Question: Question 4 Read the scenario below and answer the questions that follow: Ecotel Ltd is a tourism company listed on the Johannesburg Stock Exchange. The

Question

Read the scenario below and answer the questions that follow:

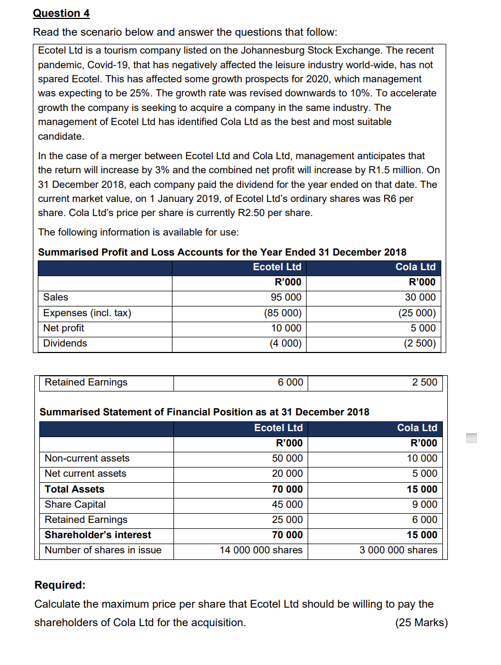

Ecotel Ltd is a tourism company listed on the Johannesburg Stock Exchange. The recent pandemic, Covid that has negatively affected the leisure industry worldwide, has not spared Ecotel. This has affected some growth prospects for which management was expecting to be The growth rate was revised downwards to To accelerate growth the company is seeking to acquire a company in the same industry. The management of Ecotel Ltd has identified Cola Ltd as the best and most suitable candidate.

In the case of a merger between Ecotel Ltd and Cola Ltd management anticipates that the return will increase by and the combined net profit will increase by R million. On December each company paid the dividend for the year ended on that date. The current market value, on January of Ecotel Ltds ordinary shares was R per share. Cola Ltds price per share is currently R per share.

The following information is available for use:

Summarised Profit and Loss Accounts for the Year Ended December

Summarised Statement of Financial Position as at December

Required:

Calculate the maximum price per share that Ecotel Ltd should be willing to pay the shareholders of Cola Ltd for the acquisition.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock