Question: Question 4 (Standard normal distribution) (12 point) The annual return, $X$, on an investment portfolio can be represented by a normal random variable with mean

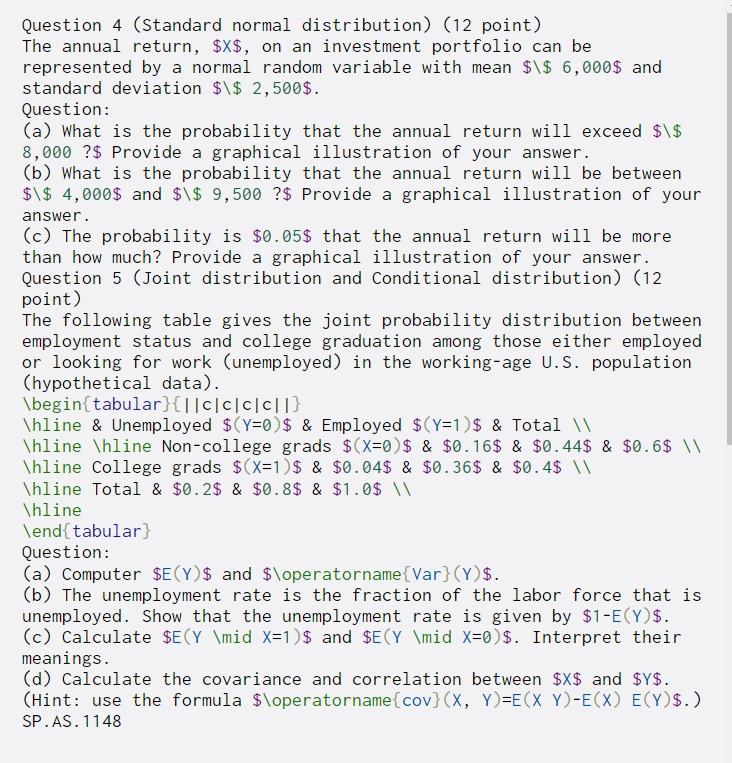

Question 4 (Standard normal distribution) (12 point) The annual return, $X$, on an investment portfolio can be represented by a normal random variable with mean $\$ 6,000$ and standard deviation $\$ 2,500$. Question: (a) What is the probability that the annual return will exceed $\$ 8,000 ?$ Provide a graphical illustration of your answer. (b) What is the probability that the annual return will be between $\$ 4,000$ and $\$ 9,500 $ Provide a graphical illustration of your answer. (c) The probability is $0.05$ that the annual return will be more than how much? Provide a graphical illustration of your answer. Question 5 (Joint distribution and Conditional distribution) (12 point) The following table gives the joint probability distribution between employment status and college graduation among those either employed or looking for work (unemployed) in the working-age U.S. population (hypothetical data). \begin{tabular}{||CC|CC||} \hline & Unemployed $(Y=0)$ & Employed $(Y=1)$ & Total \hline \hline Non-college grads $(X=0) $ & $0.16$ & $0.44$ & $0.6$ \hline College grads $(x=1)$ & $0.04$ & $0.36$ & $0.4$ \hline Total & $0.2$ & $0.8$ & $1.0$ \hline \end{tabular) Question: (a) Computer $E(Y)$ and $\operatorname{Var}(Y)$. (b) The unemployment rate is the fraction of the labor force that is unemployed. Show that the unemployment rate is given by $1-E(Y)$. (c) Calculate $E(Y \mid X=1) $ and $E(Y \mid X=0)$. Interpret their meanings. (d) Calculate the covariance and correlation between $X$ and $y$. (Hint: use the formula $\operatorname{cov}(X, Y)=E(X Y)-E(X) E(Y)$.) SP.AS. 1148

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts