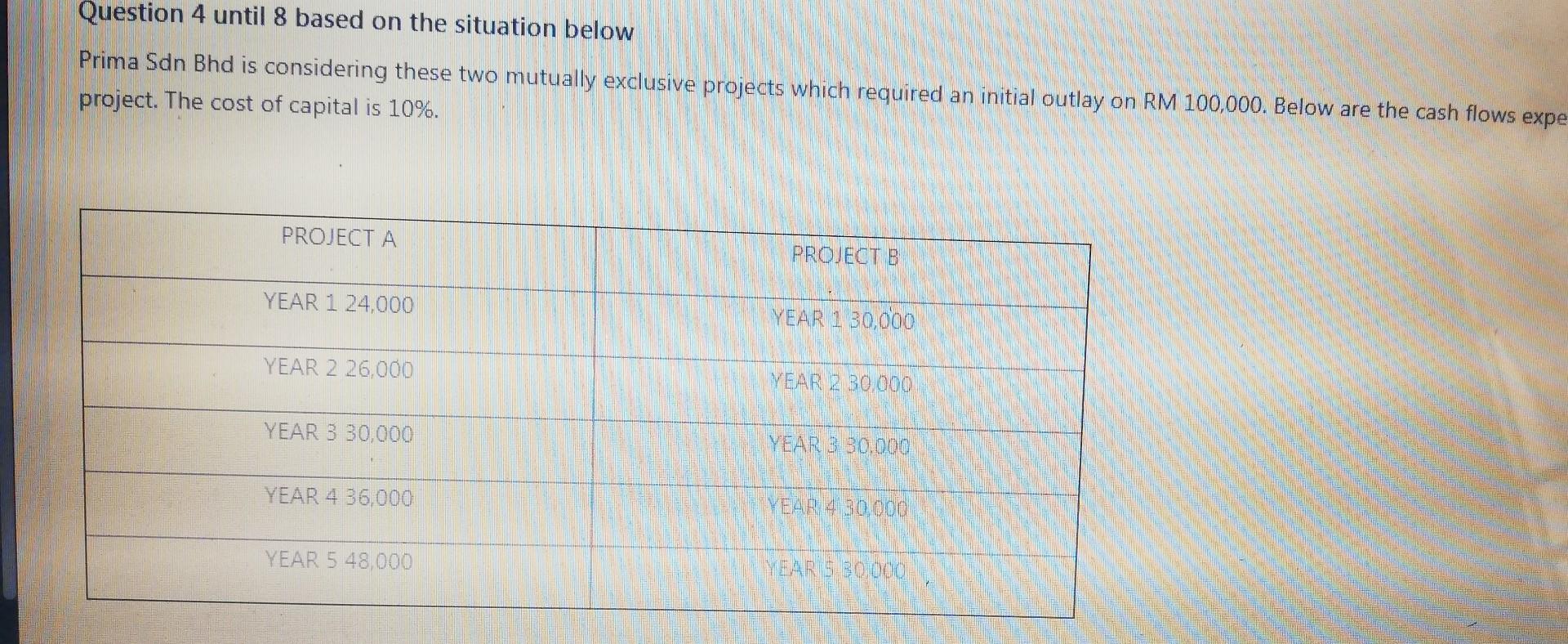

Question: Question 4 until 8 based on the situation below Prima Sdn Bhd is considering these two mutually exclusive projects which required an initial outlay on

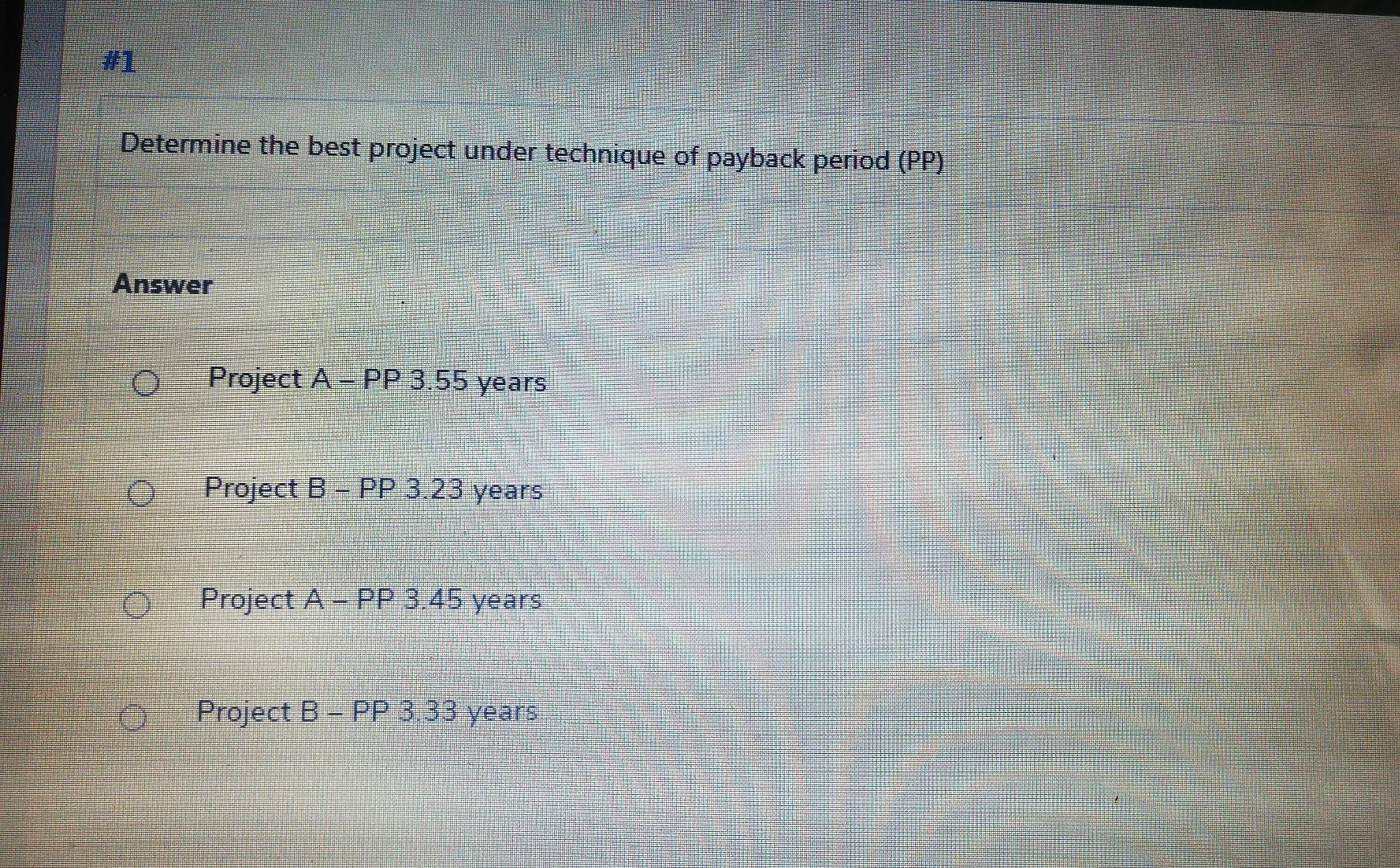

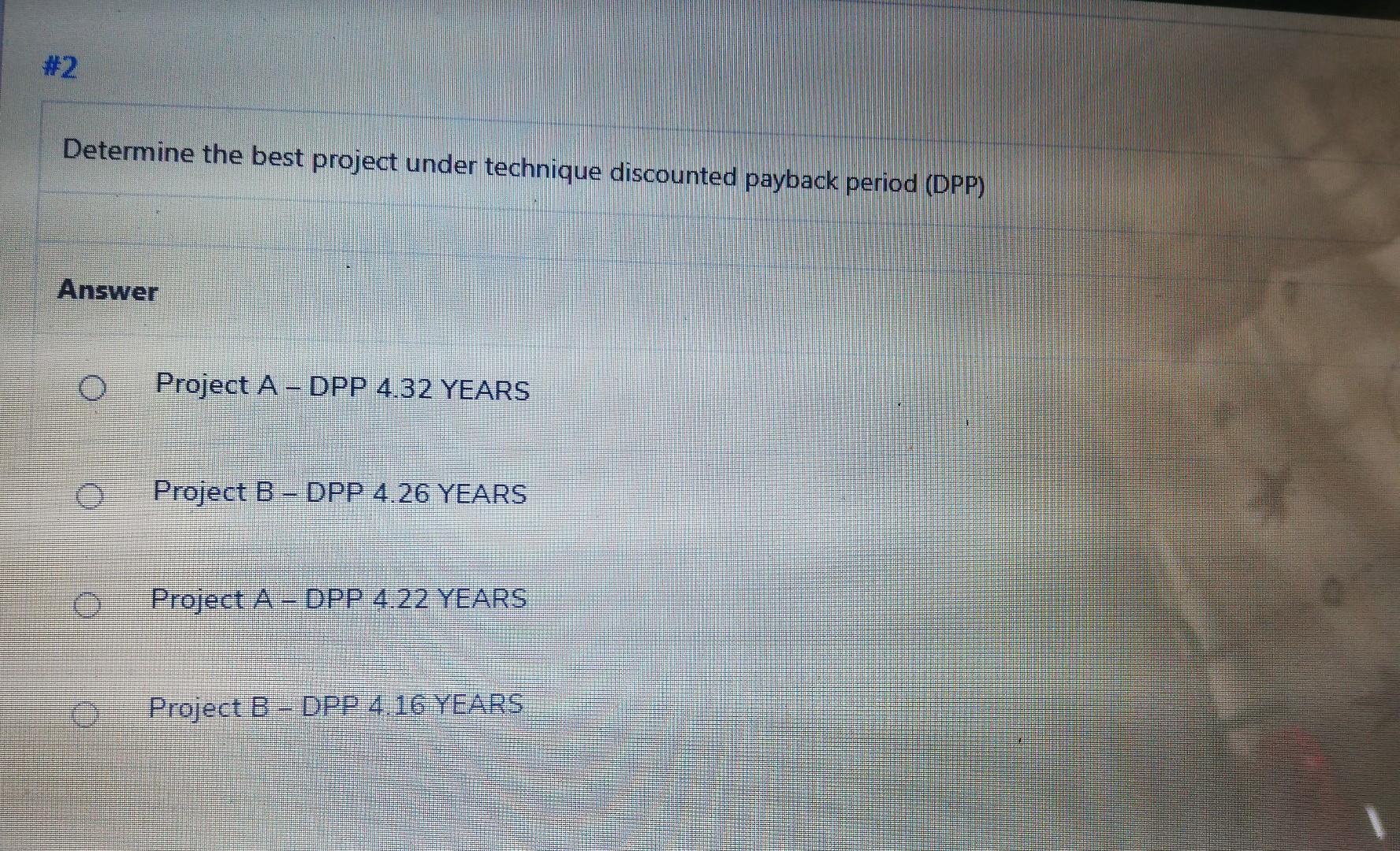

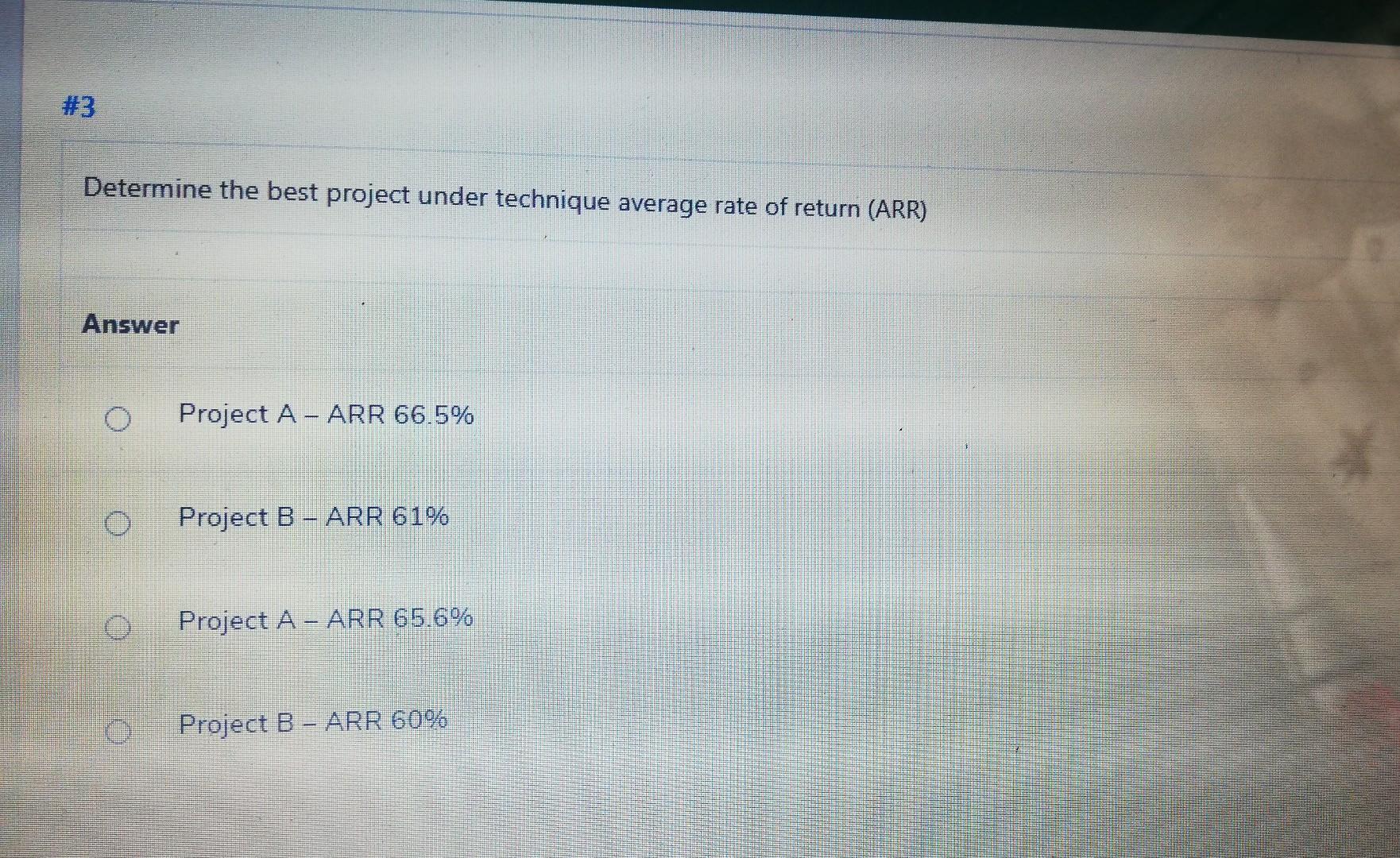

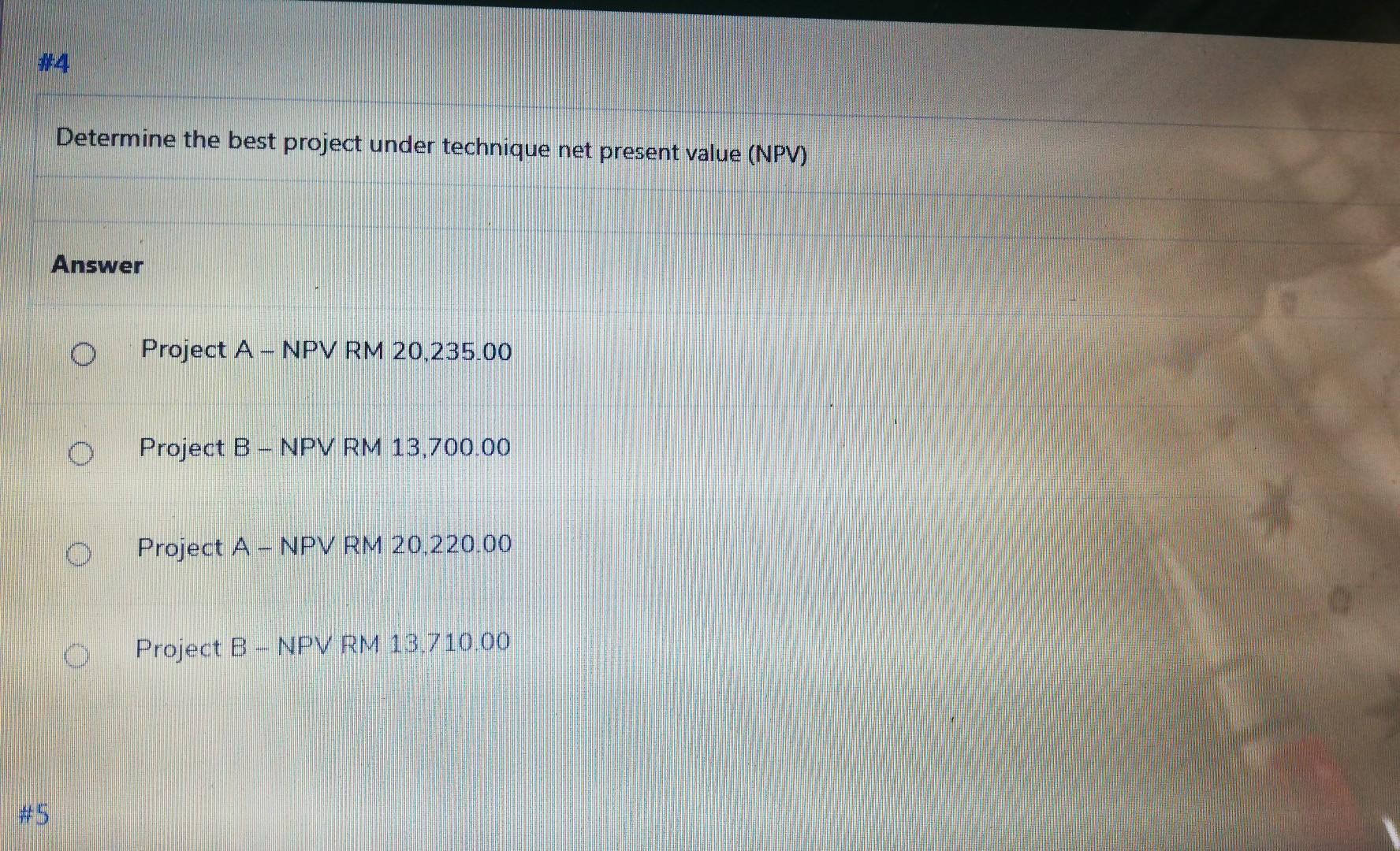

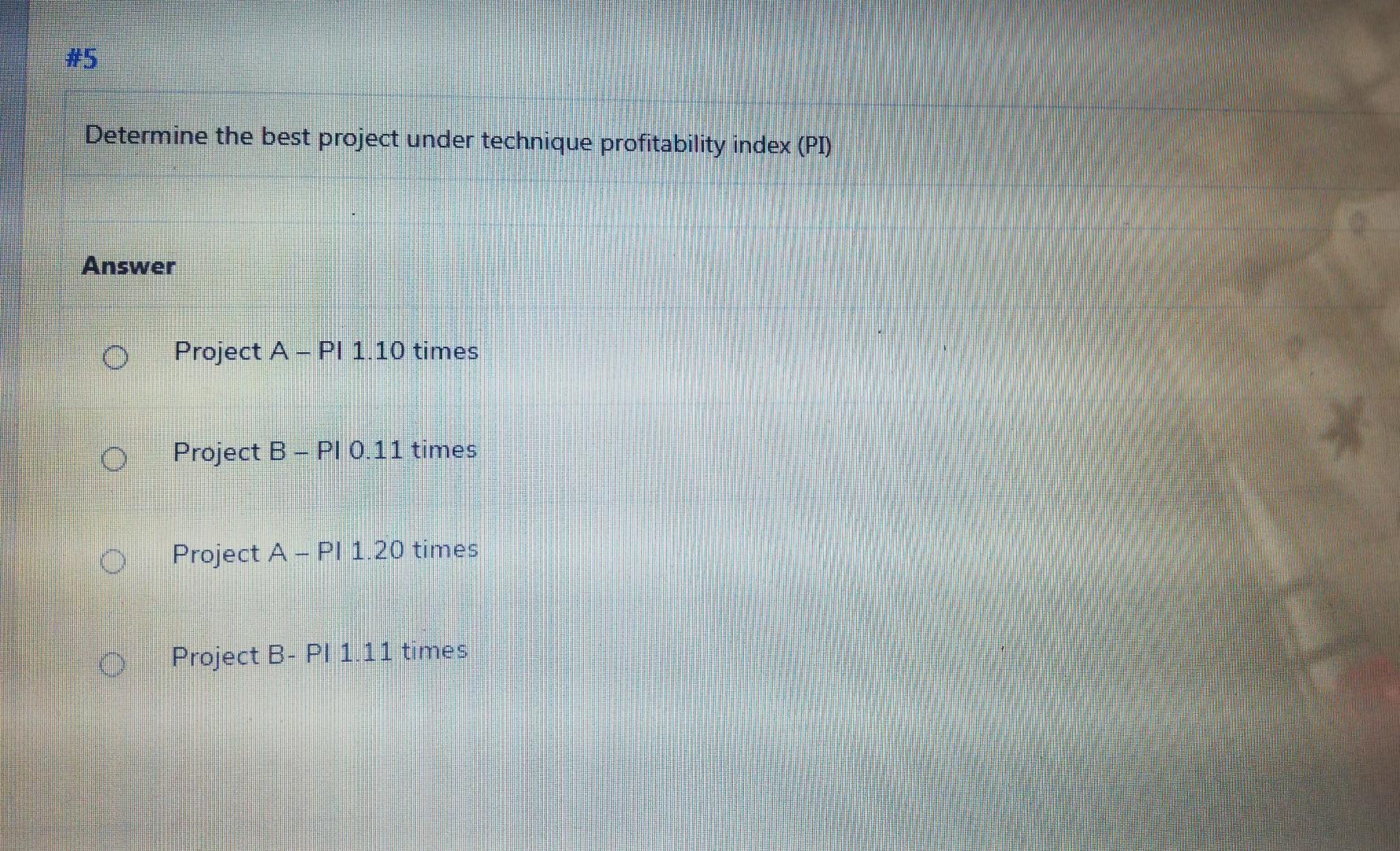

Question 4 until 8 based on the situation below Prima Sdn Bhd is considering these two mutually exclusive projects which required an initial outlay on RM 100,000. Below are the cash flows expe project. The cost of capital is 10%. PROJECT A PROJECTB YEAR 1 24,000 YEAR 1 30,000 YEAR 2 26,000 YEAR 2 30000 YEAR 3 30,000 YEAR 3 30.000 YEAR 4 36,000 YEAR 4 30,000 YEAR 5 48.000 YEAR S 30000 Determine the best project under technique of payback period (PP) Answer Project A= PP 3.55 years Project B - PP 3.23 years Project A PP 3.45 years Project B - PP 3.33 years #2 Determine the best project under technique discounted payback period (DPP) Answer Project A - DPP 4.32 YEARS Project B DPP 4.26 YEARS Project A - DPP 4.22 YEARS Project B - DPP 4 16 YEARS #3 Determine the best project under technique average rate of return (ARR) Answer Project A-ARR 66.5% Project B - ARR 61% Project A - ARR 65.6% Project B - ARR 60% *4 Determine the best project under technique net present value (NPV) Answer Project A - NPV RM 20.235.00 Project B- NPV RM 13,700.00 Project A - NPV RM 20,220.00 Project B - NPV RM 13,710.00 Determine the best project under technique profitability index (PI) Answer Project A - PI 1.10 times O Project B - PI 0.11 times 0 Project A - PI 1.20 times 0 Project B- Pl 1.11 times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts