Question: Question 4 risk free =4% MRP = 8% div in question is changed to $2 not 1.5 Case Questions: 1. What are the advantages and

Question 4

risk free =4%

MRP = 8%

div in question is changed to $2 not 1.5

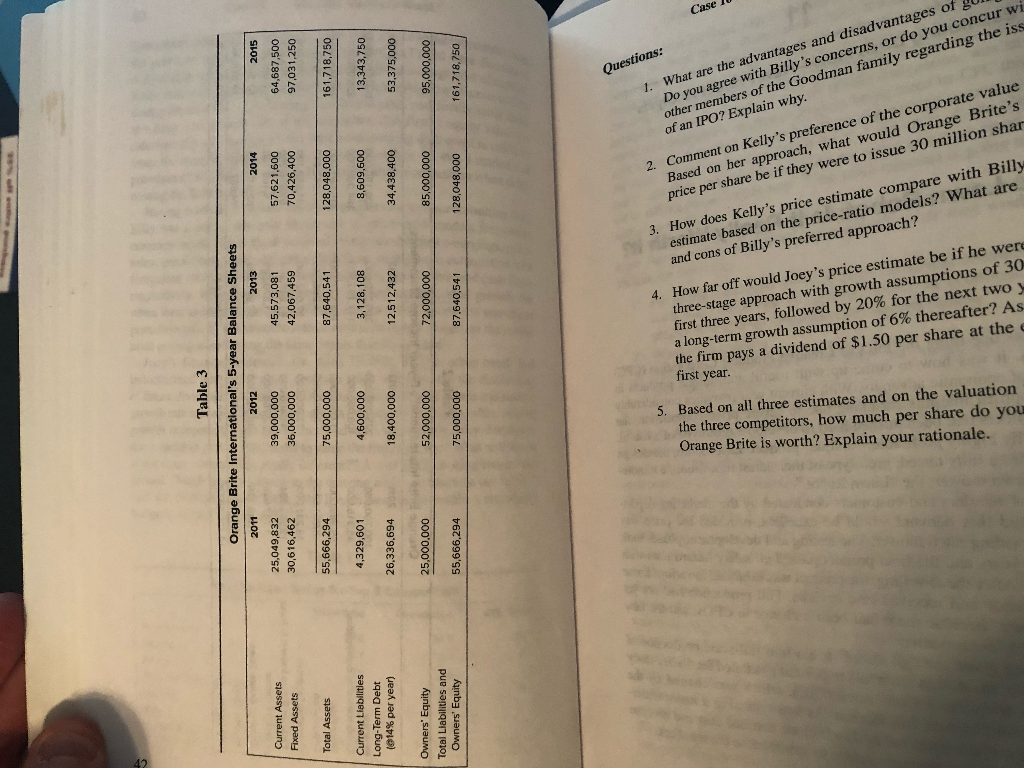

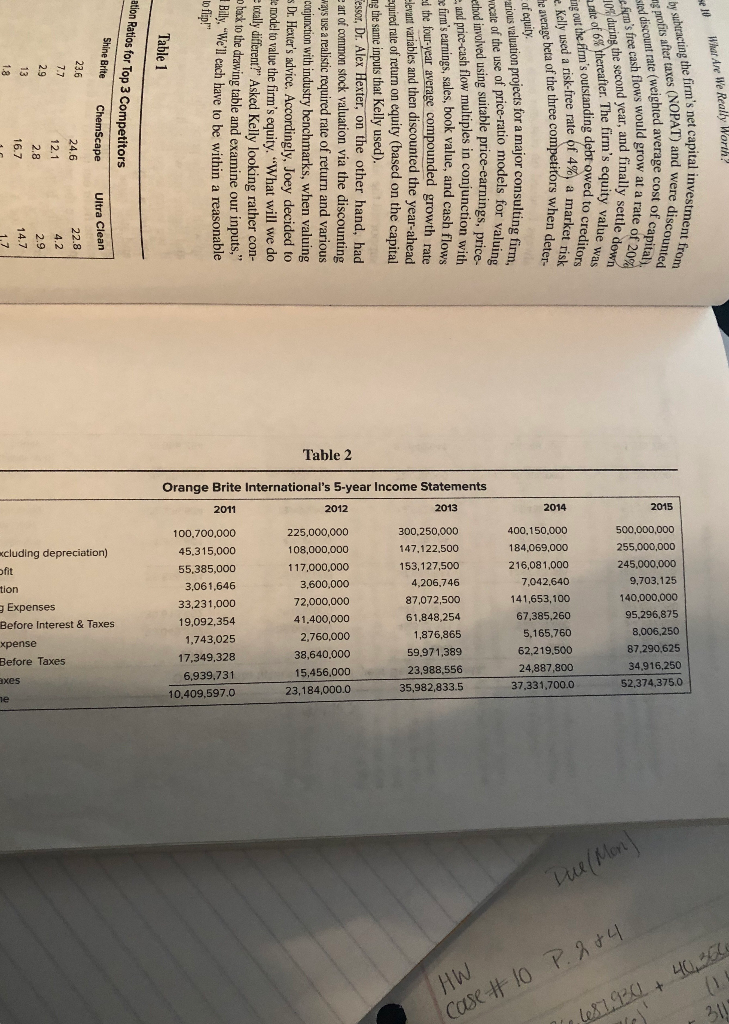

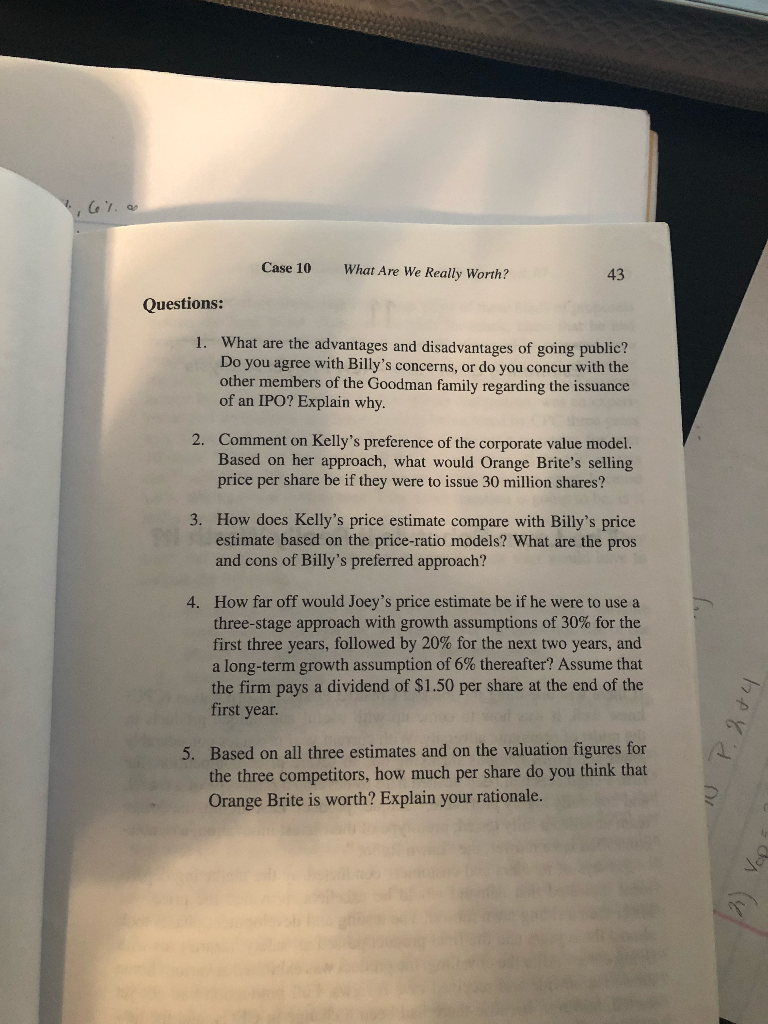

Case Questions: 1. What are the advantages and disadvantages of g Do you agree with Billy's concerns, or do you concur wi ther members of the Goodman family regarding the iss of an IPO? Explain why preference of the corporate value 2. Comment on Kelly's Based on her approach, what would Orange Brite's price per share be if they were to issue 30 million shar 3. How does Kelly's price estimate compare with Billy estimate based on the price-ratio models? What are and cons of Billy's preferred approach? How far off would J three-stage approach with growth assumptions of 30 first three years, followed by 20% for the next two y a long-term growth assumption of 6% thereafter? As the firm pays a dividend of $1.50 per share at the e first year. 4. oey's price estimate be if he were 5. Based on all three estimates and on the valuation the three competitors, how much per share do you Orange Brite is worth? Explain your rationale. by subtracting the firm's net c utaraaftertaxes (NOPAT) and were capital investment fr eddiscount rate (weighted average cost ofscounted sted disc rate of ois 000 000 000 125 000 75 250 $25 50-750 free cash flows would grow at a duringthe second year, and finally se thereafter. The firm's equity valuewan out thefirm's outstanding debt owedtoo eKelly used a risk-free rate ef 4% a marked itors he average beta of the three competitors when of equity. arious valuation project rate of the use of price-ratio nodels form ethod involved using suitable price-earnings, price- and price-cash flow multiples in conjunction firm's earnings, sales, book value, and cash flows d the four-yea,average compounded growth rate levant variables and then discounted the year-ahead quired rate of return on equity (based on the capital ng the same inputs that Kelly used) esso. Dr.AlexHexter,-on-the other hand, had art of common stock valuation via the discounting as use a realistic required rate of return and various oqunction with industry benchmarks, when valuing Dr. Hexter's advice. Accordingly, Joey decided to model to value the firm's equity. "What will we do deter- s for a major consulting firm, me 300 7 3 4 8 6 1 939 73212851 back to the drawing table and examine our inputs," Billy. "We'll each have to be within a reasonable an- 00 5 5 3 3 9 1 16 ation Ratios for Top 3 Competitors Case 10 What Are We Really Worth? 43 Questions: 1. What are the advantages and disadvantages of going public? Do you agree with Billy's concerns, or do you concur with the other members of the Goodman family regarding the issuance of an IPO? Explain why. Comment on Kelly's preference of the corporate value model. Based on her approach, what would Orange Brite's selling price per share be if they were to issue 30 million shares? 2. 3. How does Kelly's price estimate compare with Billy's price estimate based on the price-ratio models? What are the pros and cons of Billy's preferred approach? How far off would Joey's price estimate be if he were to use a three-stage approach with growth assumptions of 30% for the first three years, followed by 20% for the next two years, and a long-term growth assumption of 6% thereafter? Assume that the firm pays a dividend of $1.50 per share at the end of the first year. 4. Based on all three estimates and on the valuation figures for the three competitors, how much per share do you think that Orange Brite is worth? Explain your rationale. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts