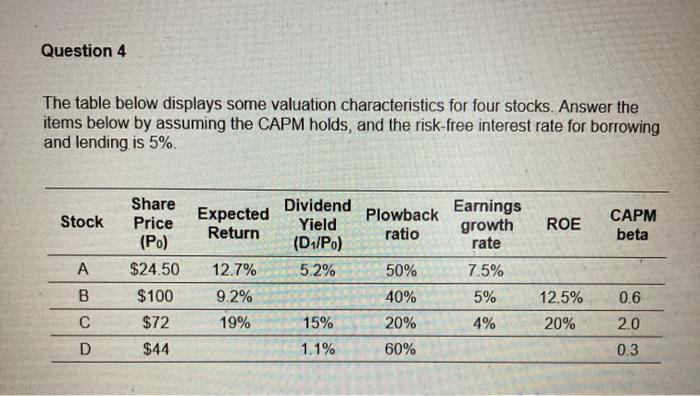

Question: Question 4 The table below displays some valuation characteristics for four stocks. Answer the items below by assuming the CAPM holds, and the risk-free interest

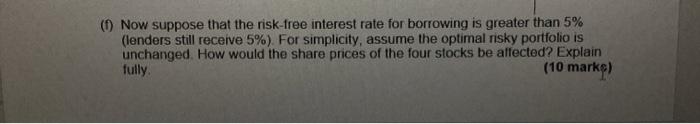

Question 4 The table below displays some valuation characteristics for four stocks. Answer the items below by assuming the CAPM holds, and the risk-free interest rate for borrowing and lending is 5%. Stock Expected Return Plowback ratio ROE Dividend Yield (D1/Po) 5.2% CAPM beta Share Price (Po) $24.50 $100 $72 $44 A 12.7% 9.2% 19% B Earnings growth rate 7.5% 5% 4% 50% 40% 20% 12.5% 20% 0.6 2.0 15% 1.1% D 60% 0.3 () Now suppose that the risk-free interest rate for borrowing is greater than 5% (lenders still receive 5%). For simplicity, assume the optimal risky portfolio is unchanged. How would the share prices of the four stocks be affected? Explain fully (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts