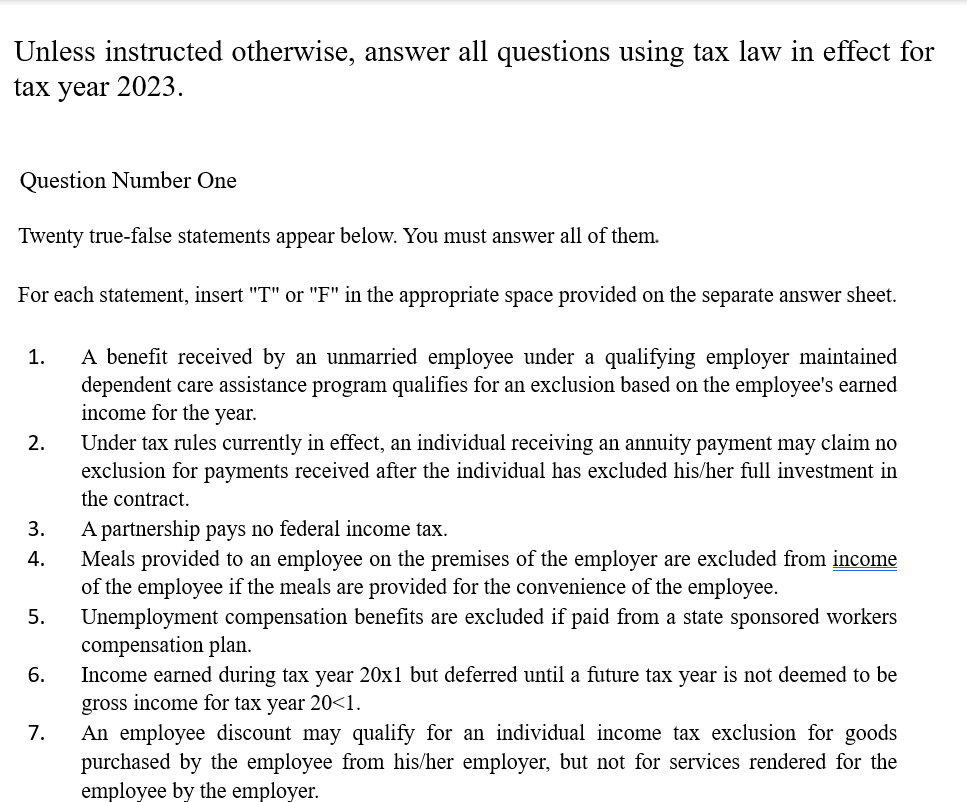

Question: Question Number One Twenty true - false statements appear below. You must answer all of them For each statement, insert T or

Question Number One

Twenty truefalse statements appear below. You must answer all of them

For each statement, insert T or F in the appropriate space provided on the separate answer sheet.

A benefit received by an unmarried employee under a qualifying employer maintained dependent care assistance program qualifies for an exclusion based on the employee's earned income for the year.

Under tax rules currently in effect, an individual receiving an annuity payment may claim no exclusion for payments received after the individual has excluded hisher full investment in the contract.

A partnership pays no federal income tax.

Meals provided to an employee on the premises of the employer are excluded from income of the employee if the meals are provided for the convenience of the employee.

Unemployment compensation benefits are excluded if paid from a state sponsored workers compensation plan.

Income earned during tax year x but deferred until a future tax year is not deemed to be gross income for tax year

An employee discount may qualify for an individual income tax exclusion for goods purchased by the employee from hisher employer, but not for services rendered for the employee by the employer.

An individual who is the sole shareholder of a corporation may make an election to report the corporation's income and expense amounts on Schedule C of the individual's Form

The income in respect of a decedent rule is an exception to the general rule which states that inherited property should be reported as gross income on a Form filed by the recipient.

The value of services received by an individual must have a fair market value in order to be recognized on Form

An individual who is not a professional gambler must "net" gambling winnings with gambling losses and report any net gain as gross income on Form but is prohibited from deducting any net loss.

An employee who opts for cash under a cafeteria plan will be taxed on Form for the amount of cash received.

Dividend income that meets the test to be classified as "qualified" will be taxed on

Form at a maximum rate of

The amount of an insurance premium paid by an employer for an insurance policy covering the life of an employee who is the owner of the policy will always be excluded from income of the employee on hisher Form for coverage in excess of $

The constructive receipt doctrine applies only to individuals who use the accrual method for income tax purposes.

Under tax rules currently in effect, a property settlement incident to a divorce will not be classified as alimony.

Under the general rule, no adjustment is made to a landlord's basis for rental property when a tenant makes an improvement to the rental property.

Punitive damage awards are tax exempt if associated with a physical injury.

Dividend income must be taxed to the individual who owns the capital stock of the corporation that pays the dividend unless the individual has given written instructions to the corporation to pay the dividend to some other person.

When life insurance proceeds are paid over a period of more than one year to the policy beneficiary, all proceed payments are excluded from the beneficiary's gross income until the basic insurance proceeds amount has been received, with subsequent payments reported as interest income in the year received. Unless instructed otherwise, answer all questions using tax law in effect for tax year

Question Number One

Twenty truefalse statements appear below. You must answer all of them.

For each statement, insert T or F in the appropriate space provided on the separate answer sheet.

A benefit received by an unmarried employee under a qualifying employer maintained dependent care assistance program qualifies for an exclusion based on the employee's earned income for the year.

Under tax rules currently in effect, an individual receiving an annuity payment may claim no exclusion for payments received after the individual has excluded hisher full investment in the contract.

A partnership pays no federal income tax.

Meals provided to an employee on the premises of the employer are excluded from income of the employee if the meals are provided for the convenience of the employee.

Unemployment compensation benefits are excluded if paid from a state sponsored workers compensation plan.

Income earned during tax year x but deferred until a future tax year is not deemed to be gross income for tax year

An employee discount may qualify for an individual income tax exclusion for goods purchased by the employee from hisher employer, but not for services rendered for the employee by the employer. An individual who is the sole shareholder of a corporation may make an election to report the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock