Question: Question 4 Soalan 4 (a) Differentiate between debt-intensive and equity-intensive capital structure. Bezakan struktur modal intensif-hutang dan intensif-ekuiti. (3 Marks/ Markah) (b) Jaki Corporation has

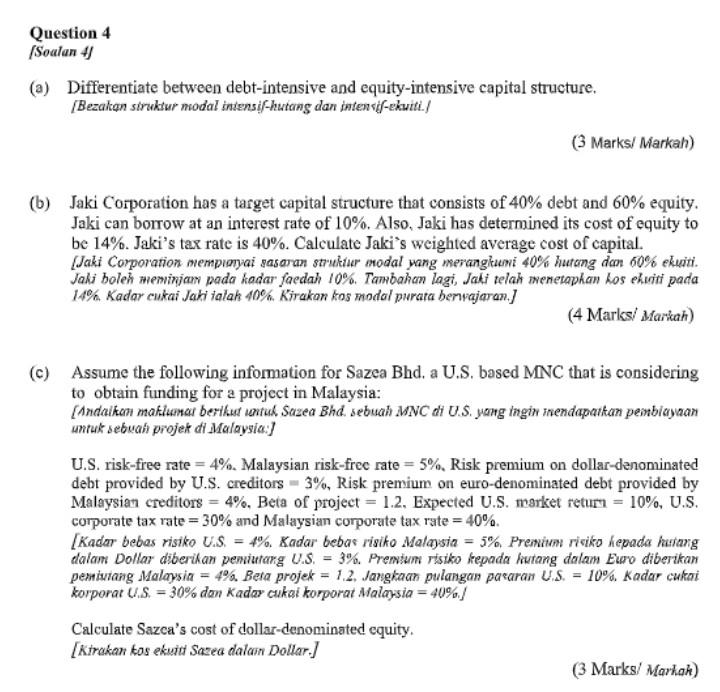

Question 4 Soalan 4 (a) Differentiate between debt-intensive and equity-intensive capital structure. Bezakan struktur modal intensif-hutang dan intensif-ekuiti. (3 Marks/ Markah) (b) Jaki Corporation has a target capital structure that consists of 40% debt and 60% equity. Jaki can borrow at an interest rate of 10%. Also, Jaki has determined its cost of equity to be 14%. Jaki's tax rate is 40%. Calculate Jaki's weighted average cost of capital. Jaki Corporation mempionai sasaran struktur modal yang merangkumi 40% hutang dan 60% ekuiti. Jaki boleh meminjar pada kadar faedah 10%. Tambahan lagi, Jaki telah menetapkan kos ekuiti pada 14% Kadar cukai Jahi ialah 10% Kirakan kos modal purata bervajaran.) (4 Marks/ Markah) C) Assume the following information for Sazea Bhd. a U.S. based MNC that is considering to obtain funding for a project in Malaysia: [Andaikan maklumar berikut untuk Sazea Bhd sebuah MNC di U.S. yang ingin mendapatkan pembiayaan untuk sebuah projek di Malaysia:] U.S. risk-free rate = 4%. Malaysian risk-frec rate = 5%, Risk premium on dollar-denominated debt provided by U.S. creditors - 3%, Risk premium on euro-denominated debt provided by Malaysian creditors = 4%, Beta of project = 1.2. Expected U.S. market returi = 10%, U.S. corporate tax rate= 30% and Malaysian corporate tax rate = 40%. Kader bebas risiko U.S. = 4%. Kadar bebas risiko Malaysia = 5% Premium risiko kepada kustang dalam Dollar diberikan pemiutang U.S. = 3%. Premium risiko kepada keutang dalam Ero diberikan peminang Malaysia = 4%. Beta projek = 1.2. Jangkaan pulangan pacaran US. = 10%. Kadar cukai korporat U.S. = 30% don Kadar cukai korporat Malaysia = 40%) Calculate Sazca's cost of dollar-denominated equity. [Kirakan kos ekuid Sazea dalan Dollar. (3 Marks/ Markah)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts