Question: Question 4 The general rule is that loans made to shareholders must be included in the shareholder's income in the calendar year that the loan

Question

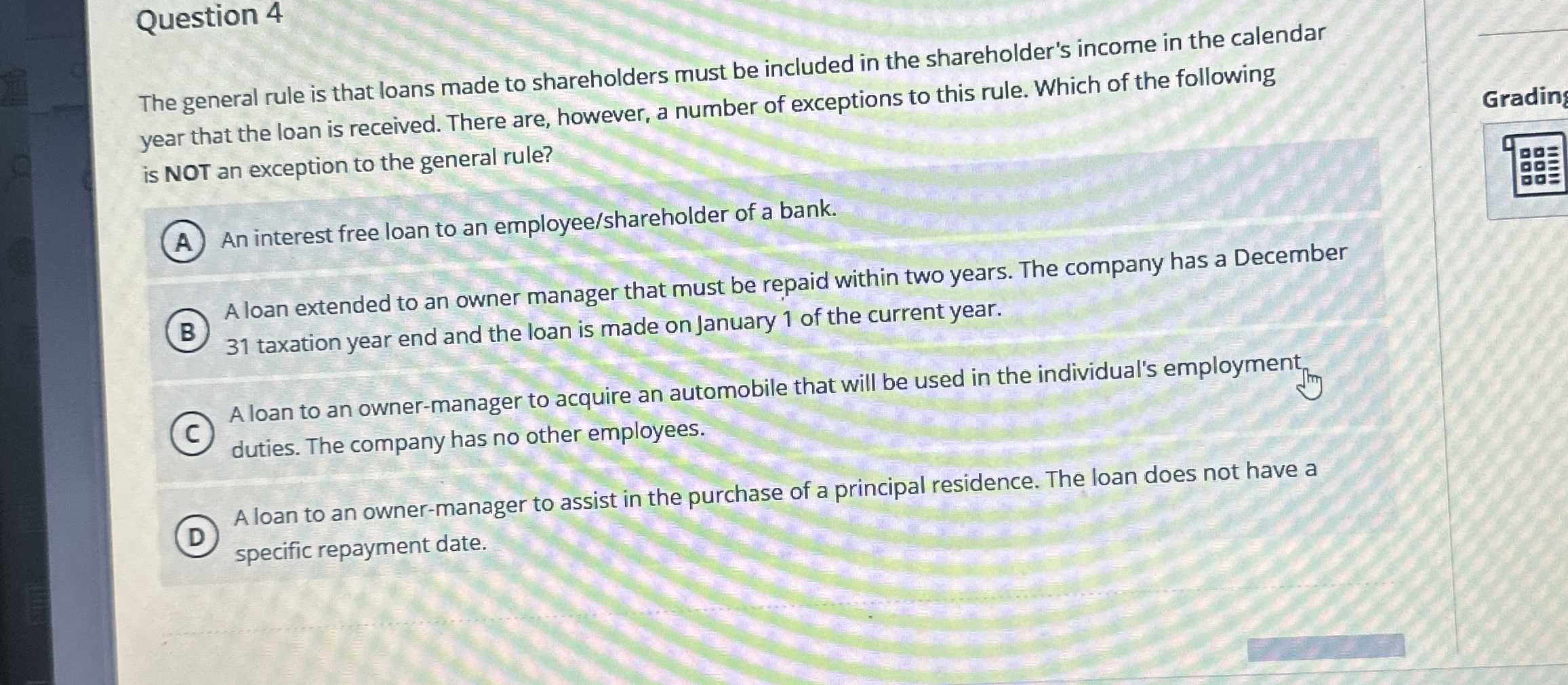

The general rule is that loans made to shareholders must be included in the shareholder's income in the calendar year that the loan is received. There are, however, a number of exceptions to this rule. Which of the following is NOT an exception to the general rule?

An interest free loan to an employeeshareholder of a bank.

A loan extended to an owner manager that must be repaid within two years. The company has a December taxation year end and the loan is made on January of the current year.

A loan to an ownermanager to acquire an automobile that will be used in the individual's employment duties. The company has no other employees.

A loan to an ownermanager to assist in the purchase of a principal residence. The loan does not have a specific repayment date.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock