Question: Question 4: (Total 8 marks) Eagle Company purchased a delivery truck at a cost of $400,000 on October 1, 2020. It is estimated that the

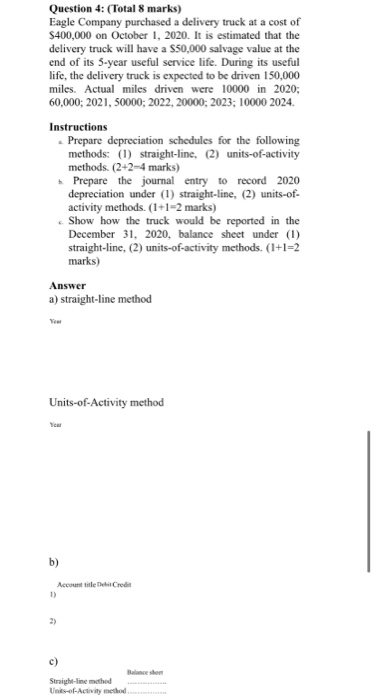

Question 4: (Total 8 marks) Eagle Company purchased a delivery truck at a cost of $400,000 on October 1, 2020. It is estimated that the delivery truck will have a $50,000 salvage value at the end of its 5-year useful service life. During its useful life, the delivery truck is expected to be driven 150,000 miles. Actual miles driven were 10000 in 2020; 60,000; 2021, 50000; 2022, 20000: 2023; 10000 2024. Instructions Prepare depreciation schedules for the following methods: (1) straight-line, (2) units-of-activity methods. (2+2-4 marks) Prepare the journal entry to record 2020 depreciation under (1) straight-line, (2) units-of- activity methods. (1+1-2 marks) Show how the truck would be reported in the December 31, 2020, balance sheet under (1) straight-line, (2) units-of-activity methods. (1+1=2 marks) Answer a) straight-line method Units-of-Activity method Account title Del Credit Balance she Straight-line mehed Units-of-Activity method

Step by Step Solution

There are 3 Steps involved in it

Solution a Depreciation Schedules 1 StraightLine MethodFormula Annual Depreciation Cost Salvage Valu... View full answer

Get step-by-step solutions from verified subject matter experts