Question: Question 4 (Portfolio Optimization, (20 marks)). Download the file indices.csv from Learn. It has mostly closing values for 7 leading stock market indices, Dow-Jones (USA),

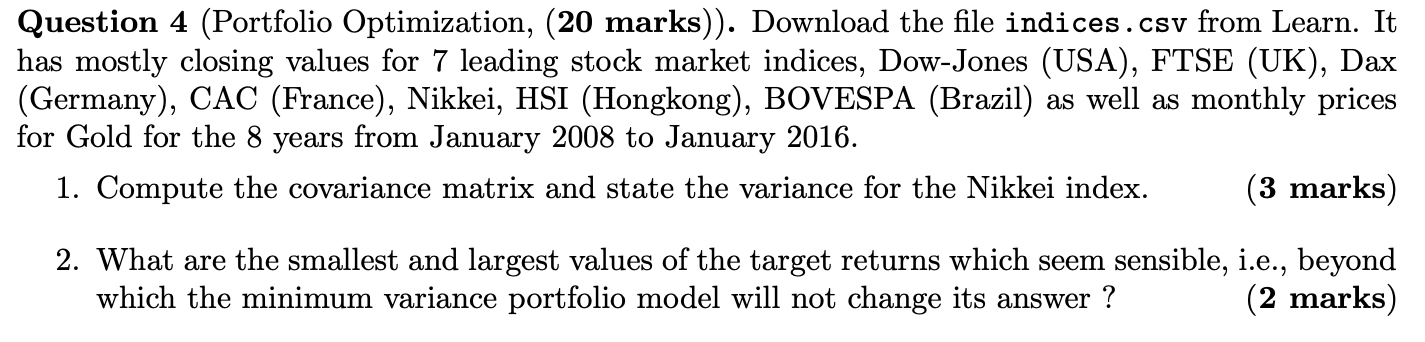

Question 4 (Portfolio Optimization, (20 marks)). Download the file indices.csv from Learn. It has mostly closing values for 7 leading stock market indices, Dow-Jones (USA), FTSE (UK), Dax (Germany), CAC (France), Nikkei, HSI (Hongkong), BOVESPA (Brazil) as well as monthly prices for Gold for the 8 years from January 2008 to January 2016. 1. Compute the covariance matrix and state the variance for the Nikkei index. (3 marks) 2 2. What are the smallest and largest values of the target returns which seem sensible, i.e., beyond which the minimum variance portfolio model will not change its answer ? (2 marks) Question 4 (Portfolio Optimization, (20 marks)). Download the file indices.csv from Learn. It has mostly closing values for 7 leading stock market indices, Dow-Jones (USA), FTSE (UK), Dax (Germany), CAC (France), Nikkei, HSI (Hongkong), BOVESPA (Brazil) as well as monthly prices for Gold for the 8 years from January 2008 to January 2016. 1. Compute the covariance matrix and state the variance for the Nikkei index. (3 marks) 2 2. What are the smallest and largest values of the target returns which seem sensible, i.e., beyond which the minimum variance portfolio model will not change its answer ? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts