Question: Question 4 The following returns have been reported: Year 2012 2013 2014 2015 2016 2017 Market return 0.27 0.12 -0.03 0.12 -0.03 0.27 Apple return

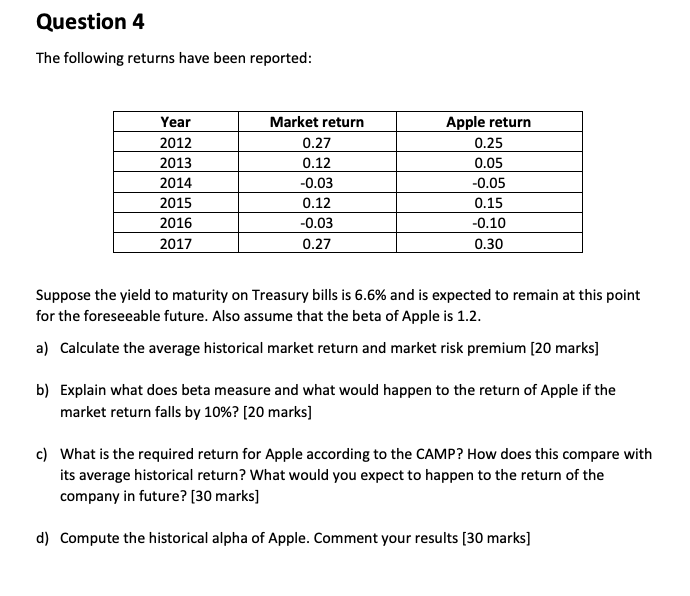

Question 4 The following returns have been reported: Year 2012 2013 2014 2015 2016 2017 Market return 0.27 0.12 -0.03 0.12 -0.03 0.27 Apple return 0.25 0.05 -0.05 0.15 -0.10 0.30 Suppose the yield to maturity on Treasury bills is 6.6% and is expected to remain at this point for the foreseeable future. Also assume that the beta of Apple is 1.2. a) Calculate the average historical market return and market risk premium (20 marks] b) Explain what does beta measure and what would happen to the return of Apple if the market return falls by 10%? [20 marks] c) What is the required return for Apple according to the CAMP? How does this compare with its average historical return? What would you expect to happen to the return of the company in future? [30 marks] d) Compute the historical alpha of Apple. Comment your results (30 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts