Question: Question 4 : The Runner Corp is a cell phone company that offers its customers a choice between buying and leasing their cell phone. Cell

Question :

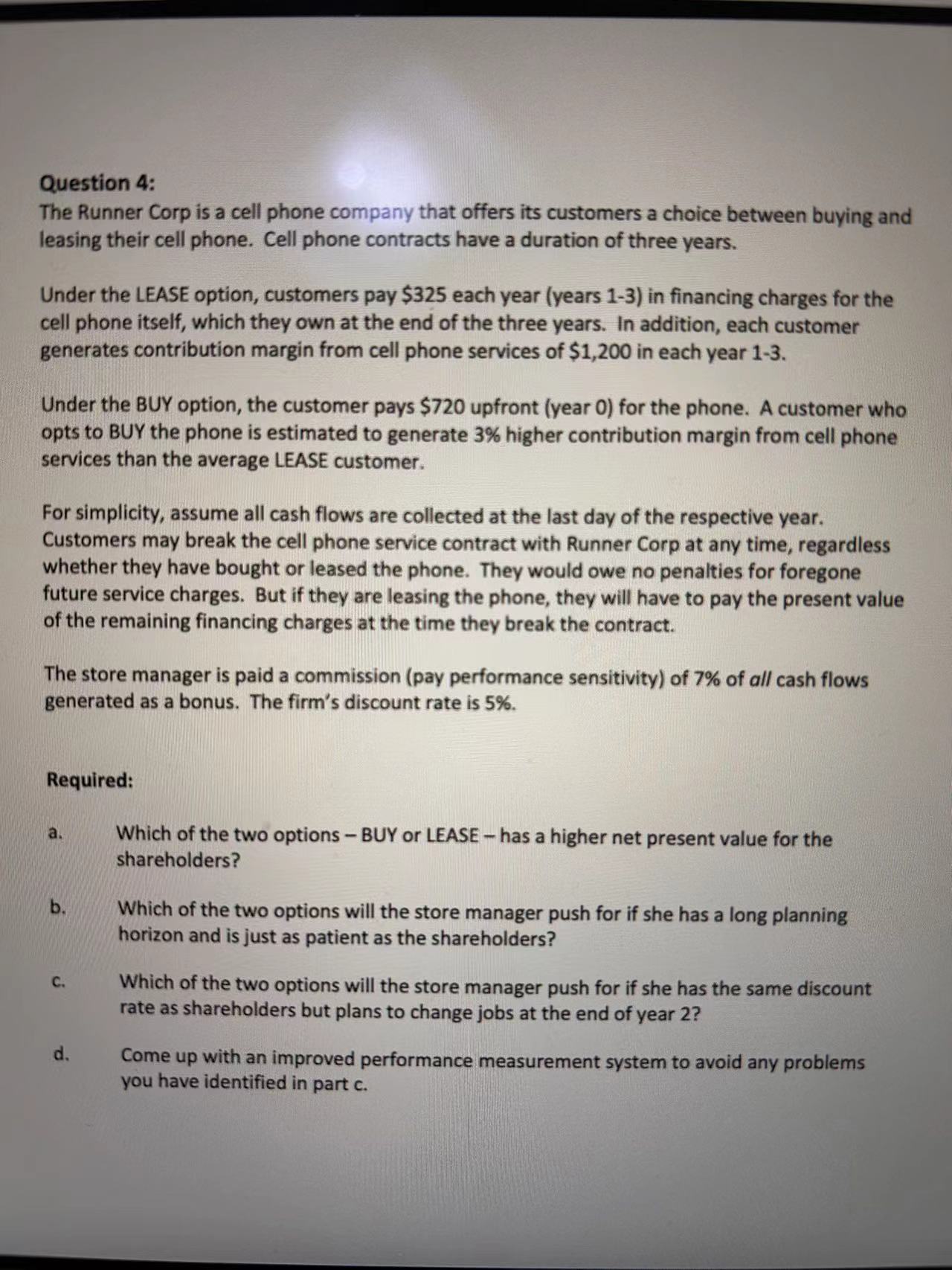

The Runner Corp is a cell phone company that offers its customers a choice between buying and

leasing their cell phone. Cell phone contracts have a duration of three years.

Under the LEASE option, customers pay $ each year years in financing charges for the

cell phone itself, which they own at the end of the three years. In addition, each customer

generates contribution margin from cell phone services of $ in each year

Under the BUY option, the customer pays $ upfront year for the phone. A customer who

opts to BUY the phone is estimated to generate higher contribution margin from cell phone

services than the average LEASE customer.

For simplicity, assume all cash flows are collected at the last day of the respective year.

Customers may break the cell phone service contract with Runner Corp at any time, regardless

whether they have bought or leased the phone. They would owe no penalties for foregone

future service charges. But if they are leasing the phone, they will have to pay the present value

of the remaining financing charges at the time they break the contract.

The store manager is paid a commission pay performance sensitivity of of all cash flows

generated as a bonus. The firm's discount rate is

Required:

a Which of the two options BUY or LEASE has a higher net present value for the

shareholders?

b Which of the two options will the store manager push for if she has a long planning

horizon and is just as patient as the shareholders?

c Which of the two options will the store manager push for if she has the same discount

rate as shareholders but plans to change jobs at the end of year

d Come up with an improved performance measurement system to avoid any problems

you have identified in part

My question is in the two options, $ and $ upfront are cash inflow or outflow?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock