetermined overhead rate = Estimated total amount of the allocation base $300.000 = 25.000 direct labor-hours ESID per direct labor-hour Fabrication Department: Predetermined overhead rate = Estimated total manufacturing overhead cost Estimated total amount of the allocation base $400.000 50.000 machine-hours = $8.00 per machine-hour The manufacturing overhead applied to Job A200 is computed as follows: (1) 2) Overhead Rate Actual Hours Used Applied Overhead (1) X 12) Job A200 $12 per DLH $8 per MH 10 hours 7 hours Assembly Department . Fabrication Department Total applied overhead $120 56 $176 3. The unit product cost for Job A200 is computed as follows: Assembly Fabrication Total Job A200 $160 $110 $70 $120 $50 $4.5 $56 176 $451 Direct materials Direct labor Applied overhead Total job cost lay Number of units in Job A200 (6) Unit product costa bl. 50 Calculating Unit Product Costs Redhawk Company has two manufacturing departments-Assembly and Fabrication. The com- pany considers all of its manufacturing overhead costs to be fixed costs. The first set of data shown below is based on estimates that were made at the beginning of the year for the expected total output. The second set of data relates to one particular job completed during the yearJob A200. Estimated Data Assembly Fabrication Total Manufacturing overhead costs $300,000 $400,000 $700,000 Direct labor-hours 25,000 15,000 40,000 Machine-hours.. 10,000 50,000 60,000 Job A200 Assembly Fabrication Total Direct materials $110 $50 $160 Direct labor $70 $45 $115 Direct labor-hours 10 hours 2 hours 12 hours Machine-hours 1 hour 7 hours 8 hours ... ... Required: 1. If Redhawk uses a predetermined plantwide overhead rate with direct labor-hours as the allo- cation base, how much manufacturing overhead would be applied to Job A200? Job-Order Costing: Calculating Unit Product Costs 2. If Redhawk uses predetermined departmental overhead rates with direct labor-hours as the allocation base in Assembly and machine-hours as the allocation base in Fabrication, how much total manufacturing overhead cost would be applied to Job A200? 3. Assume that Redhawk uses the departmental overhead rates mentioned in requirement 2 and that Job A200 includes 50 units. What is the unit product cost for Job A200? Solution to Review Problem 1. The predetermined plantwide overhead rate is computed as follows: Predetermined overhead rate - Estimated total amount of the allocation base Estimated total manufacturing overhead cost $700,000 40,000 direct labor-hours = $17.50 per direct labor-hour The manufacturing overhead applied to Job A200 is computed as follows: Overhead applied to _Predetermined Actual direct labor-hours X Job A200 overhead rate charged to Job A200 = $17.50 per DLH X 12 DLHs 2 = $210 of overhead applied to Job A200 The predetermined departmental overhead rates are computed as follows: Assembly Department: Estimated total manufacturing overhead cost Predetermined overhead rate Estimated total amount of the allocation base $300,000 25,000 direct labor-hours = $12 per direct labor-hour Fabrication Department: Predetermined overhead rate = Estimated total amount of the allocation base Estimated total manufacturing overhead cost $400,000 50,000 machine-hours = $8.00 per machine-hour The manufacturing overhead applied to Job A200 is computed as follows: Job A200 (1) (2) Overhead Rate Actual Hours Used $12 per DLH 10 hours $8 per MH 7 hours Assembly Department ...... Fabrication Department ... Total applied overhead ... Applied Overhead (1) x (2) $120 56 $176 3. The unit product cost for Job A200 is computed as follows: Job A200 Total Assembly Fabrication $110 $50 $70 $45 $120 $56 Direct materials Direct labor Applied overhead Total job cost (a) Number of units in Job A200 (b) Unit product cost (a) + (b) $160 115 176 $451 50 $9.02

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts